Fatca Full Form - Fatca is used by government personnel to detect indicia of u.s. Taxpayers holding financial assets outside the country to report. Law designed to combat tax evasion by requiring foreign financial institutions. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. The foreign account tax compliance act (fatca) requires certain u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. The foreign account tax compliance act (fatca) is a u.s.

Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. Fatca is used by government personnel to detect indicia of u.s. Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) is a u.s. Law designed to combat tax evasion by requiring foreign financial institutions. The foreign account tax compliance act (fatca) requires certain u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s.

Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Law designed to combat tax evasion by requiring foreign financial institutions. Fatca is used by government personnel to detect indicia of u.s. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) is a u.s. The foreign account tax compliance act (fatca) requires certain u.s.

PPT WHAT IS FATCA ? PowerPoint Presentation, free download ID4993243

Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. Fatca is used by government personnel to detect indicia of u.s. Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) is a u.s. Law designed to combat tax evasion by requiring foreign financial institutions.

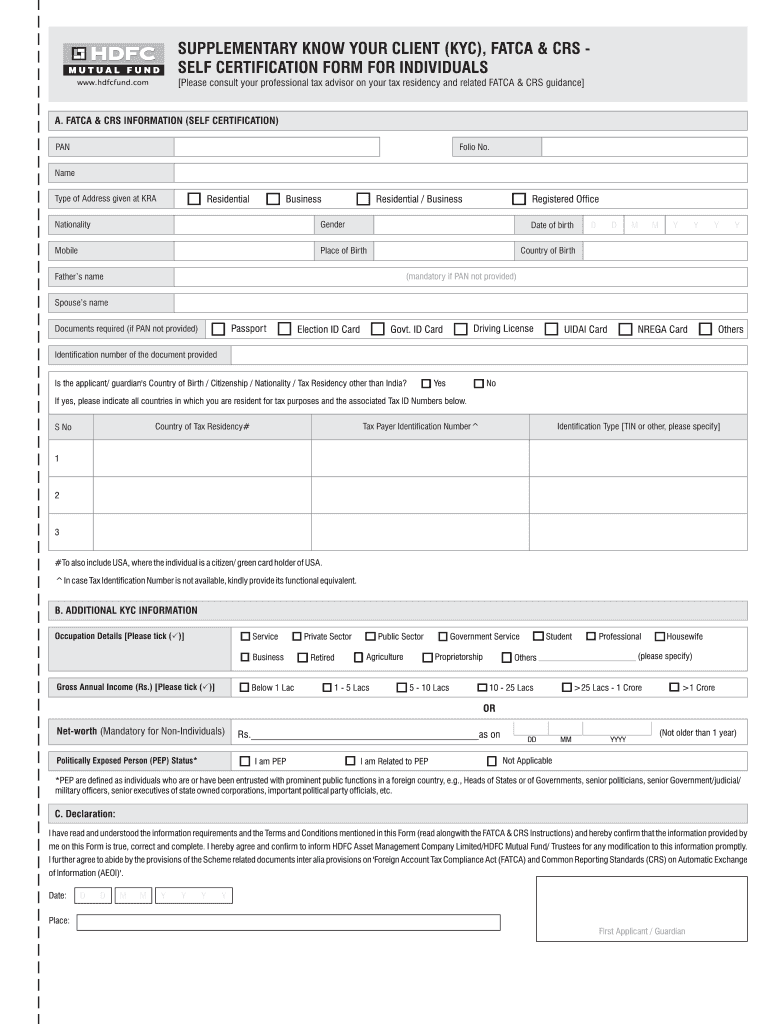

Foreign Account Tax Compliance Act (FATCA) Form PDF

Fatca is used by government personnel to detect indicia of u.s. Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) is a u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Law designed to combat tax evasion by requiring foreign financial institutions.

FATCA Declaration Form (New) PDF

Taxpayers holding financial assets outside the country to report. Fatca is used by government personnel to detect indicia of u.s. Law designed to combat tax evasion by requiring foreign financial institutions. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. The foreign account tax compliance act (fatca) is a u.s.

FATCA full form full form of FATCA full form YouTube

Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. The foreign account tax compliance act (fatca) requires certain u.s. Taxpayers holding financial assets outside the country to report. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Fatca is used by.

Foreign Account Tax Compliance Act Finance Strategists

Fatca is used by government personnel to detect indicia of u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. The foreign account tax compliance act (fatca) requires certain u.s. The foreign.

How to fill Fatca & CRS declaration form in SBI fatca declaration

Taxpayers holding financial assets outside the country to report. Law designed to combat tax evasion by requiring foreign financial institutions. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. The foreign account tax compliance act (fatca) is a u.s. Fatca is used by government personnel to detect indicia of u.s.

FATCA, CRS & the Automatic Exchange of Information A Look at

Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) requires certain u.s. Fatca is used by government personnel to detect indicia of u.s. The foreign account tax compliance act (fatca) is a u.s. Law designed to combat tax evasion by requiring foreign financial institutions.

FATCACRS Declaration & Supplementary KYC Information Declaration Form

Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Taxpayers holding financial assets outside the country to report. The foreign account tax compliance act (fatca) requires certain u.s. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. Law designed to combat.

【深度解析】FATCA与CRS全球税务合规之路:挑战、争议与未来展望 ingstart全球公司成立与合规

The foreign account tax compliance act (fatca) is a u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s. Fatca is used by government personnel to detect indicia of u.s. Law designed.

Fatca full form Fill out & sign online DocHub

Fatca is used by government personnel to detect indicia of u.s. Taxpayers holding financial assets outside the country to report. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. The foreign account tax compliance act (fatca) is a u.s. Law designed to combat tax evasion by requiring foreign financial institutions.

Taxpayers Holding Financial Assets Outside The Country To Report.

Law designed to combat tax evasion by requiring foreign financial institutions. Fatca is used by government personnel to detect indicia of u.s. Fatca requires foreign financial institutions (ffis) to report to the irs information about financial accounts held by u.s. Signed into law in 2010, the foreign account tax compliance act (fatca) aims to curb tax evasion by u.s.

The Foreign Account Tax Compliance Act (Fatca) Requires Certain U.s.

The foreign account tax compliance act (fatca) is a u.s.