1139 Form - (a) as used in this chapter: A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. (1) (a) “emergency condition” means the existence of either of the following: (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,.

A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. (a) as used in this chapter: Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,. (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (1) (a) “emergency condition” means the existence of either of the following:

Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (1) (a) “emergency condition” means the existence of either of the following: (i) conditions of disaster or extreme. A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (a) as used in this chapter: Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report.

Dhs 1139 Form ≡ Fill Out Printable PDF Forms Online

A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (a) as used in this chapter: (i) conditions of disaster or extreme. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave.

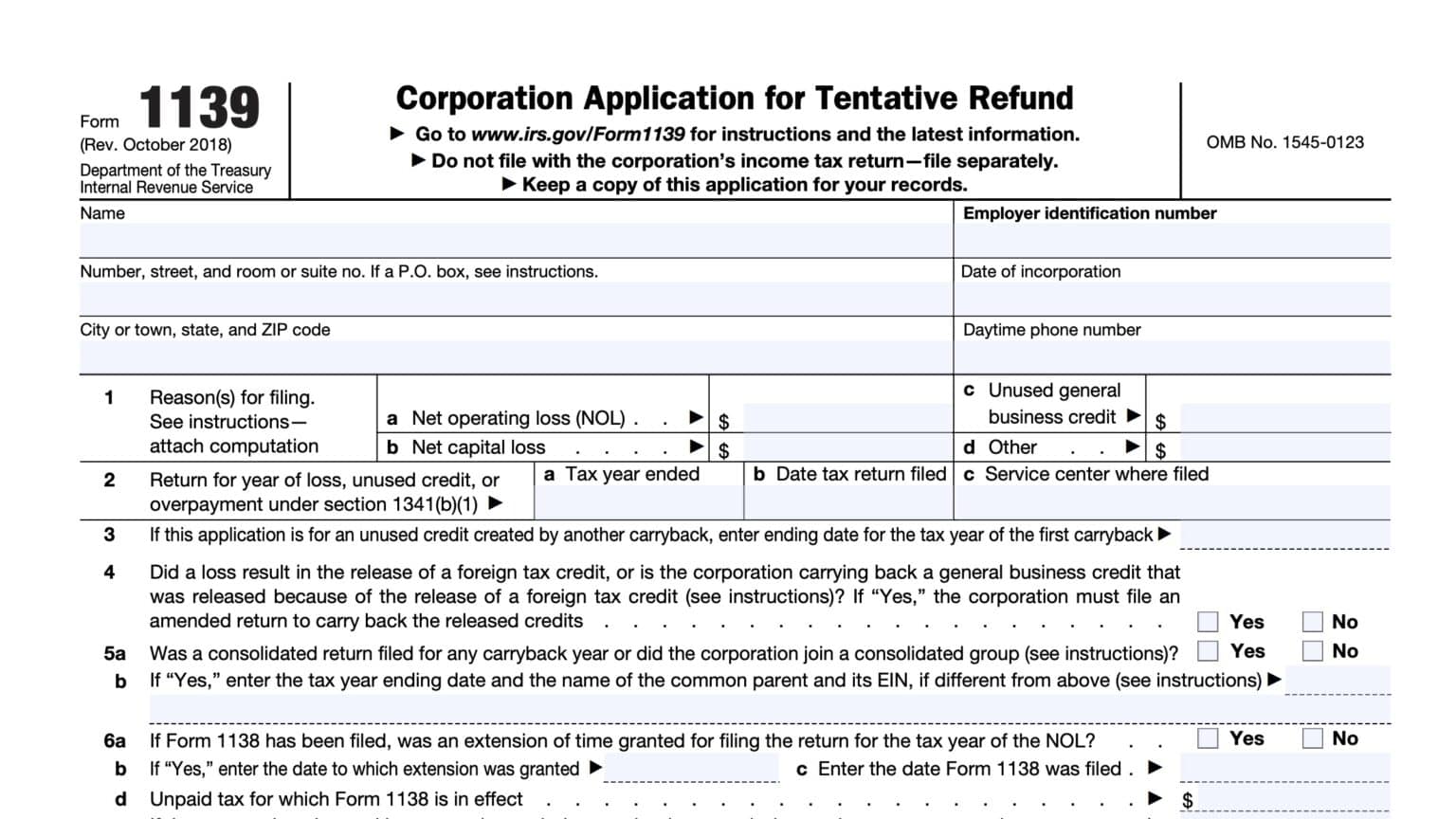

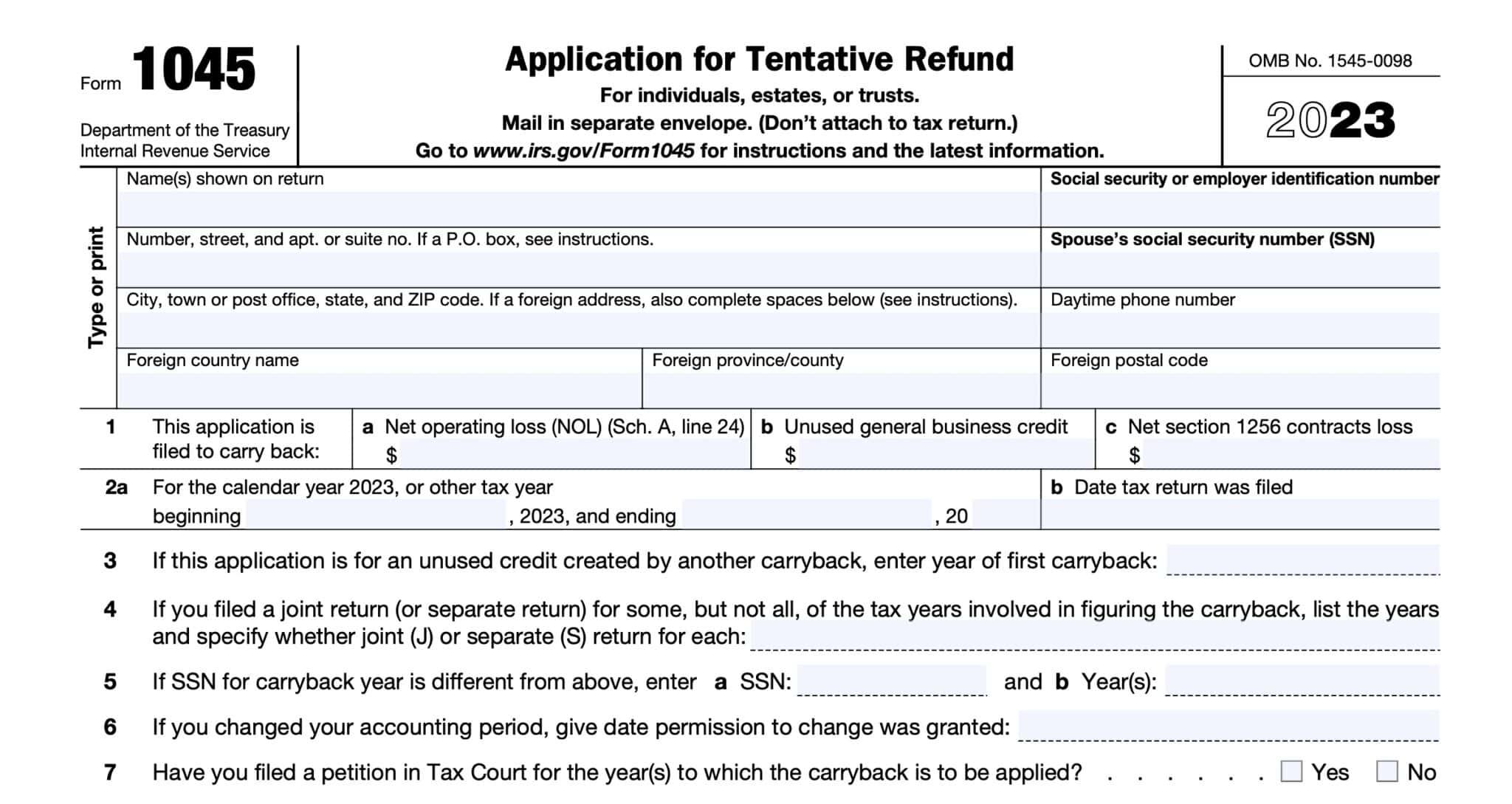

IRS Form 1139 Corporation Application for Tentative Refund

Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (i) conditions of disaster or extreme. A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (1) (a) “emergency condition” means the existence of.

