Form An Llc In California - Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. You must meet specific requirements to file this form. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. They are subject to the annual tax, llc. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the.

They are subject to the annual tax, llc. You must meet specific requirements to file this form. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes.

Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. They are subject to the annual tax, llc. You must meet specific requirements to file this form.

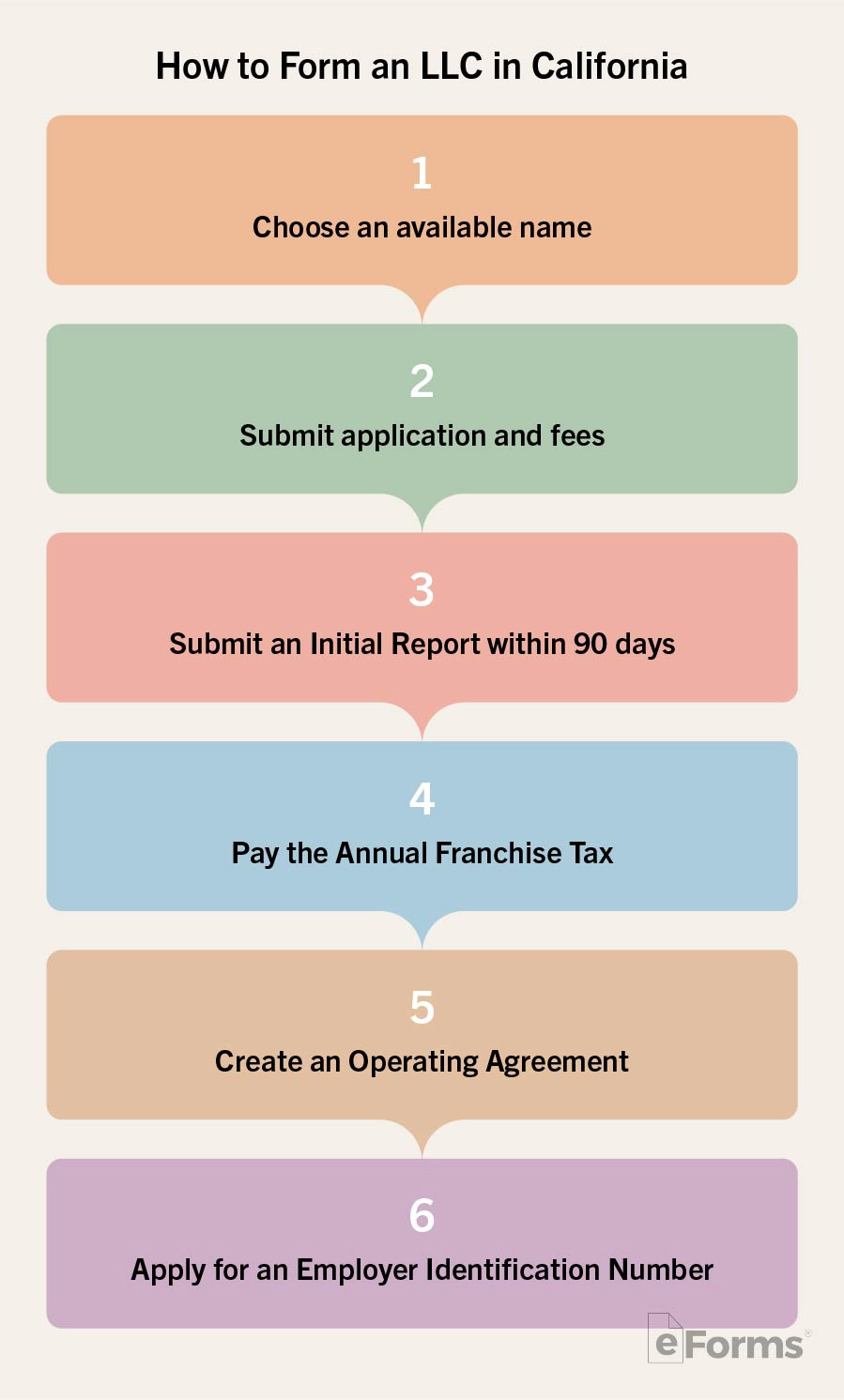

How to Form an LLC in California (Step by Step Guide) California LLC

The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. They are subject to the annual tax, llc. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Limited liability company (llc) forms an llc to run a business or to hold assets to.

