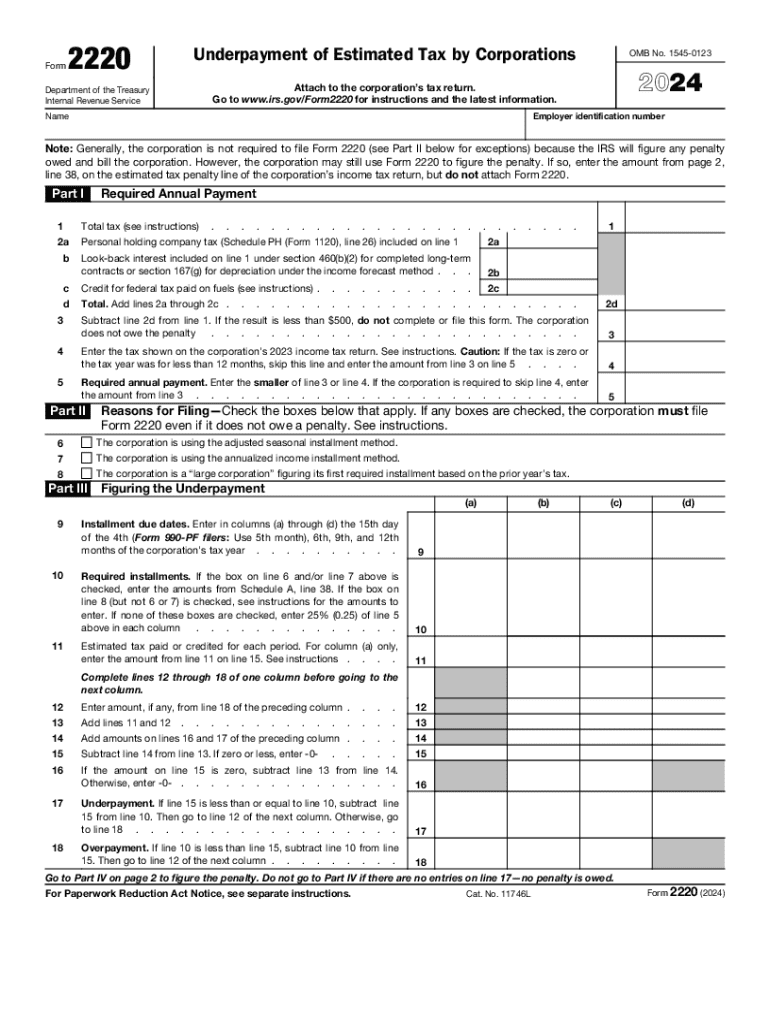

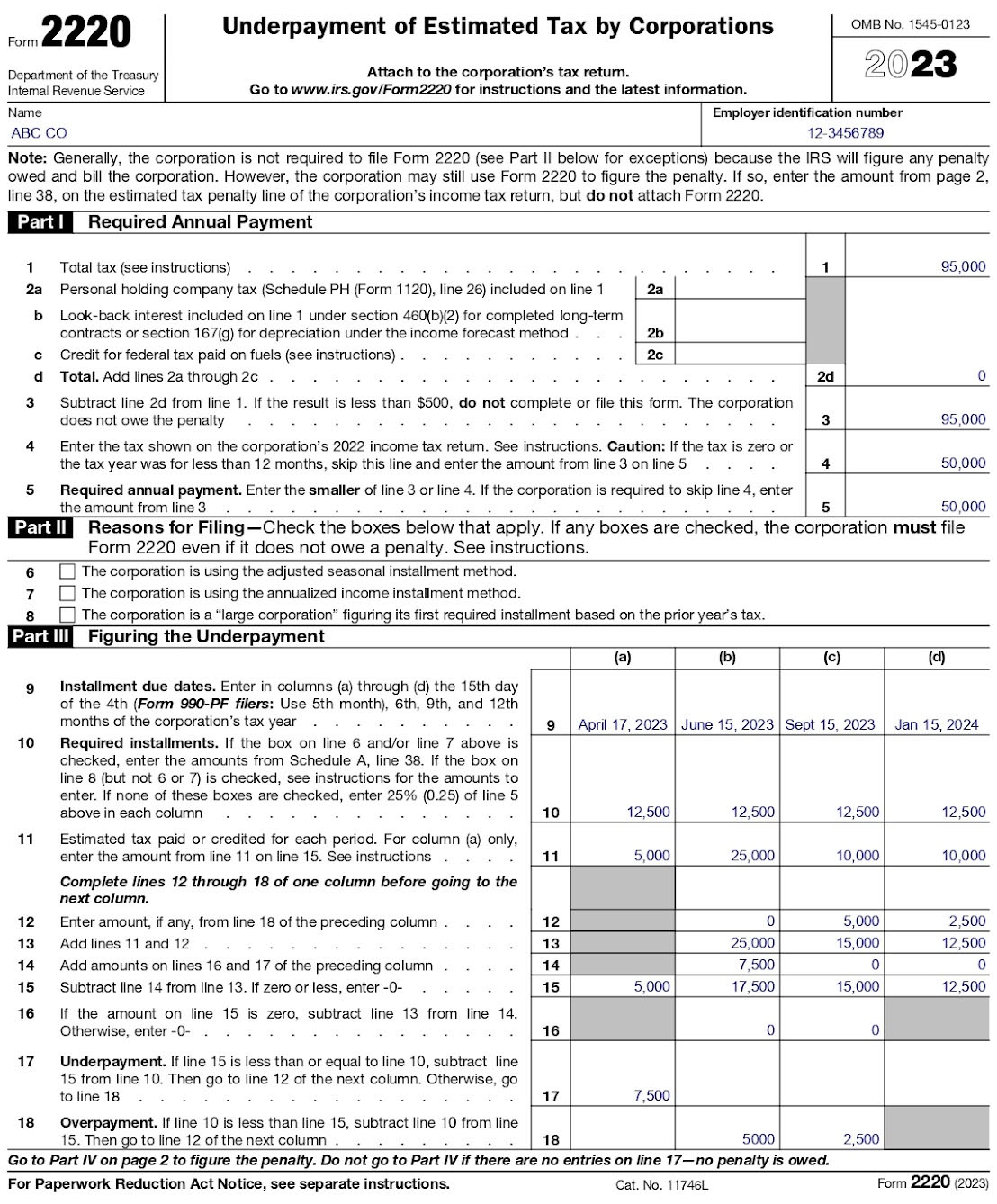

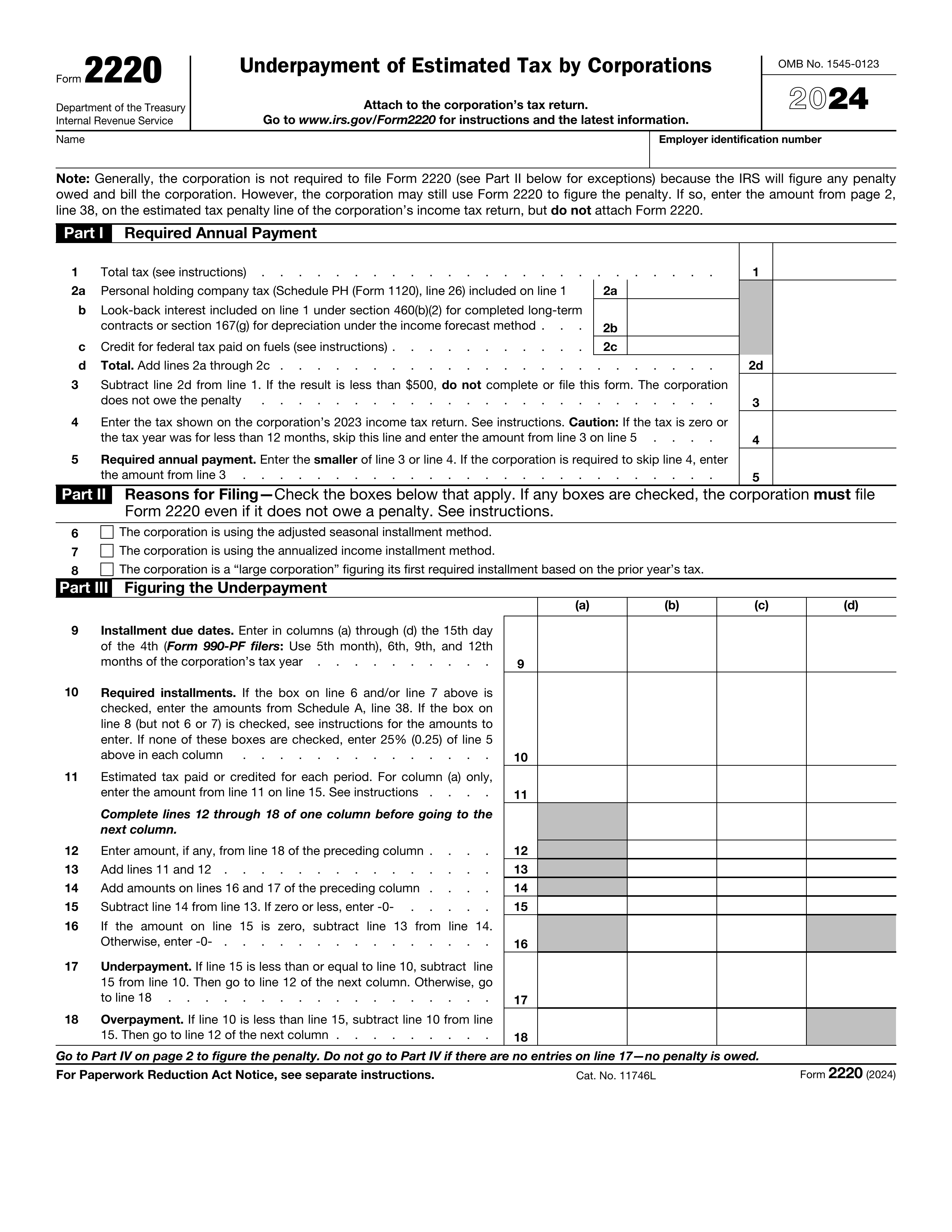

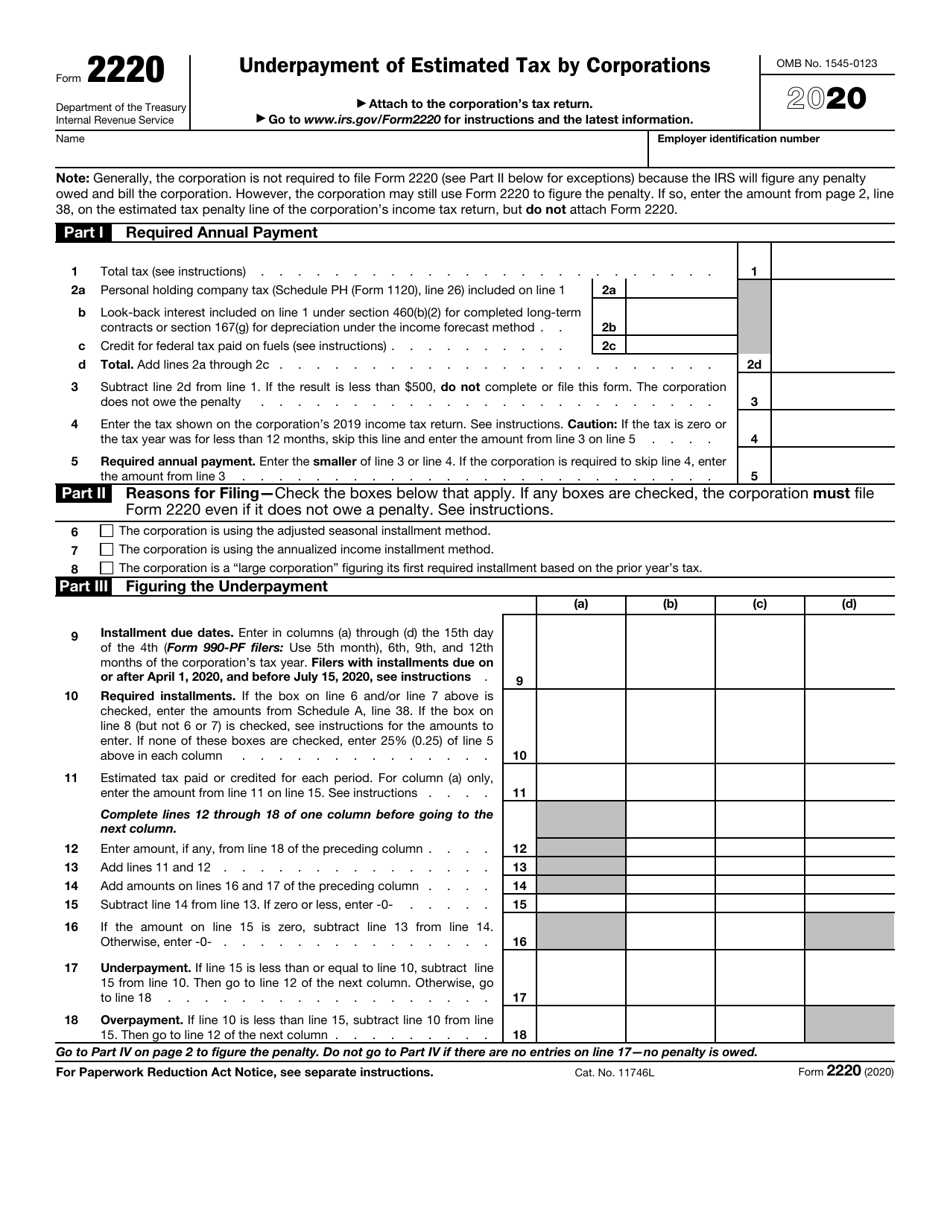

2220 Form - Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. Read the instructions on the