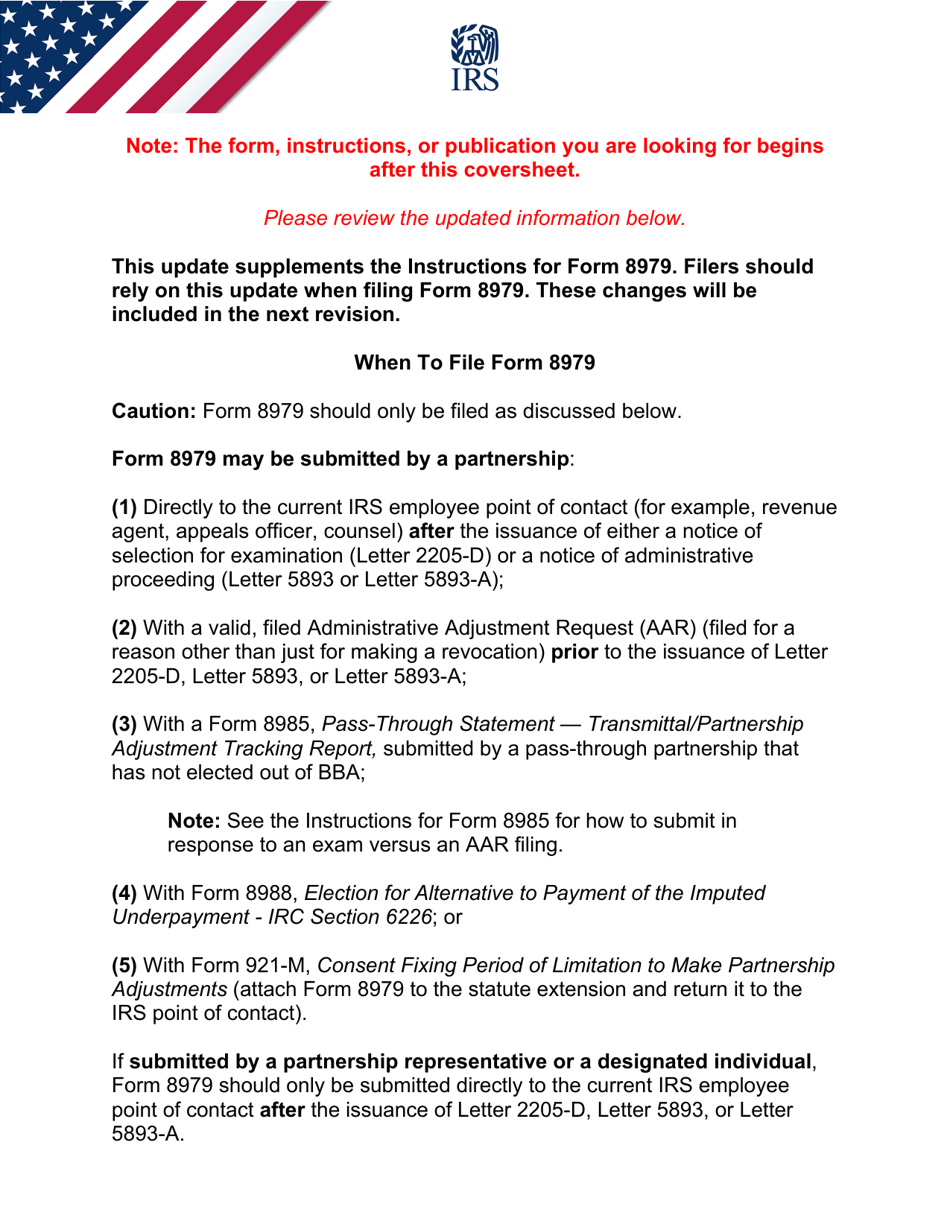

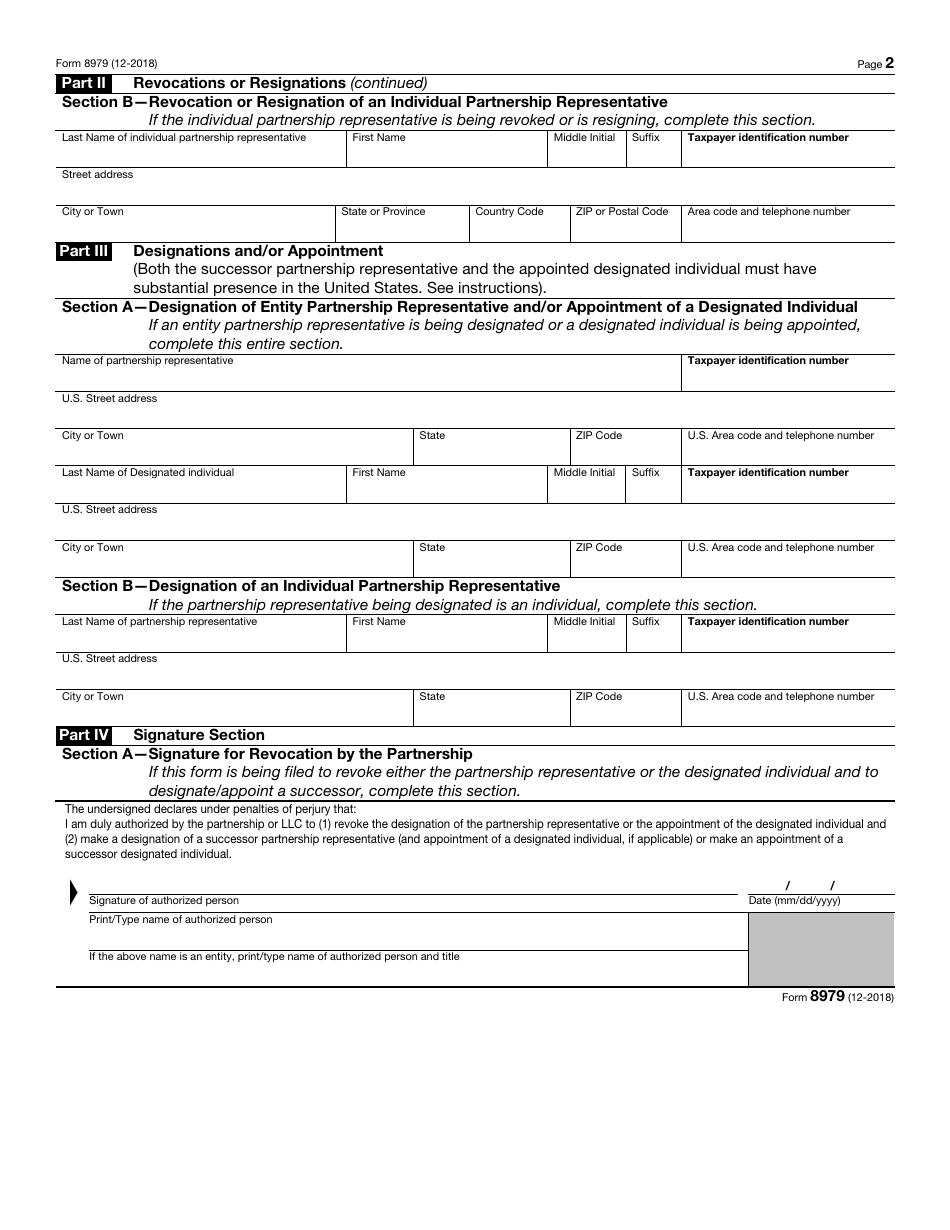

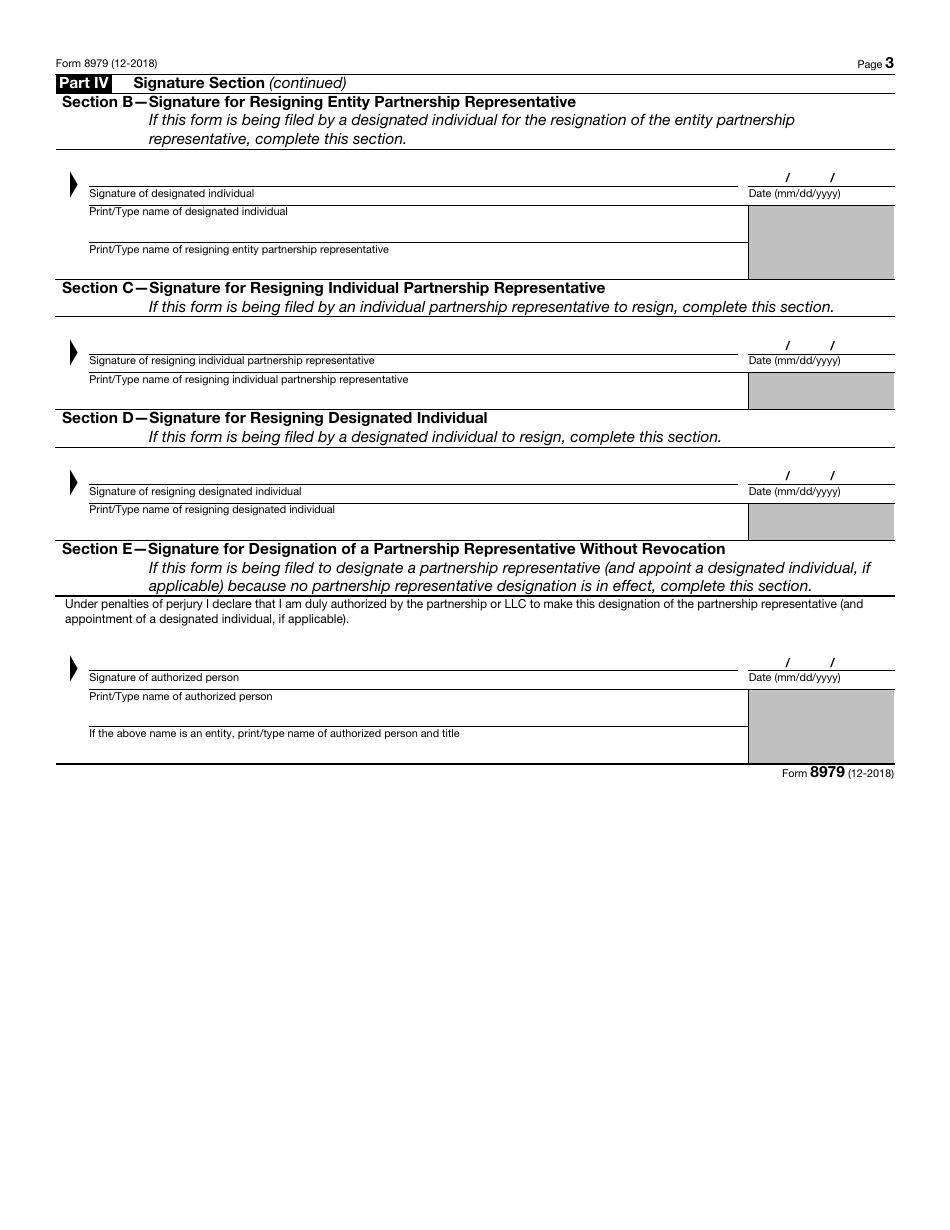

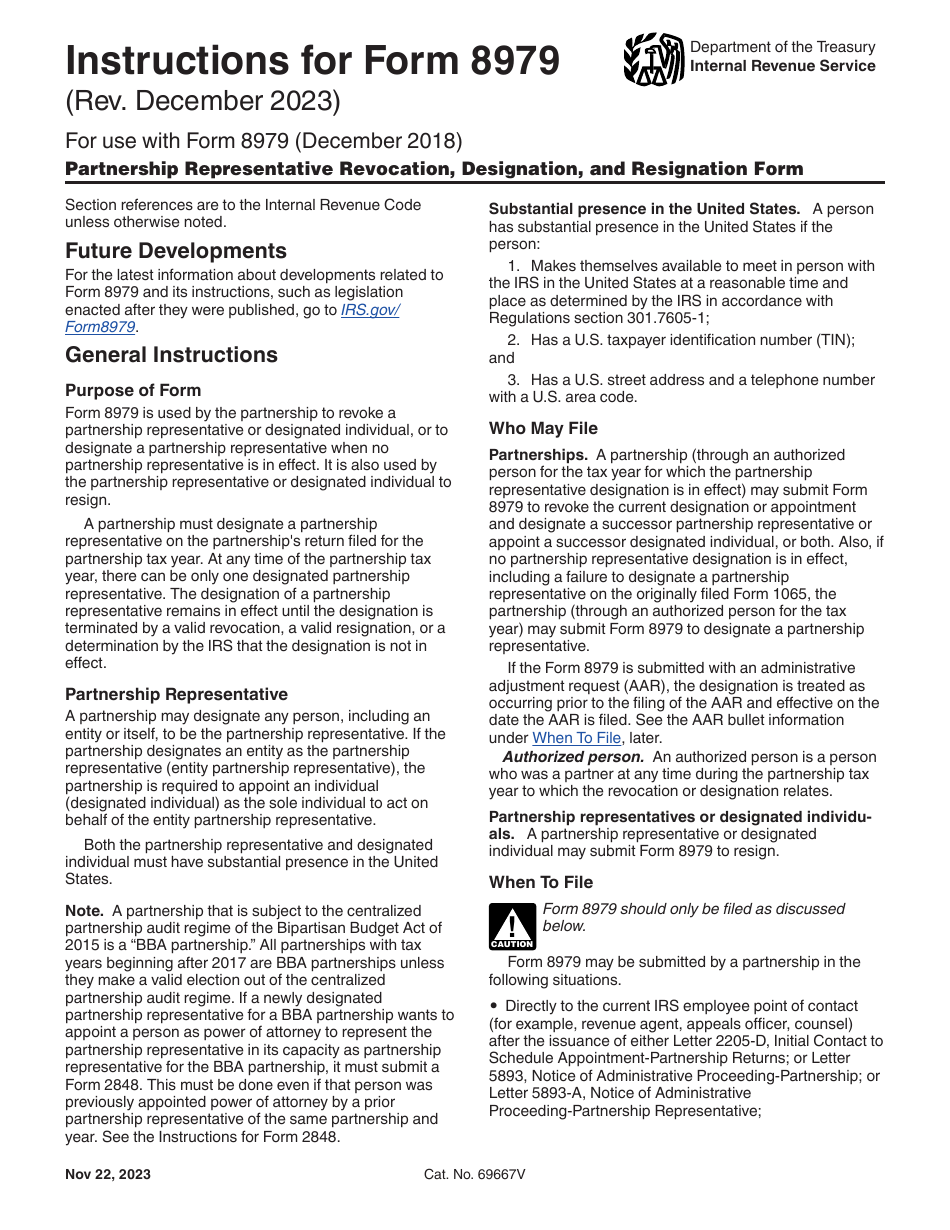

Form 8979 - Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. This update supplements the instructions for form 8979. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative.

If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. This update supplements the instructions for form 8979. Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs.

Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. This update supplements the instructions for form 8979. Filers should rely on this update for the change described, which will be incorporated into the next.

