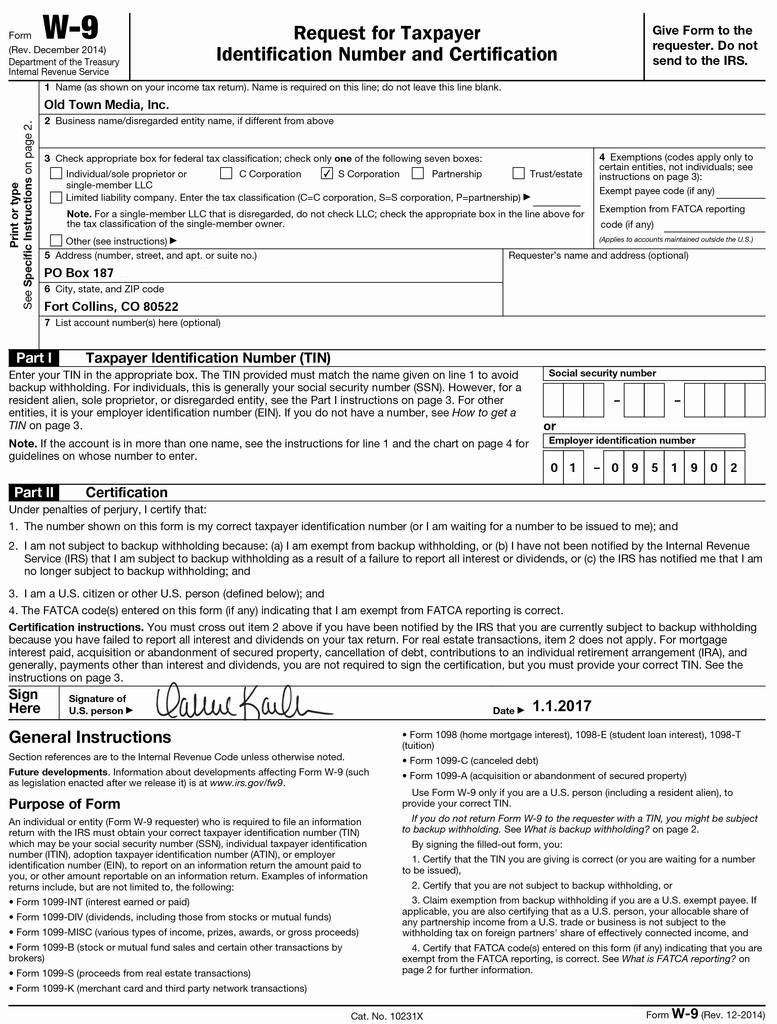

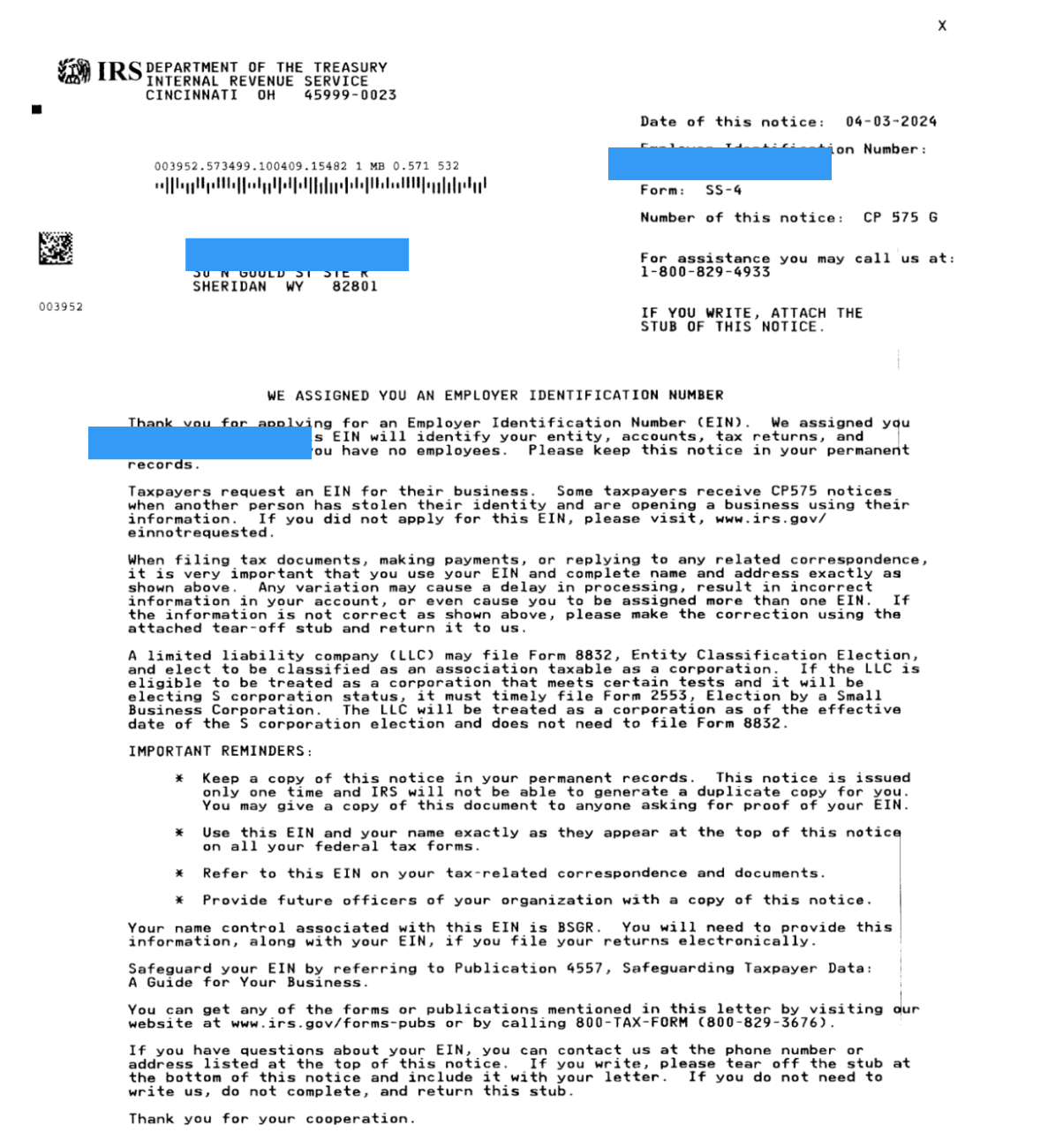

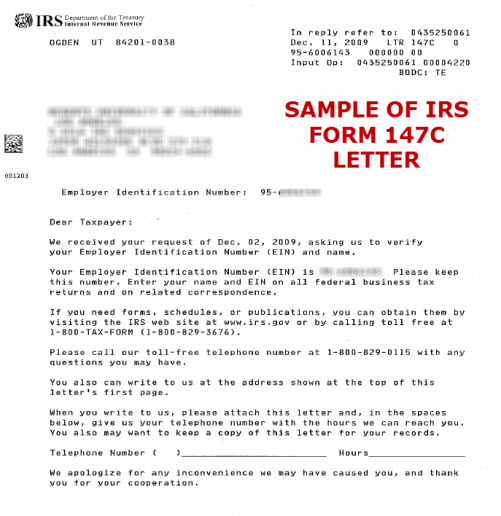

147C Tax Form - If the business name is incorrect, contact the irs business &. Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). You can request it by calling the irs business & specialty. The irs will mail the. The irs 147c letter confirms your organization’s fein and is often required for contracts. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). Irs letter 147c confirms your employer identification number (ein) details. The cp575 confirms your ein.

The irs 147c letter confirms your organization’s fein and is often required for contracts. Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). The cp575 confirms your ein. If the business name is incorrect, contact the irs business &. The irs will mail the. You can request it by calling the irs business & specialty. Irs letter 147c confirms your employer identification number (ein) details.

When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). The irs will mail the. You can request it by calling the irs business & specialty. Irs letter 147c confirms your employer identification number (ein) details. The cp575 confirms your ein. Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). The irs 147c letter confirms your organization’s fein and is often required for contracts. If the business name is incorrect, contact the irs business &.

Irs Form 147c Printable Fillable

When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). The irs will mail the. If the business name is incorrect, contact the irs business &. Irs letter 147c confirms your employer identification number (ein) details. The irs 147c letter confirms your organization’s fein and is often required.

Irs Form 147C Printable

The irs will mail the. The irs 147c letter confirms your organization’s fein and is often required for contracts. Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). If the business name is incorrect, contact the irs business &. You can request it by calling the irs business &.

How can I get a copy of my EIN Verification Letter (147C) from the IRS?

The cp575 confirms your ein. You can request it by calling the irs business & specialty. Irs letter 147c confirms your employer identification number (ein) details. The irs 147c letter confirms your organization’s fein and is often required for contracts. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a.

Irs Form 147c Printable Sample

Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). You can request it by calling the irs business & specialty. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). The irs 147c letter confirms your organization’s.

