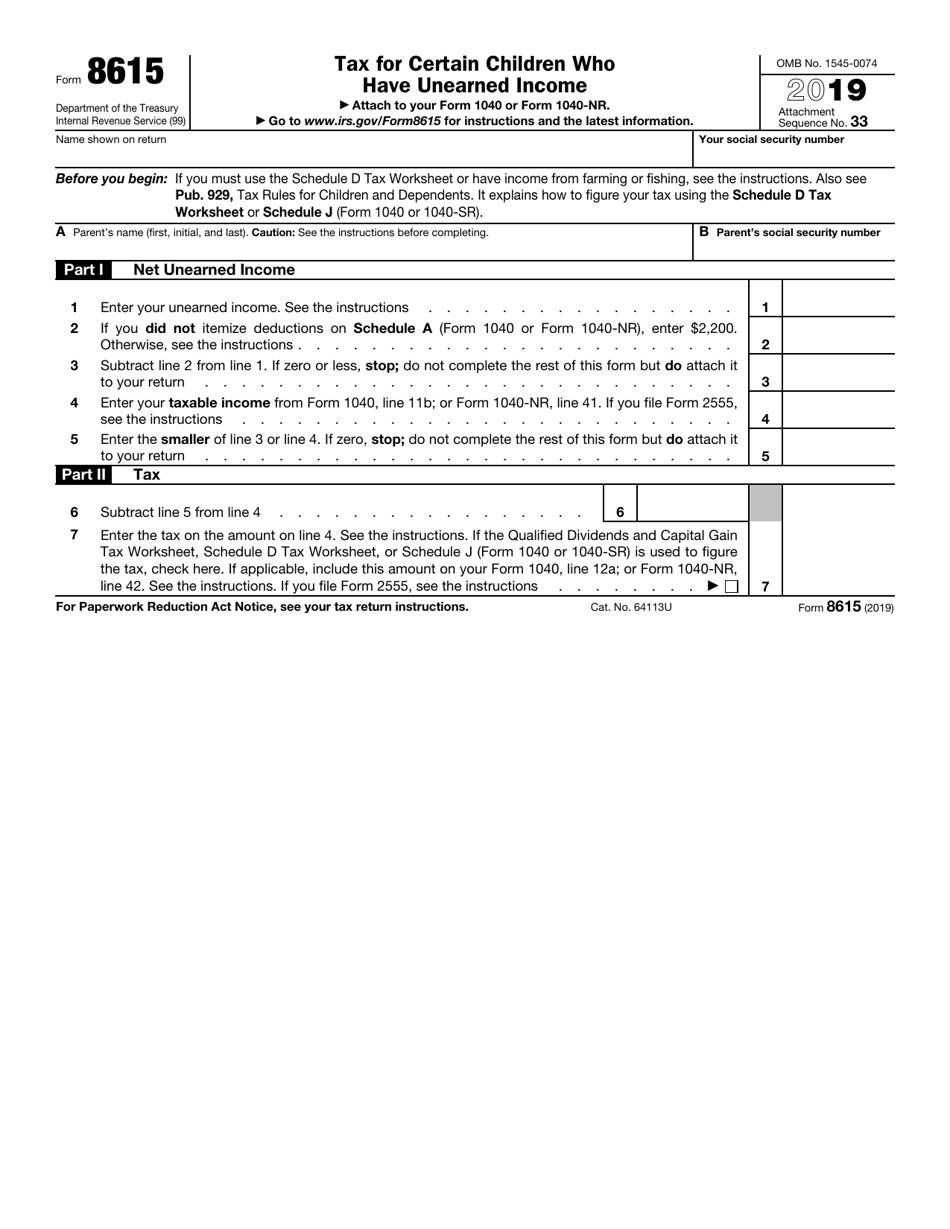

8615 Tax Form - Form 8615 applies to unearned income of certain children. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Learn about form 8615 and calculating children’s unearned income here. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 is used to calculate taxes on. Learn how it works and what it means for your family’s tax return.

Form 8615 applies to unearned income of certain children. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Learn about form 8615 and calculating children’s unearned income here. Form 8615 is used to calculate taxes on. Learn how it works and what it means for your family’s tax return.

Form 8615 is used to calculate taxes on. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 applies to unearned income of certain children. Learn how it works and what it means for your family’s tax return. Learn about form 8615 and calculating children’s unearned income here. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children.