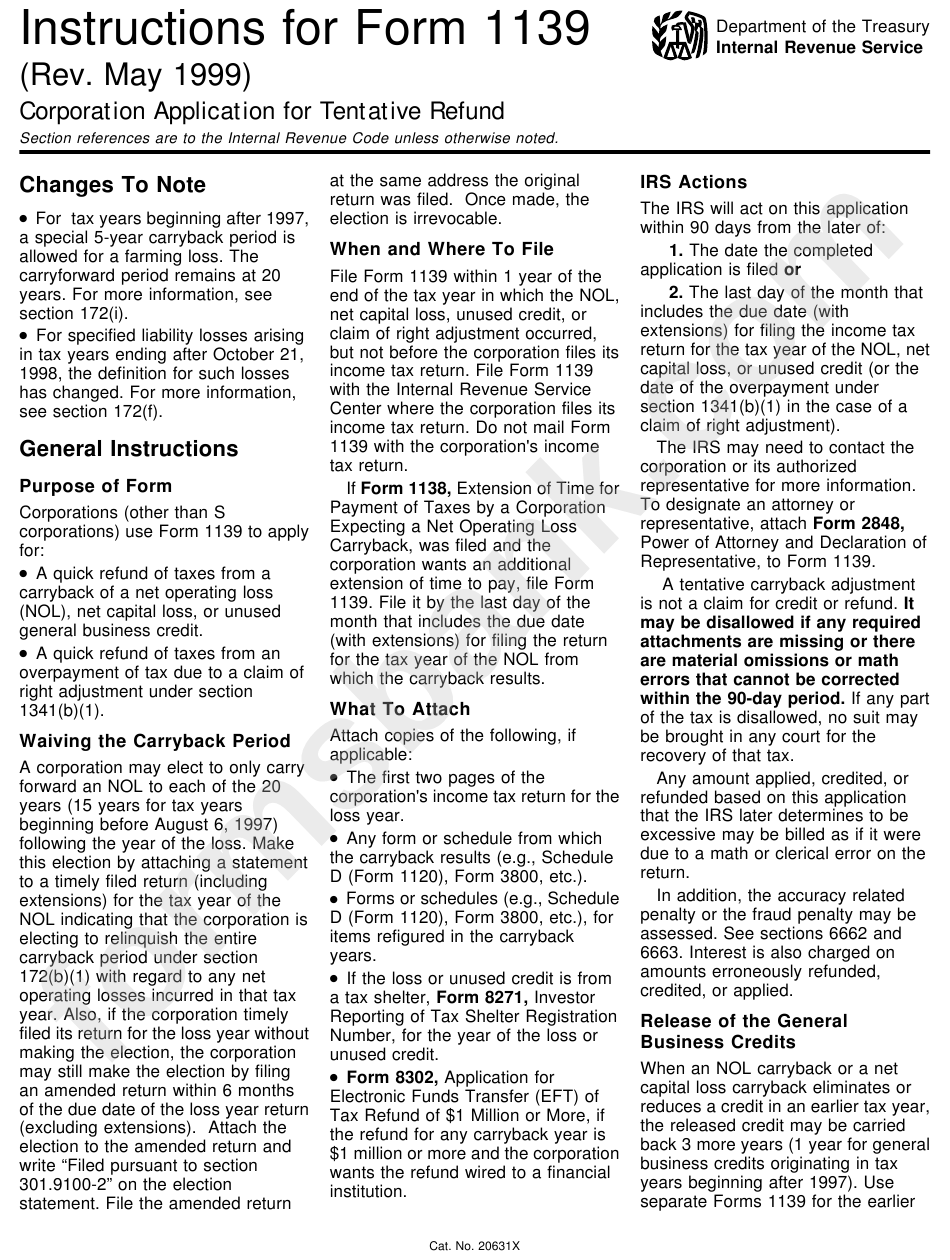

Instructions For Form 1139 Corporation Application For Tentative

(1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. Information about form 1139, corporation application for tentative.

