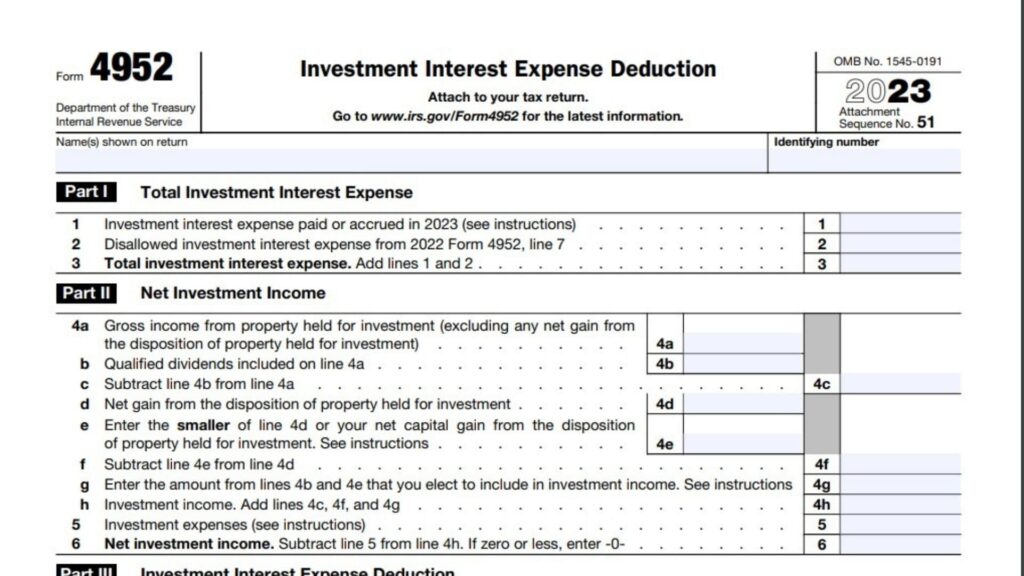

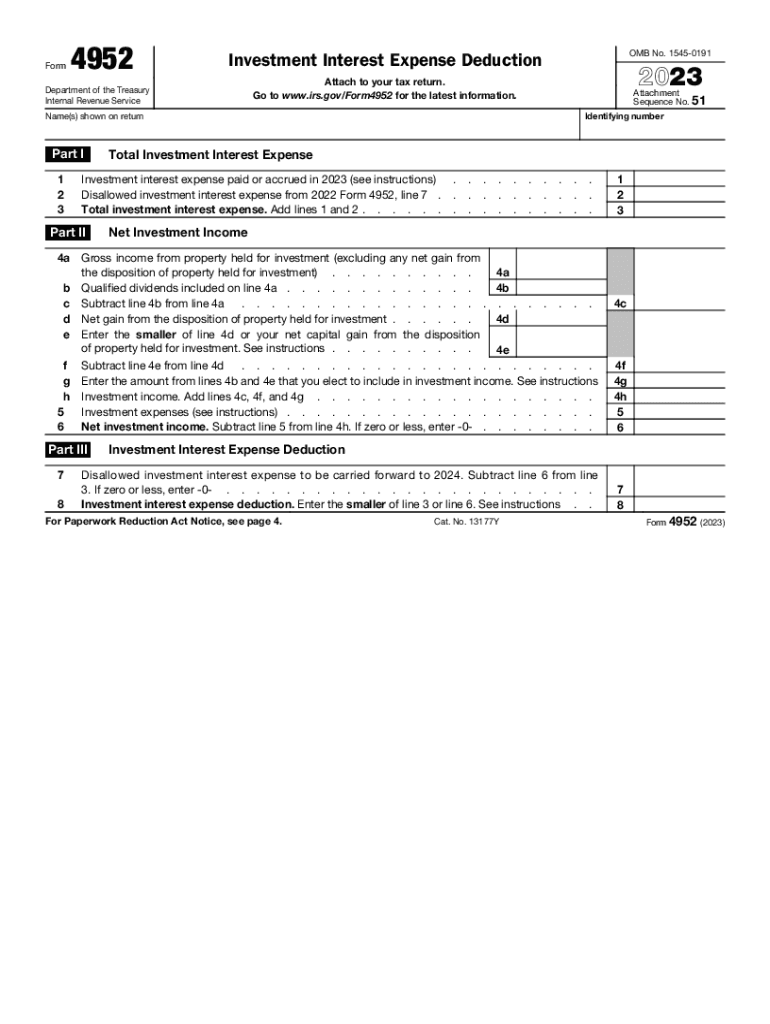

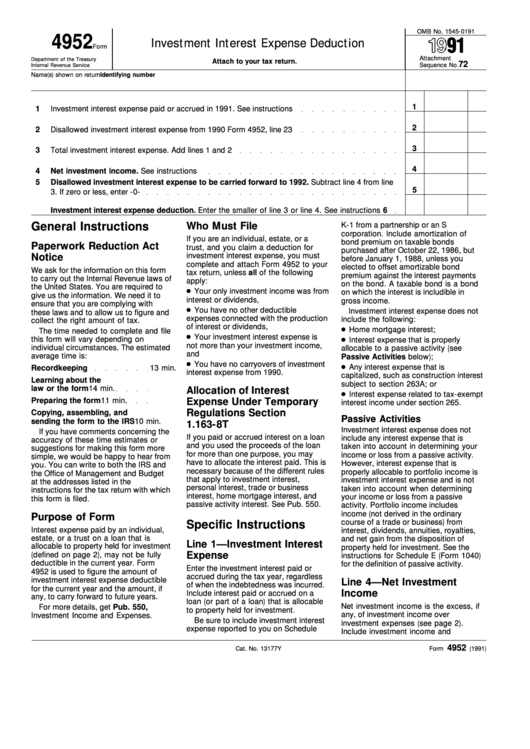

4952 Form Instructions - Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Maximize tax savings with form for investment interest deduction. Looking for tax deductions to itemize on schedule a? Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Easily claim deductions for individual tax returns. This guide will show you how irs form 4952 can help deduct investment interest.

Maximize tax savings with form for investment interest deduction. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Easily claim deductions for individual tax returns. Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. This guide will show you how irs form 4952 can help deduct investment interest. Looking for tax deductions to itemize on schedule a?

Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Looking for tax deductions to itemize on schedule a? This guide will show you how irs form 4952 can help deduct investment interest. Easily claim deductions for individual tax returns. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Maximize tax savings with form for investment interest deduction.

IRS Form 4952 Instructions Investment Interest Deduction

This guide will show you how irs form 4952 can help deduct investment interest. Easily claim deductions for individual tax returns. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Maximize tax savings with form for investment interest deduction. Download or print the 2024 federal form 4952.

IRS Form 4952 Instructions Investment Interest Deduction

Looking for tax deductions to itemize on schedule a? Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Download or print the 2024 federal form 4952 (investment interest expense deduction) for.

Form 4952 Fill and sign online with Lumin

Easily claim deductions for individual tax returns. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Maximize tax savings with form for investment interest deduction. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Looking for tax deductions to itemize.

IRS Form 4952 Instructions Investment Interest Deduction

Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Maximize tax savings with form for investment interest deduction. Looking for tax deductions to itemize on schedule a? Easily claim deductions for individual tax returns. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who.

Form 4952 Instructions 2024 2025