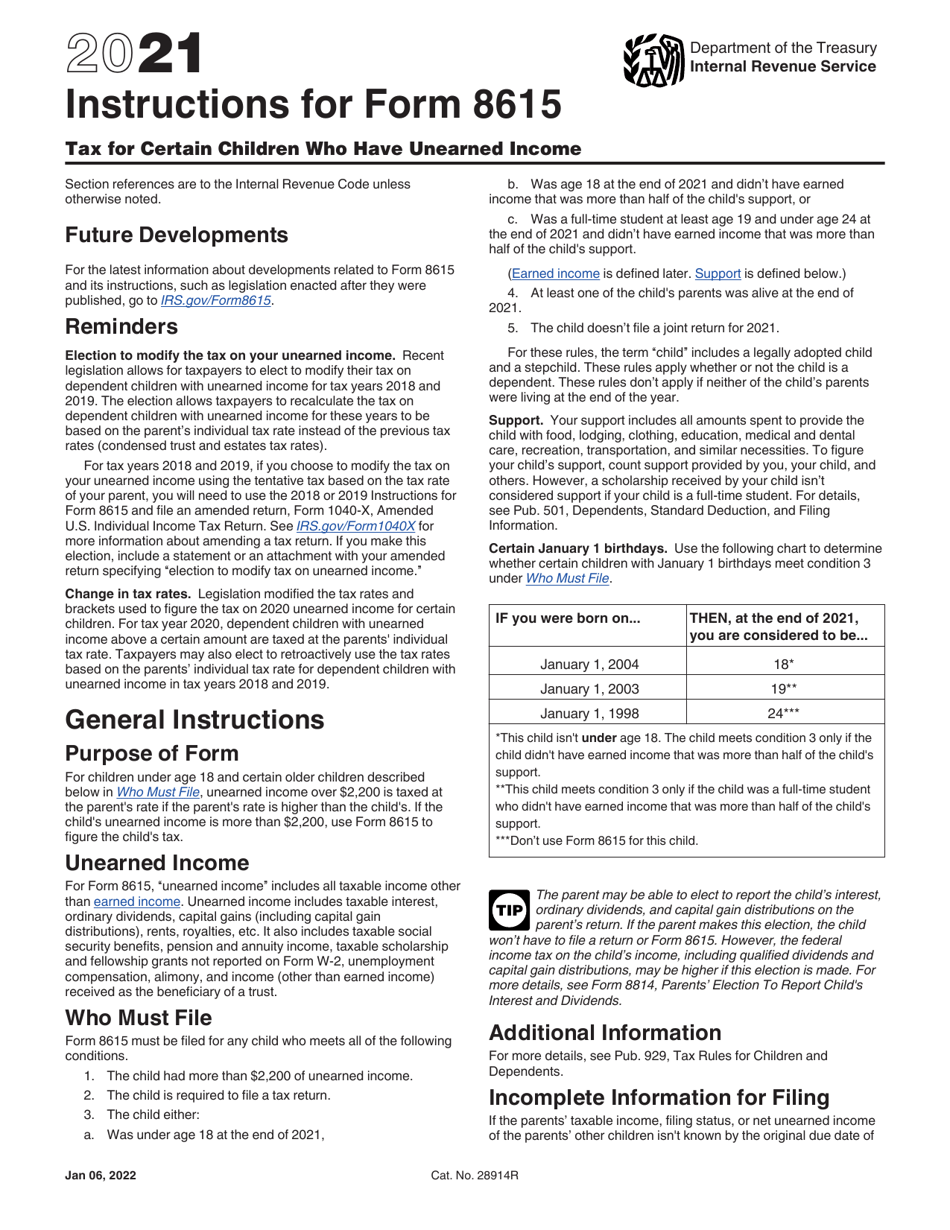

IRS Form 8615 Instructions

For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Learn about form 8615 and calculating children’s unearned income here. Learn how it works and what it means for your family’s tax return. Form 8615 applies to unearned income of certain children..

Instructions For Form 8615 Tax For Certain Children Who Have

Form 8615 applies to unearned income of certain children. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Learn about form 8615 and calculating children’s unearned income here. Form 8615 is used to calculate taxes on children's unearned income, which is.