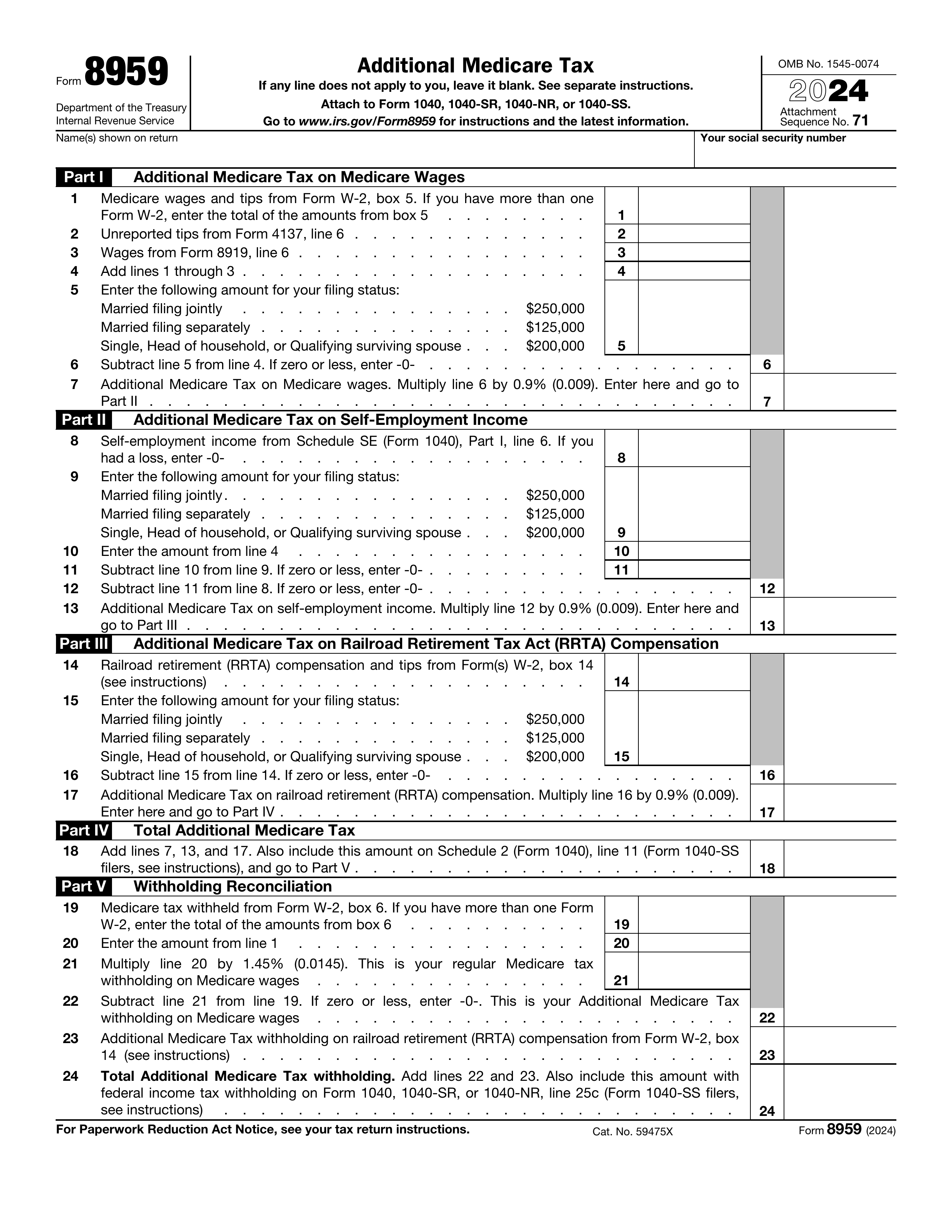

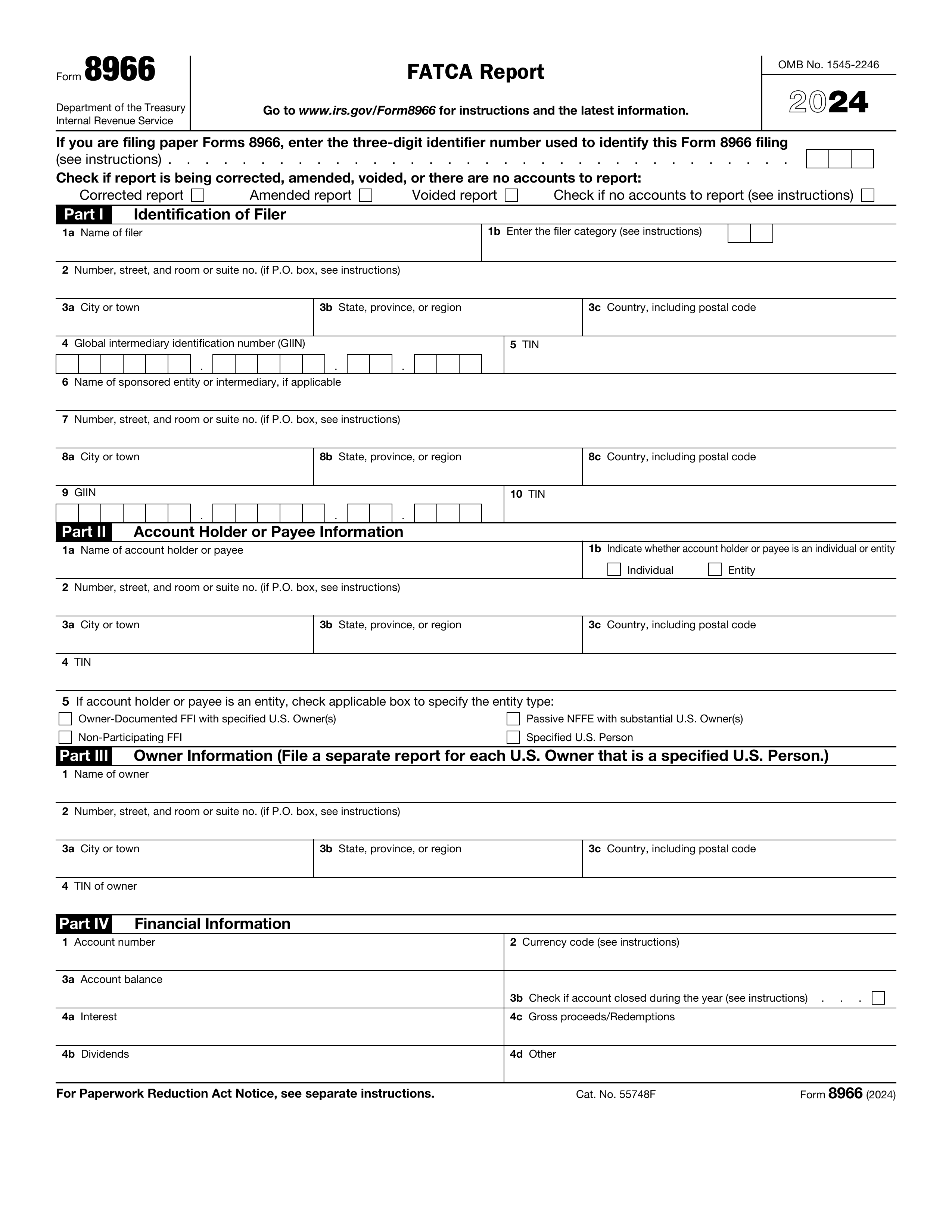

Fill Form 8990 Limitation on Business Interest Expense 20242025

Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. This update supplements the instructions for form 8979. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Filers should rely on this update for the change described, which will be incorporated.