Irs Form 147c Printable Copy

If the business name is incorrect, contact the irs business &. Irs letter 147c confirms your employer identification number (ein) details. The cp575 confirms your ein. You can request it by calling the irs business & specialty. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter).

What is a 147c Letter? Why do you need One?

The cp575 confirms your ein. If the business name is incorrect, contact the irs business &. The irs 147c letter confirms your organization’s fein and is often required for contracts. Irs letter 147c confirms your employer identification number (ein) details. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a.

147C Letter Printable 147C Form

Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). The cp575 confirms your ein. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). You can request it by calling the irs business & specialty. If the.

How Do I Get A 147C Letter From The IRS? YouTube

The cp575 confirms your ein. If the business name is incorrect, contact the irs business &. The irs will mail the. Irs form 147c is an official transcript that verifies a taxpayer’s employer identification number (ein) or taxpayer identification number (tin). The irs 147c letter confirms your organization’s fein and is often required for contracts.

Printable 147c Form Printable Form 2024

The cp575 confirms your ein. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter). You can request it by calling the irs business & specialty. The irs 147c letter confirms your organization’s fein and is often required for contracts. Irs letter 147c confirms your employer identification number.

What Is a CP575 Letter? Your Guide to the EIN Confirmation Notice

Irs letter 147c confirms your employer identification number (ein) details. The cp575 confirms your ein. If the business name is incorrect, contact the irs business &. The irs will mail the. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter).

The Cp575 Confirms Your Ein.

Irs letter 147c confirms your employer identification number (ein) details. The irs 147c letter confirms your organization’s fein and is often required for contracts. If the business name is incorrect, contact the irs business &. The irs will mail the.

Irs Form 147C Is An Official Transcript That Verifies A Taxpayer’s Employer Identification Number (Ein) Or Taxpayer Identification Number (Tin).

You can request it by calling the irs business & specialty. When you get through to a representative, request a replacement for your ein confirmation letter (often referred to as a 147c letter).