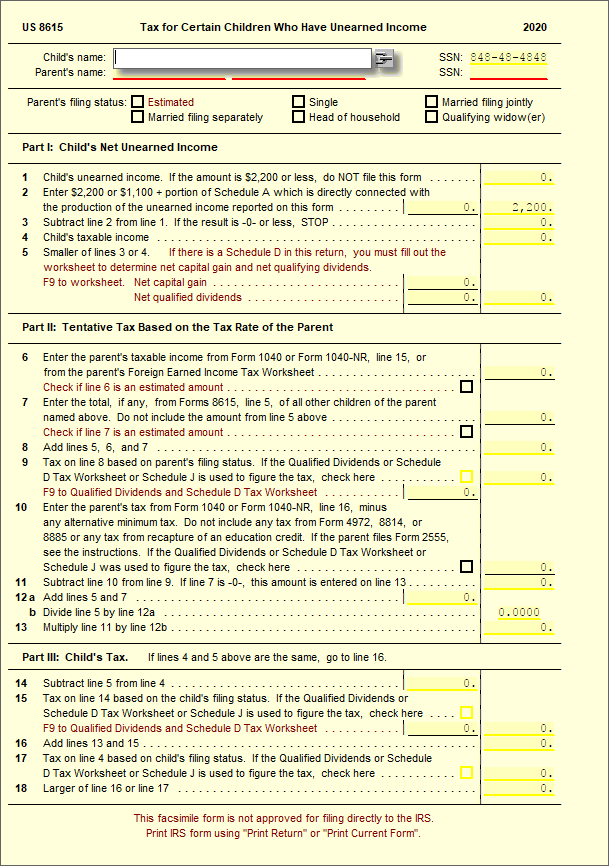

2022 Form IRS 8615 Fill Online, Printable, Fillable, Blank pdfFiller

For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 applies to unearned income of certain children. Form 8615 is used to calculate taxes on. Learn how it works and what it means for your family’s tax return. Form 8615.

IRS Form 8615 Download Fillable PDF or Fill Online Tax for Certain

For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Learn how it works and what it means for your family’s tax return. Form 8615 is used to calculate taxes on. Learn about form 8615 and calculating children’s unearned income here. Form.

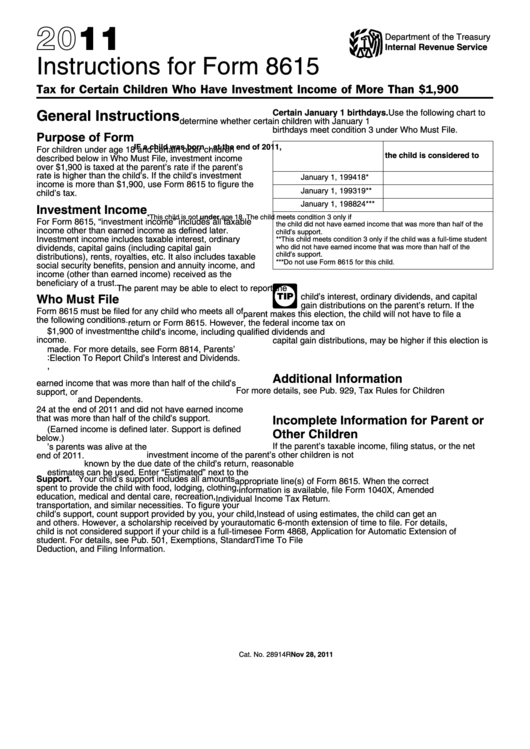

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Learn about form 8615 and calculating children’s unearned income here. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 is used to calculate taxes on. Learn how it works and what it means for your family’s tax return. Form.

IRS Form 8615 Instructions

Learn how it works and what it means for your family’s tax return. Form 8615 is used to calculate taxes on. Learn about form 8615 and calculating children’s unearned income here. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Form 8615 applies to unearned income.

Instructions for Filling Out Form 8615 Pilot Blogs Pilot Blog

Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Form 8615 is used to calculate taxes on. Learn how it works and what it means for your family’s tax return. For children under age 18 and certain older children described below in who must file ,.

8615 Tax for Certain Children Who Have Unearned UltimateTax

Form 8615 applies to unearned income of certain children. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Learn how it works and what it means for your family’s tax return. For children under age 18 and certain older children described below in who must file.

Publication 929 Tax Rules for Children and Dependents; Tax Rules for

Form 8615 is used to calculate taxes on. Learn about form 8615 and calculating children’s unearned income here. Form 8615 applies to unearned income of certain children. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. For children under age 18 and certain older children described.

Download Instructions for IRS Form 8615 Tax for Certain Children Who

Form 8615 applies to unearned income of certain children. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children. Learn how it works and what it means for your family’s tax return. Learn about form 8615 and calculating children’s unearned income here. Form 8615 is used to.

Learn How It Works And What It Means For Your Family’s Tax Return.

Form 8615 is used to calculate taxes on. Learn about form 8615 and calculating children’s unearned income here. For children under age 18 and certain older children described below in who must file , unearned income over $2,600 is taxed at the parent's rate if the. Form 8615 is used to calculate taxes on children's unearned income, which is taxed at a higher rate than income earned by children.

.webp)