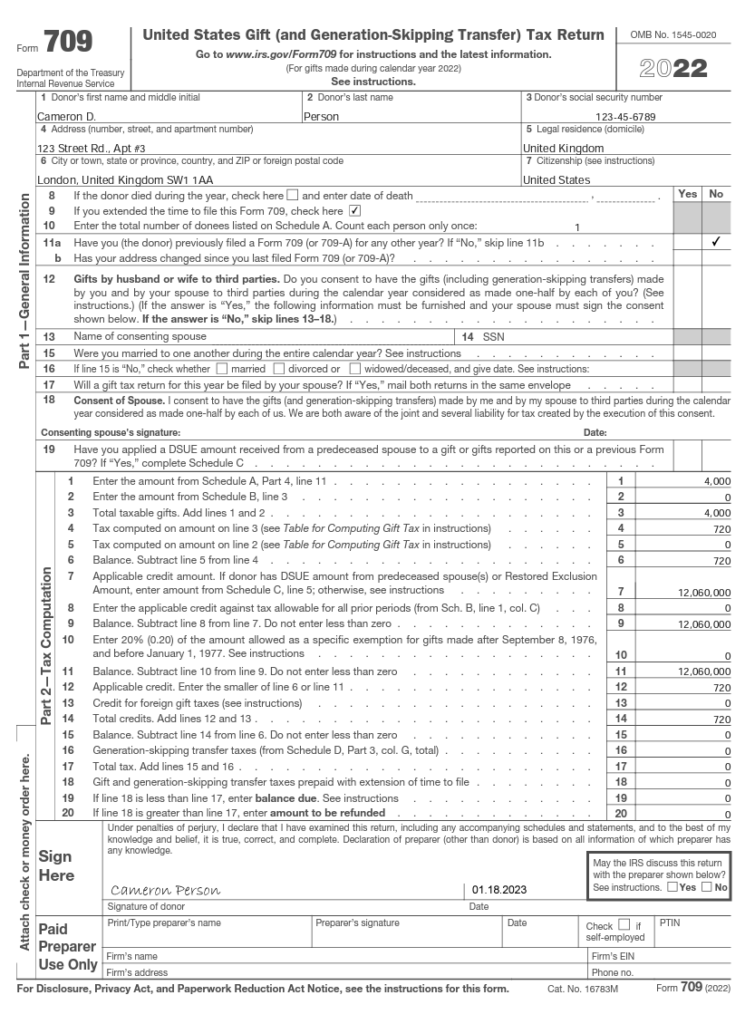

Form 709 Guide to US Gift Taxes for Expats

Filers should rely on this update for the change described, which will be incorporated into the next. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. This update supplements the instructions.

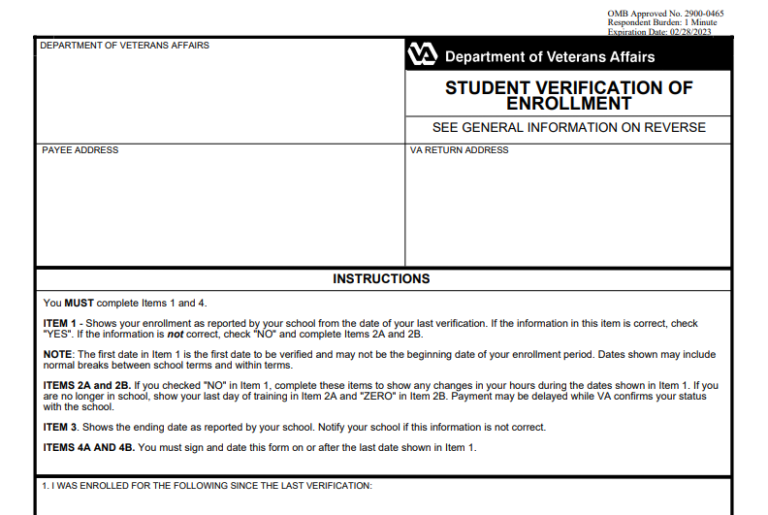

Printable VA Form 22 8979 VA Form

Filers should rely on this update for the change described, which will be incorporated into the next. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. This update supplements the instructions for form 8979. Form 8979 is essential for partnerships needing to update their designated tax representative.

Download Instructions for IRS Form 8979 Partnership Representative

Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. This update.

IRS Form 8979 Fill Out, Sign Online and Download Fillable PDF

Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original.

Fill Form 8990 Limitation on Business Interest Expense 20242025

If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Filers should rely on this update for the change described, which will be incorporated into the next. This update supplements the instructions for form 8979. Form 8979 is essential for partnerships needing to update their designated tax representative.

IRS Form 8979 Fill Out, Sign Online and Download Fillable PDF

Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. This update supplements.

Download Instructions for IRS Form 8979 Partnership Representative

Filers should rely on this update for the change described, which will be incorporated into the next. This update supplements the instructions for form 8979. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. If no pr was designated on the original form 1065, one will need to be identified.

Download Instructions for IRS Form 8979 Partnership Representative

Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. This update supplements the instructions for form 8979. Filers should rely on this update for the change described, which will be incorporated into the next..

Download Instructions for IRS Form 8979 Partnership Representative

Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Form 8979 is used to.

This Update Supplements The Instructions For Form 8979.

Form 8979 is essential for partnerships needing to update their designated tax representative with the irs. If no pr was designated on the original form 1065, one will need to be identified using a form 8979, partnership representative. Filers should rely on this update for the change described, which will be incorporated into the next. Form 8979 is used to revoke a partnership representative or designated individual, resign as a partnership representative or designated.