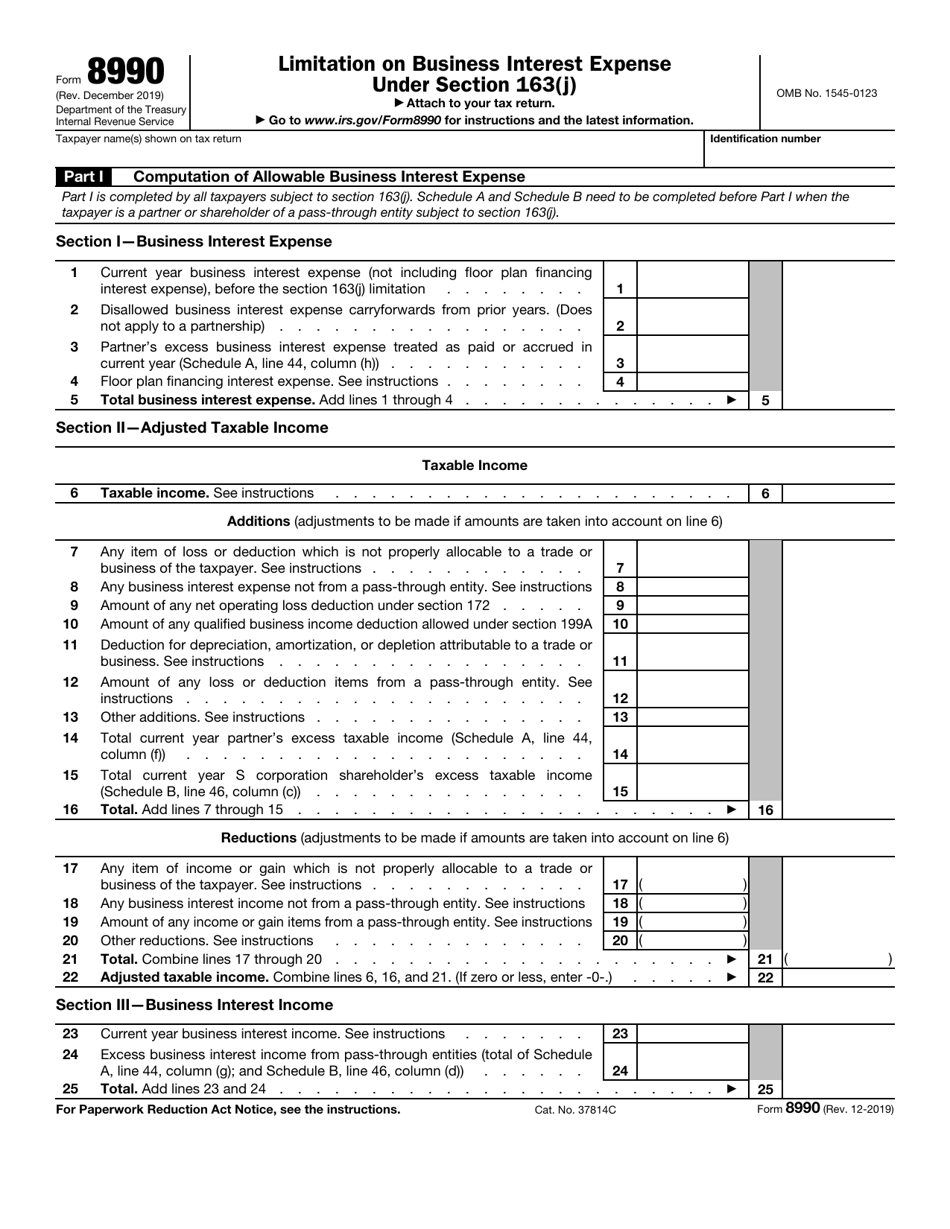

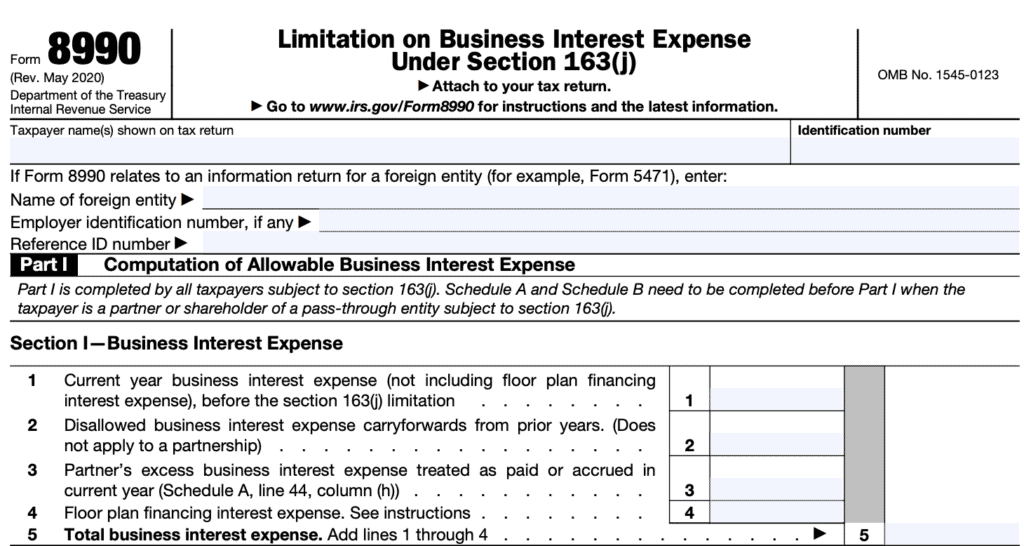

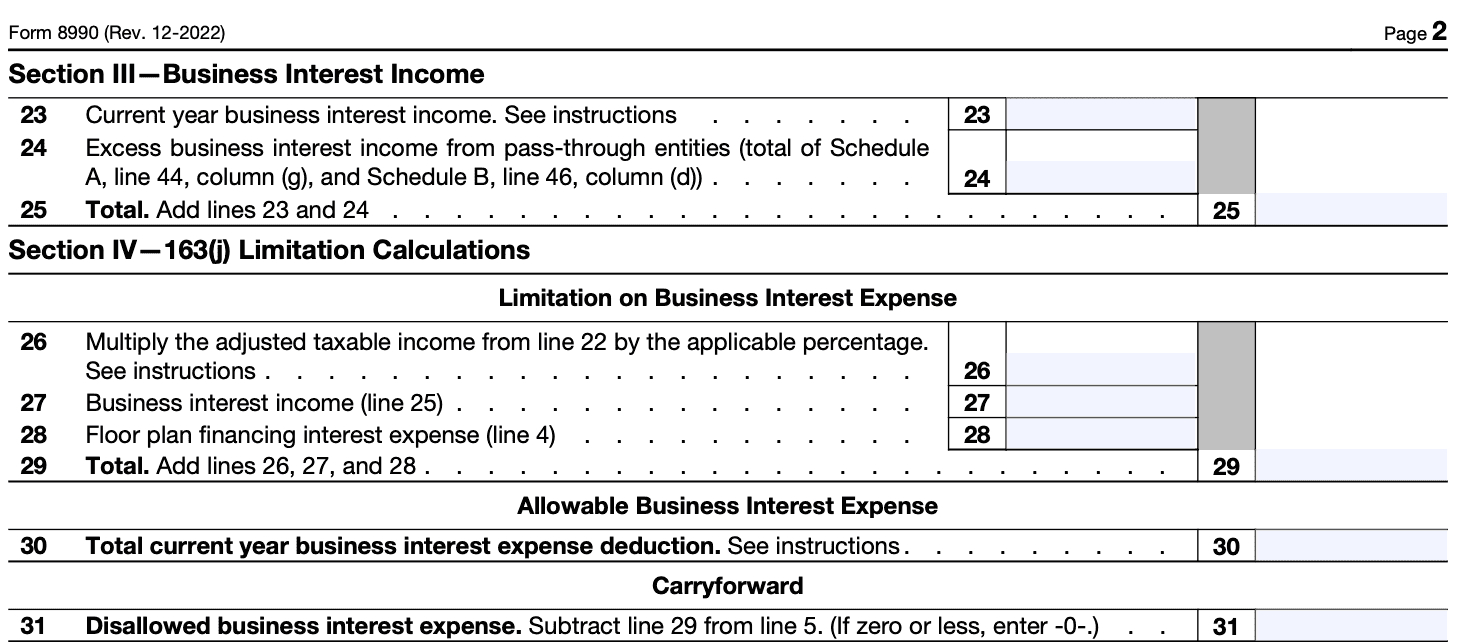

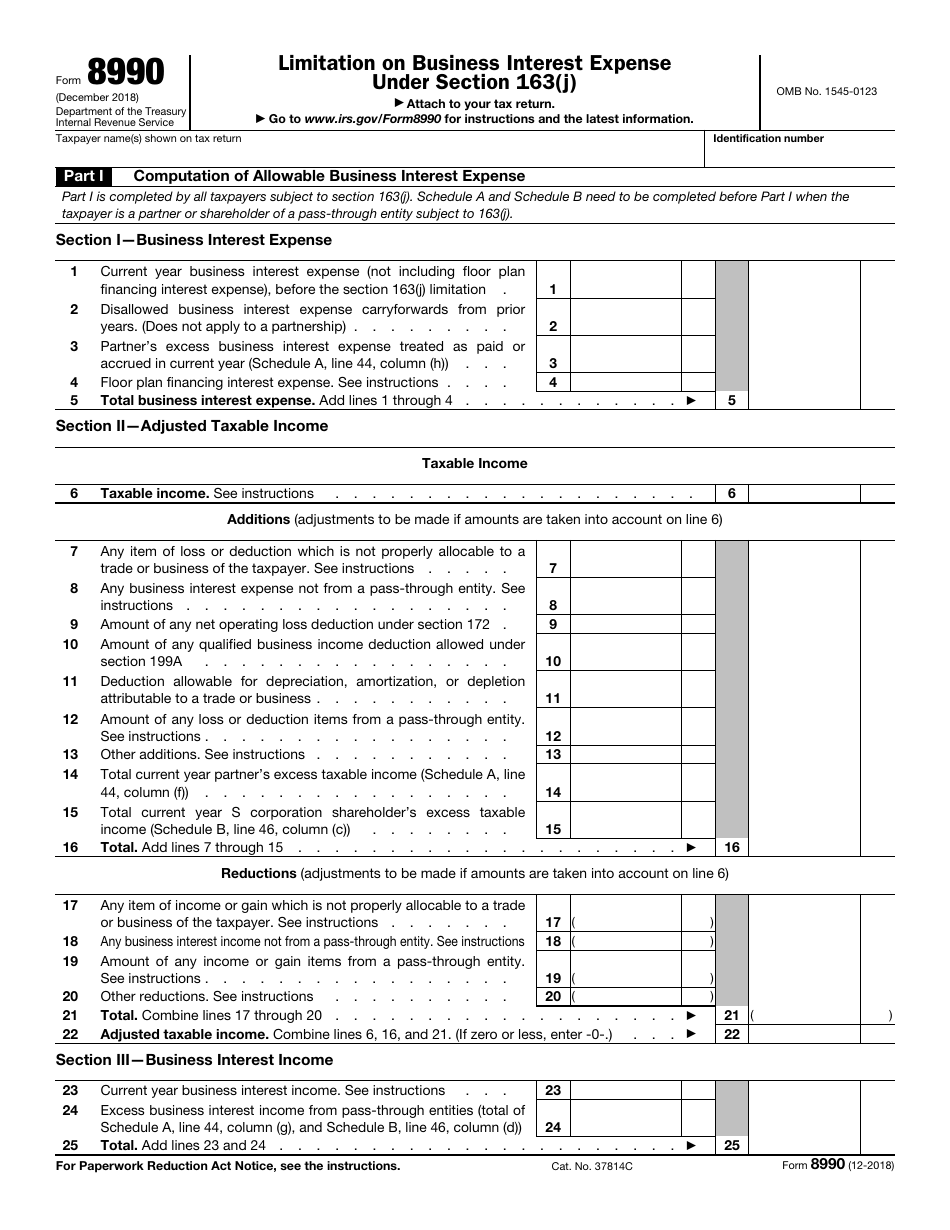

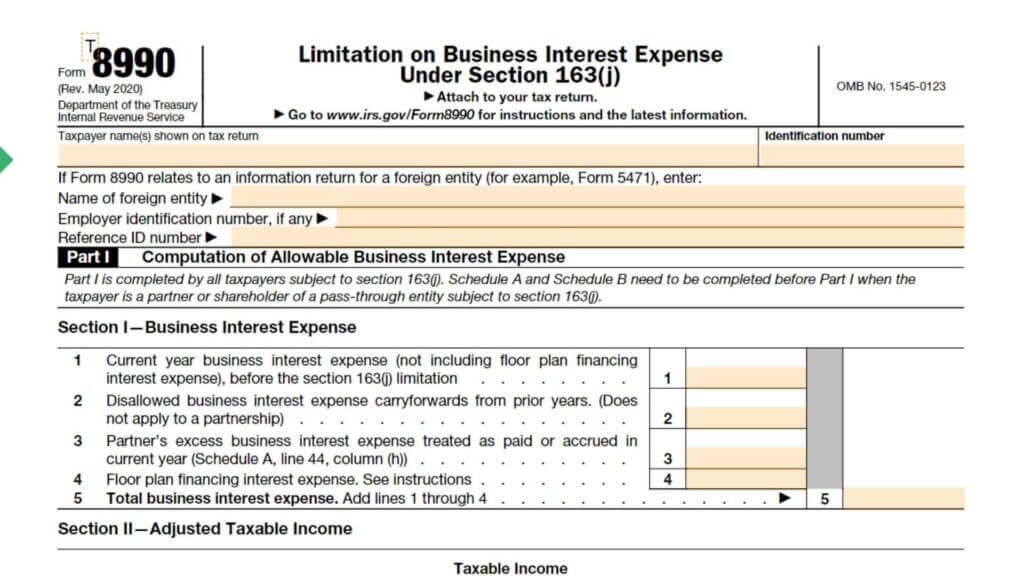

Form 8990 Instructions 2023 - In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Thoroughly read through the instructions provided with form 8990. This will help you understand the form's purpose, eligibility criteria, and how to.

Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Thoroughly read through the instructions provided with form 8990. This will help you understand the form's purpose, eligibility criteria, and how to. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on.

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. This will help you understand the form's purpose, eligibility criteria, and how to. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Thoroughly read through the instructions provided with form 8990.