This guide will show you how irs form 4952 can help deduct investment interest. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. Easily claim deductions for individual tax returns. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Maximize.

Form 4952 Instructions 2024 2025

Maximize tax savings with form for investment interest deduction. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Easily claim deductions for individual tax returns. This guide will show you how irs form 4952 can help deduct investment interest. Looking for tax deductions to itemize on schedule a?

Form 4952 Fill and sign online with Lumin

Looking for tax deductions to itemize on schedule a? Maximize tax savings with form for investment interest deduction. Easily claim deductions for individual tax returns. Information about form 4952, investment interest expense deduction, including recent updates, related forms and instructions on. Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue.

Investment 20232025 Form Fill Out and Sign Printable PDF Template

Maximize tax savings with form for investment interest deduction. Easily claim deductions for individual tax returns. Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible. This guide.

Form 4952 Worksheet

This guide will show you how irs form 4952 can help deduct investment interest. Easily claim deductions for individual tax returns. Maximize tax savings with form for investment interest deduction. Looking for tax deductions to itemize on schedule a? Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service.

What Is Form 4952 Used For Coremymages

Download or print the 2024 federal form 4952 (investment interest expense deduction) for free from the federal internal revenue service. Maximize tax savings with form for investment interest deduction. This guide will show you how irs form 4952 can help deduct investment interest. Looking for tax deductions to itemize on schedule a? Information about form 4952, investment interest expense deduction,.

Information About Form 4952, Investment Interest Expense Deduction, Including Recent Updates, Related Forms And Instructions On.

Easily claim deductions for individual tax returns. This guide will show you how irs form 4952 can help deduct investment interest. Looking for tax deductions to itemize on schedule a? Maximize tax savings with form for investment interest deduction.

Download Or Print The 2024 Federal Form 4952 (Investment Interest Expense Deduction) For Free From The Federal Internal Revenue Service.

Form 4952, titled the investment interest expense deduction, is a critical document for taxpayers who need to calculate and report their deductible.