reverse side. Ent of estimated tax for corporations, for. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19.

Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Ent of estimated tax for corporations, for. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. Read the instructions on the reverse side.

Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. Read the instructions on the reverse side. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Ent of estimated tax for corporations, for.

Irs 2210 20242025 Form Fill Out and Sign Printable PDF Template

Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Read the.

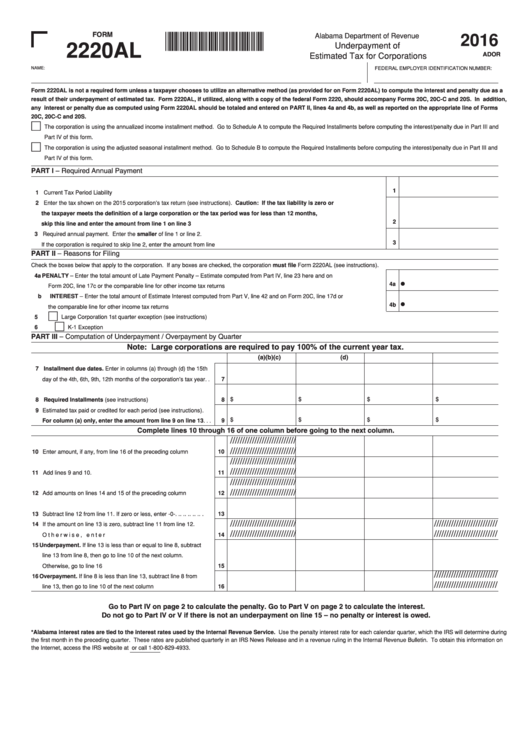

Fillable Form 2220al Underpayment Of Estimated Tax For Corporations

6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue.