IRS Form 8990 Instructions Business Interest Expense Limitation

In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Thoroughly read through the instructions provided with form.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. This will help you understand the form's purpose, eligibility criteria, and how to. Thoroughly read.

Instructions for Fill Out Form 8990 Pilot Blogs Pilot Blog

Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. Thoroughly read through the instructions provided with form 8990. Information about form 8990, limitation on.

Form 8990 Instructions 2024 2025

Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year. This will help you understand the form's purpose, eligibility criteria, and how to. Thoroughly read through the instructions provided with form 8990. Information about form 8990, limitation on business interest expense under section 163 (j), including.

Form 8990 Instructions 2023 2024

In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Use form 8990 to figure the amount of.

IRS Form 8990 Fill Out, Sign Online and Download Fillable PDF

Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. This will help you understand the form's purpose,.

IRS Form 8990 Instructions Business Interest Expense Limitation

This will help you understand the form's purpose, eligibility criteria, and how to. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. In addition to the form.

IRS Tax Form 8990 StepbyStep Filing Guide & Instructions

Thoroughly read through the instructions provided with form 8990. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the.

IRS Form 8990 Fill Out, Sign Online and Download Fillable PDF

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Thoroughly read through the instructions provided with form 8990. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. In addition to the form 8990 that is filed.

Form 8990 Instructions 2024 2025

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Thoroughly read through the instructions provided with form 8990. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the.

Complete Lines A Through D Of Form 8990 In Accordance With The Instructions Discussed Earlier In Specific Instructions And Complete The.

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Thoroughly read through the instructions provided with form 8990. In addition to the form 8990 that is filed for each cfc group member, a separate form 8990 must be filed for the cfc group in order to report the combined. Use form 8990 to figure the amount of business interest expense you can deduct and the amount to carry forward to the next year.

.webp)