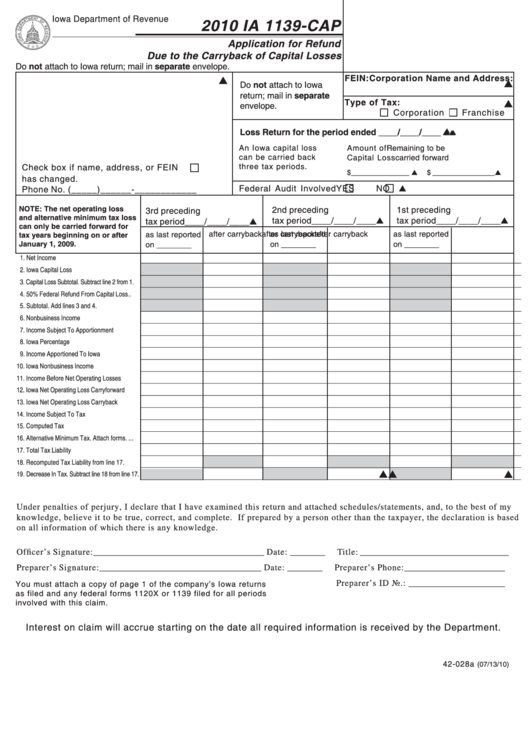

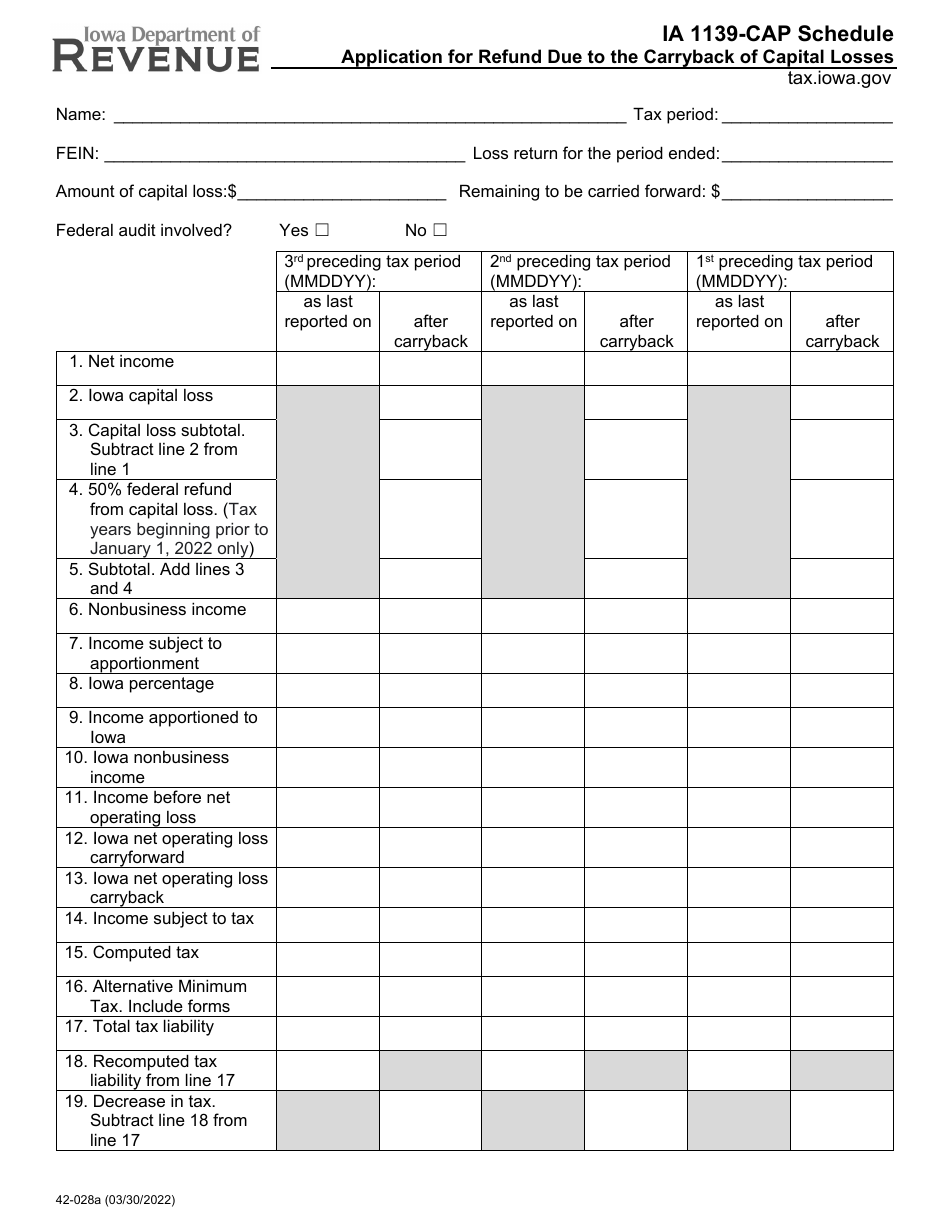

Form Ia 1139Cap Application For Refund Due To The Carryback Of

(1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (1) (a) “emergency condition” means the existence of either of the following: A corporation can file form 1139.

IRS Form 9779 Instructions EFTPS Enrollment for Businesses

(1) (a) “emergency condition” means the existence of either of the following: A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave.

IRS Form 1139 Corporation Application for Tentative Refund

(a) as used in this chapter: (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. Apply for.

Form IA1139CAP (42028) Download Fillable PDF or Fill Online

(a) as used in this chapter: (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. Apply for and manage the va benefits and services you’ve earned as.

IRS Form 1139 Instructions Tentative Corporate Tax Refund

(a) as used in this chapter: Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,. A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. (i) conditions.

2012 Form NZ INZ 1139 Fill Online, Printable, Fillable, Blank pdfFiller