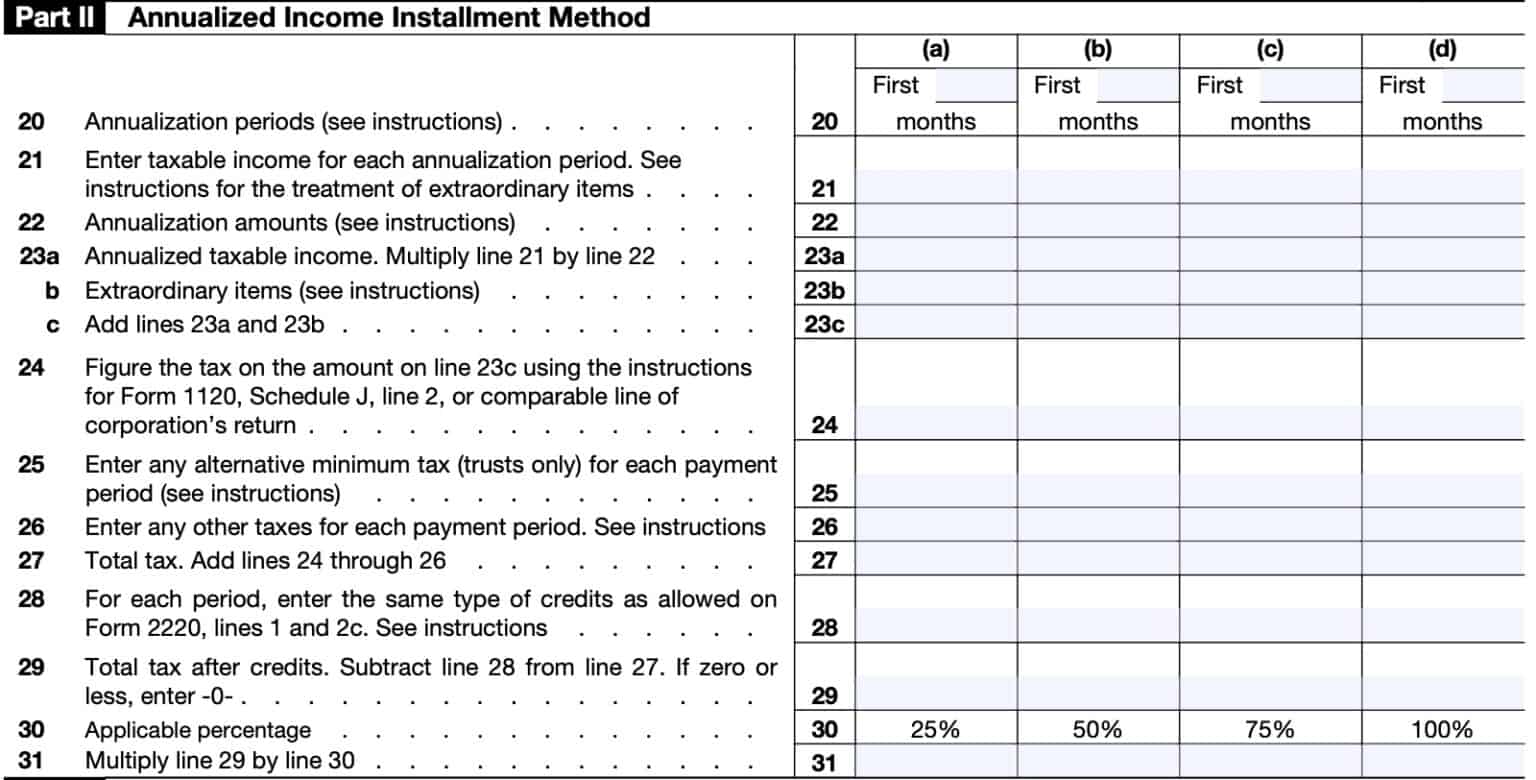

Fillable Online Instructions for Form 2220 Underpayment of Estimated

6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Ent of estimated tax for corporations, for. Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from.

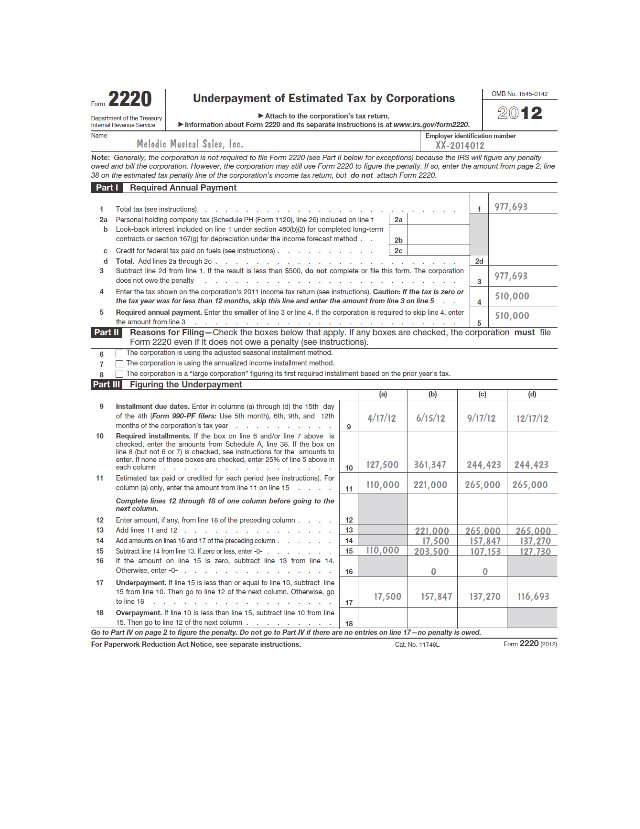

IRS Form 2220 Instructions Estimated Corporate Tax

6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Read the instructions on the reverse side. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. Ent of estimated tax for corporations, for. Affected corporations must still file the 2024 form 2220,.