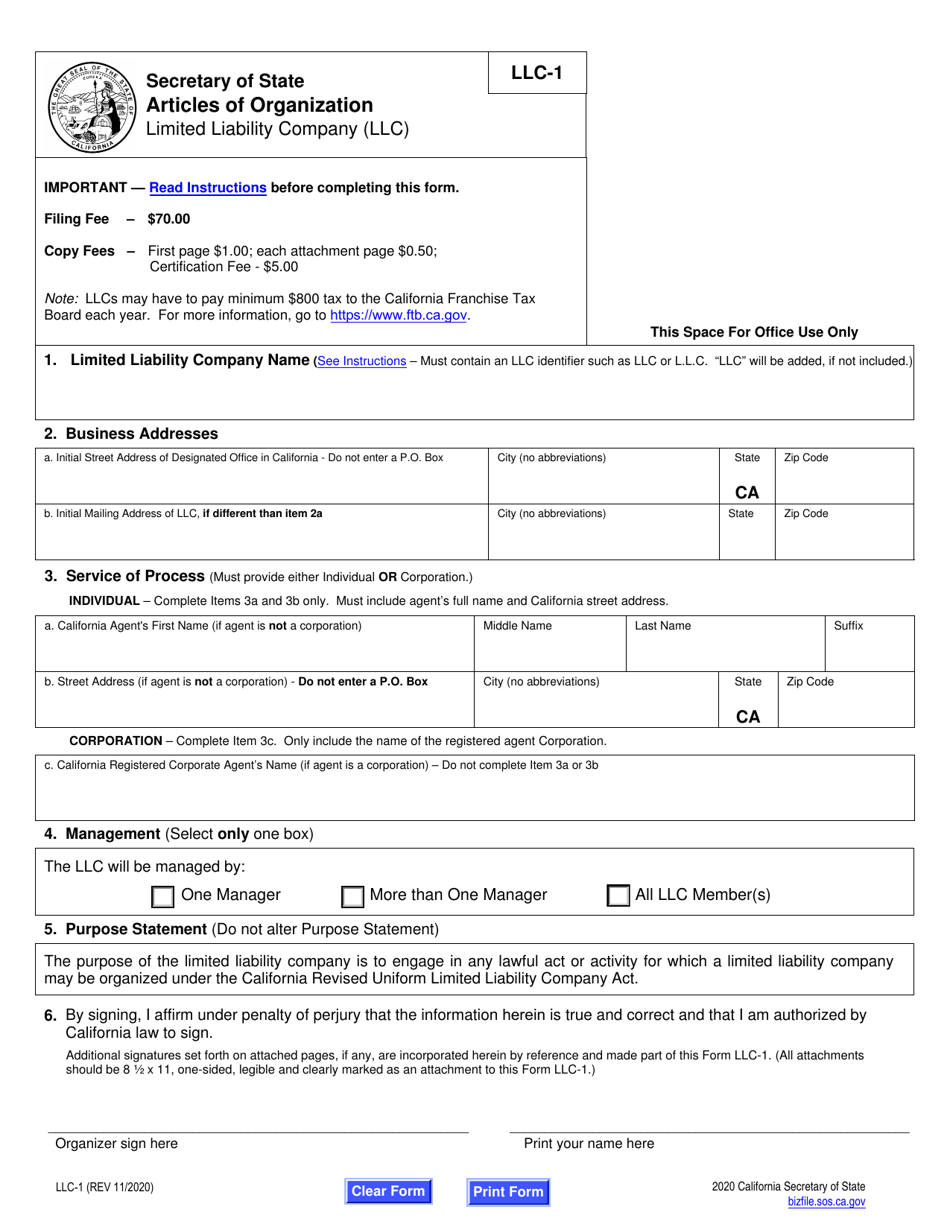

Llc california application Fill out & sign online DocHub

The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. You must.

How to Start an LLC in California Startup Guide

We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. They are.

Free California LLC Operating Agreements (2) PDF Word eForms

They are subject to the annual tax, llc. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. You must meet specific requirements to file this form. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Limited liability company (llc) forms an llc.

How To start an LLC in California Stepby Step Guide (2025)

Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. You must.

Form LLC1 Fill Out, Sign Online and Download Printable PDF

We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. They are subject to the annual tax, llc. Limited liability company (llc) forms an llc to run a business or to hold assets to.

How to Start an LLC in California CA Limited Liability Company

We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. They are subject to the annual tax, llc. You must meet specific requirements to file this form. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. The california.

How to Form an LLC in California in 6 Steps [Updated for 2023]

The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. They are subject to the annual tax, llc. You must meet specific requirements to file this form. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Limited liability company (llc) forms an llc.

California LLC 1 Limited Liability Company Corporations

You must meet specific requirements to file this form. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. They are subject to the annual tax, llc. The california.

Forming An LLC In California A StepbyStep Guide California Llc

Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. We require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the. You must.

We Require An Smllc To File Form 568, Even Though They Are Considered A Disregarded Entity For Tax Purposes.

You must meet specific requirements to file this form. They are subject to the annual tax, llc. Limited liability company (llc) forms an llc to run a business or to hold assets to protect its members against personal liabilities. The california revised uniform limited liability company act (california corporations code sections 17701.01 through 17713.13) authorizes the.

![How to Form an LLC in California in 6 Steps [Updated for 2023]](https://assets-global.website-files.com/610922bf9b095f4969ed70fb/63d27183d187392c166adedd_California.png)