(a) as used in this chapter: Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,. (i) conditions of disaster or extreme. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. A corporation can file form 1139 to claim a tentative refund of.

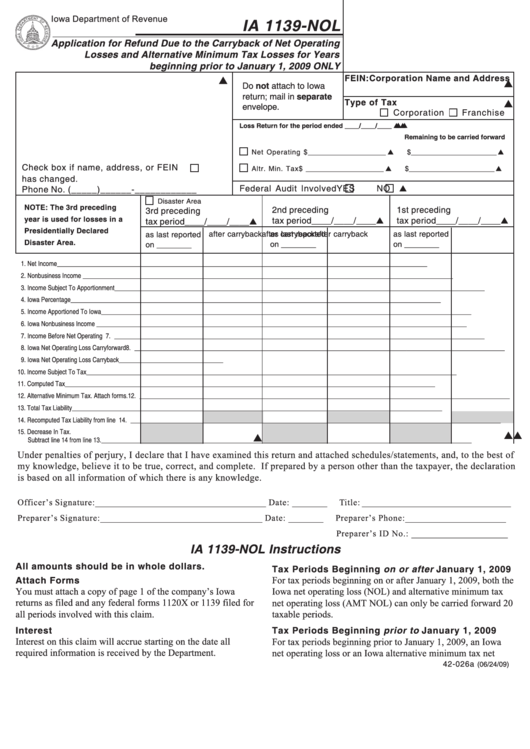

Form Ia 1139Nol Application For Refund Due To The Carryback Of Net

A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under. Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,. (1) (a) “emergency condition” means the existence of.

(1) (A) “Emergency Condition” Means The Existence Of Either Of The Following:

(1)when feasible, an employee shall notify the employer of the emergency condition requiring the employee to leave or refuse to report. Information about form 1139, corporation application for tentative refund, including recent updates, related forms and. (a) as used in this chapter: A corporation can file form 1139 to claim a tentative refund of any amount for which a refund for its tax year beginning in 2018 is due to an election under.

(I) Conditions Of Disaster Or Extreme.

Apply for and manage the va benefits and services you’ve earned as a veteran, servicemember, or family member—like health care, disability,.