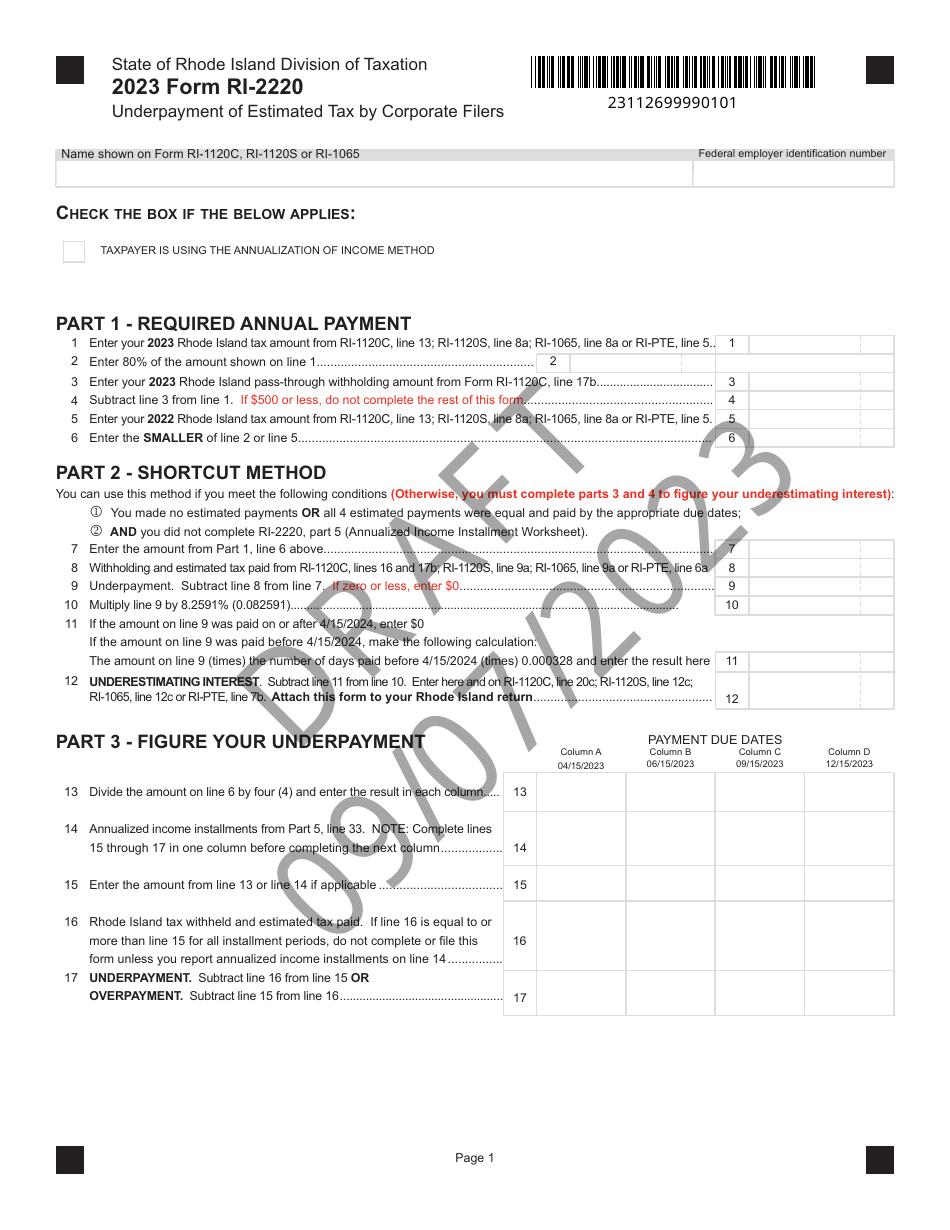

Form RI2220 Download Printable PDF or Fill Online Underpayment of

Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Read the instructions on the reverse side. Form 2220, “underpayment of estimated tax by corporations,” is used to determine.

What is Form 2220 (+Example)

Ent of estimated tax for corporations, for. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Read the instructions on the reverse side. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. Form 2220, “underpayment of estimated tax by corporations,” is.

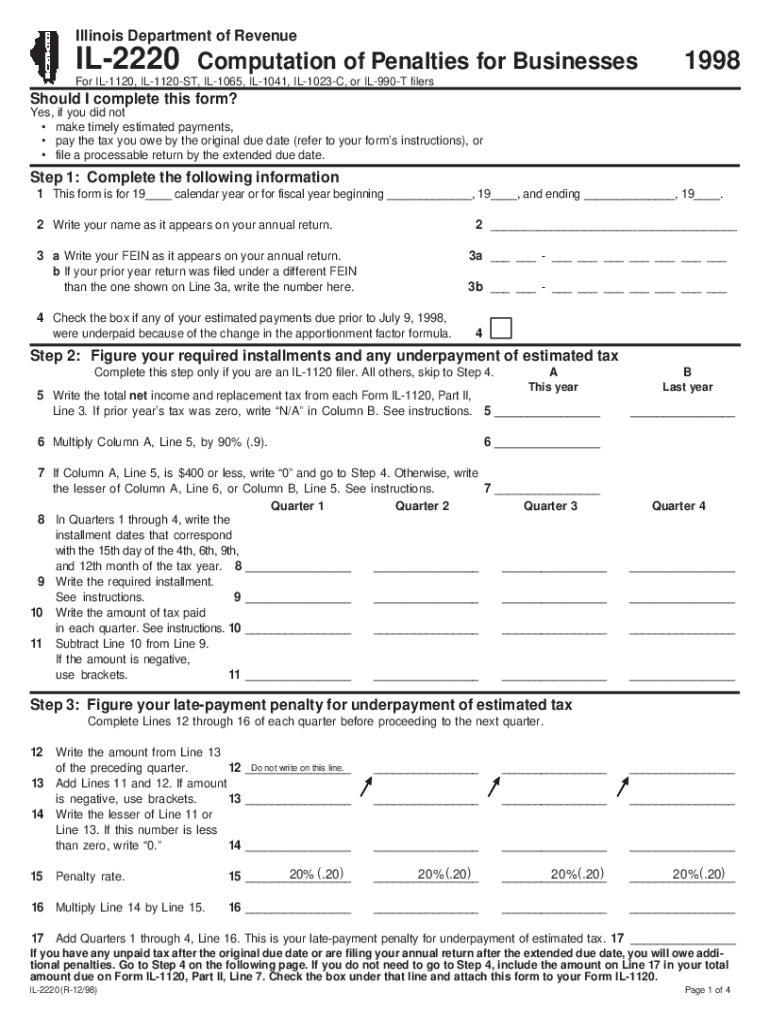

Fillable Online tax illinois 2022 Form IL2220 Computation of

Read the instructions on the reverse side. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free.

Form 2220 20242025 Fill Out Official Tax Forms Online

Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty. Information about.

Can someone explain to me why Line 10 of the Form

Download or print the 2024 federal form 2220 (underpayment of estimated tax by corporations) for free from the federal internal revenue service. Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to. Ent of estimated tax for corporations, for. Form 2220, “underpayment of estimated tax by corporations,” is used to.

IRS Form 2220 Download Fillable PDF or Fill Online Underpayment of

Ent of estimated tax for corporations, for. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax.

Read The Instructions On The Reverse Side.

Ent of estimated tax for corporations, for. Form 2220, “underpayment of estimated tax by corporations,” is used to determine if a corporation has paid enough. 6 8 16 17 18 19 part i — calculate the underpayment 1 6 8 16 17 18 19. Affected corporations must still file the 2024 form 2220, even if they owe no estimated tax penalty.

Download Or Print The 2024 Federal Form 2220 (Underpayment Of Estimated Tax By Corporations) For Free From The Federal Internal Revenue Service.

Information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and instructions on how to.