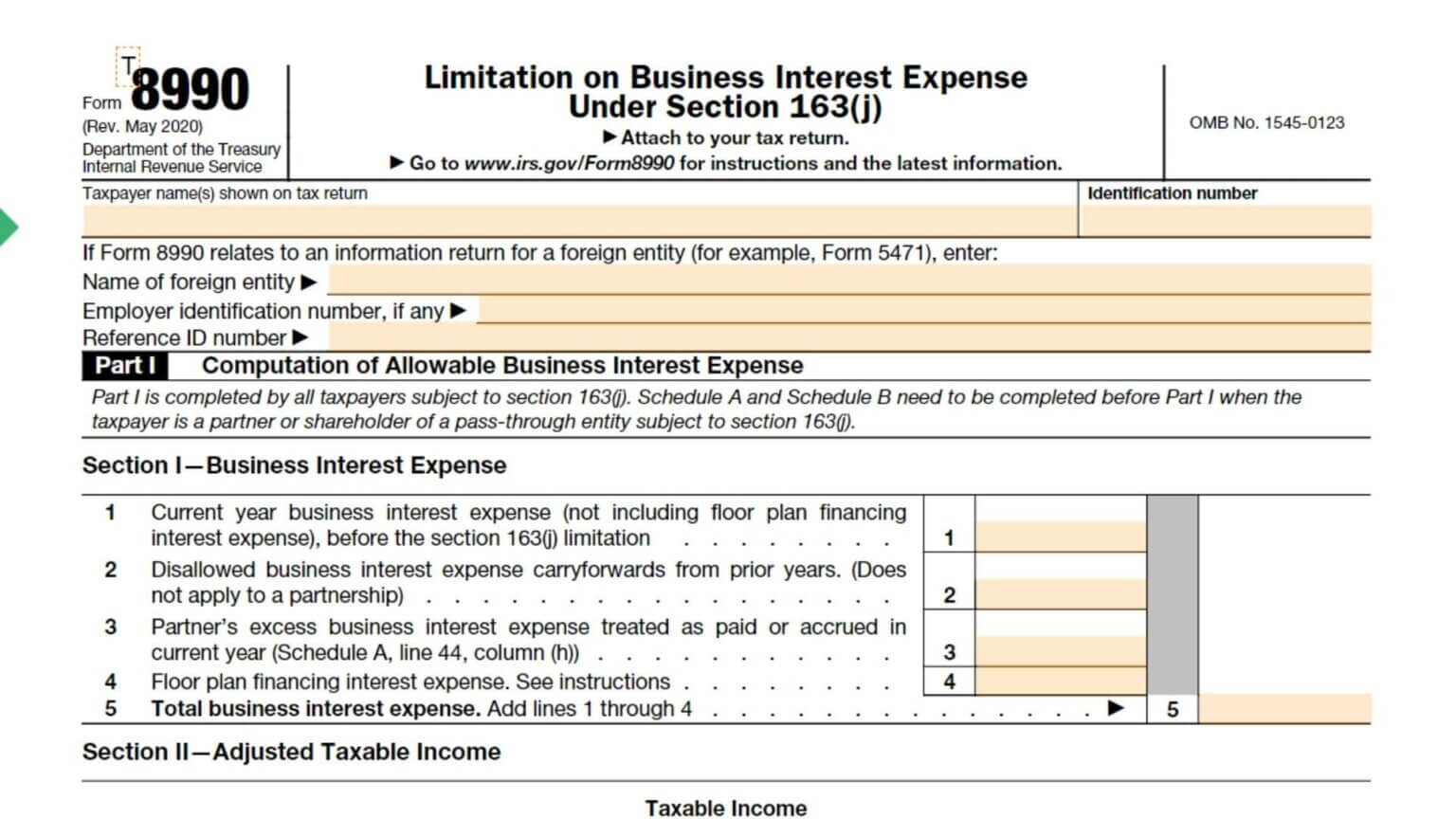

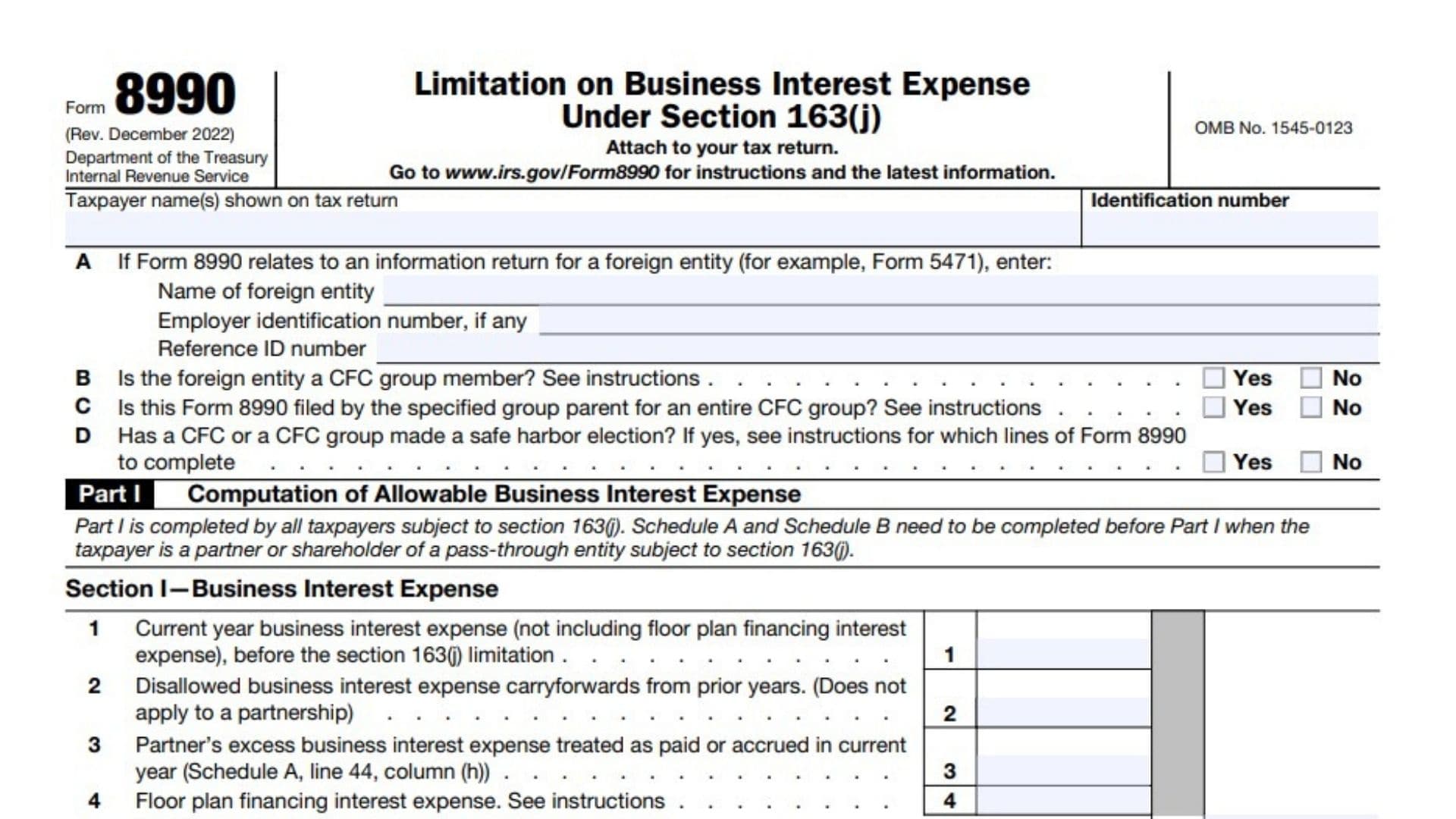

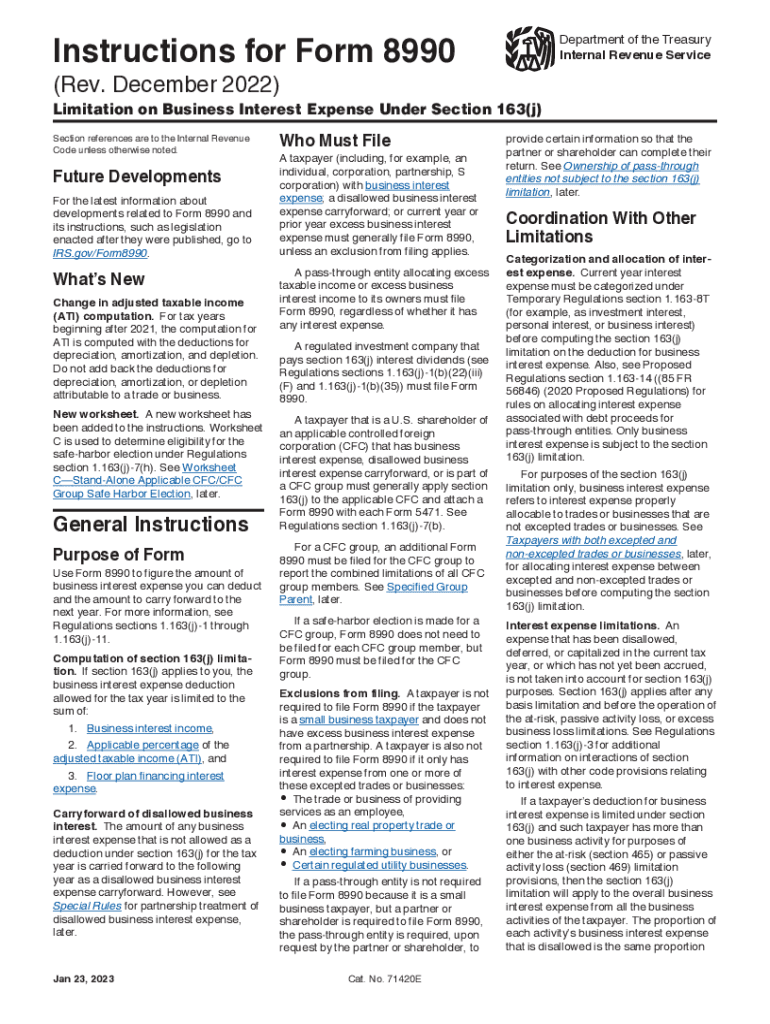

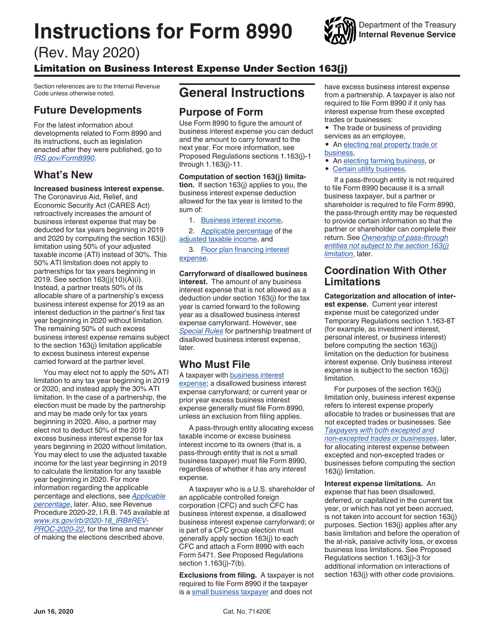

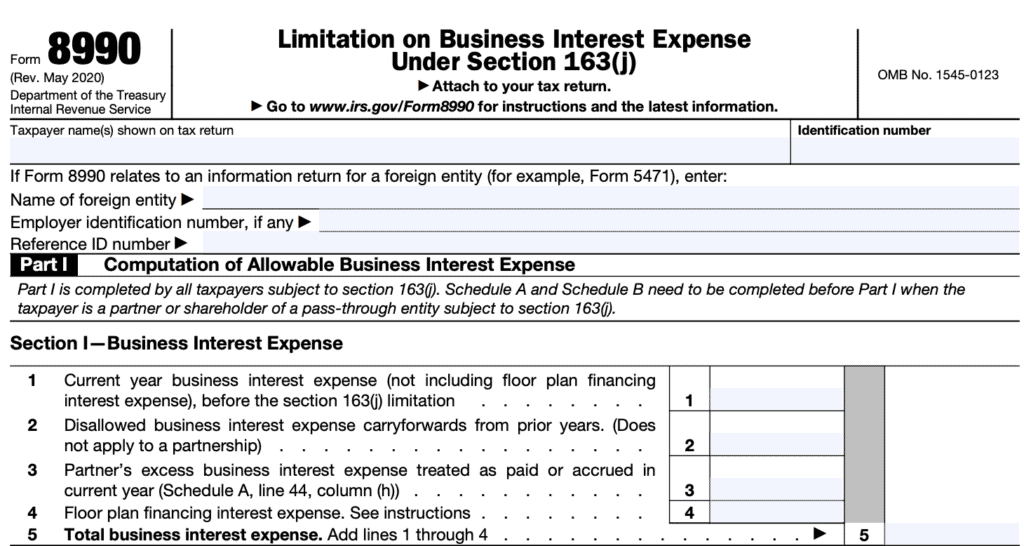

Irs Form 8990 Instructions - Part i is completed by all taxpayers subject to section 163(j). Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Schedule a and schedule b need to be completed before part i when the taxpayer is a.

Schedule a and schedule b need to be completed before part i when the taxpayer is a. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Part i is completed by all taxpayers subject to section 163(j).

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Part i is completed by all taxpayers subject to section 163(j). Schedule a and schedule b need to be completed before part i when the taxpayer is a.

IRS Form 8990 Instructions Business Interest Expense Limitation

Part i is completed by all taxpayers subject to section 163(j). Schedule a and schedule b need to be completed before part i when the taxpayer is a. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Information about form 8990, limitation on business interest expense under section.

Download Instructions for IRS Form 8990 Limitation on Business Interest

Part i is completed by all taxpayers subject to section 163(j). For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Schedule a and schedule b.

Instructions for Fill Out Form 8990 Pilot Blogs Pilot Blog

Schedule a and schedule b need to be completed before part i when the taxpayer is a. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions.

Form 8990 Instructions 2024 2025

Schedule a and schedule b need to be completed before part i when the taxpayer is a. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Part i is completed by all taxpayers subject to section 163(j). Information about form 8990, limitation on business interest expense.

Form 8990 Instructions 2024 2025

Schedule a and schedule b need to be completed before part i when the taxpayer is a. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test.

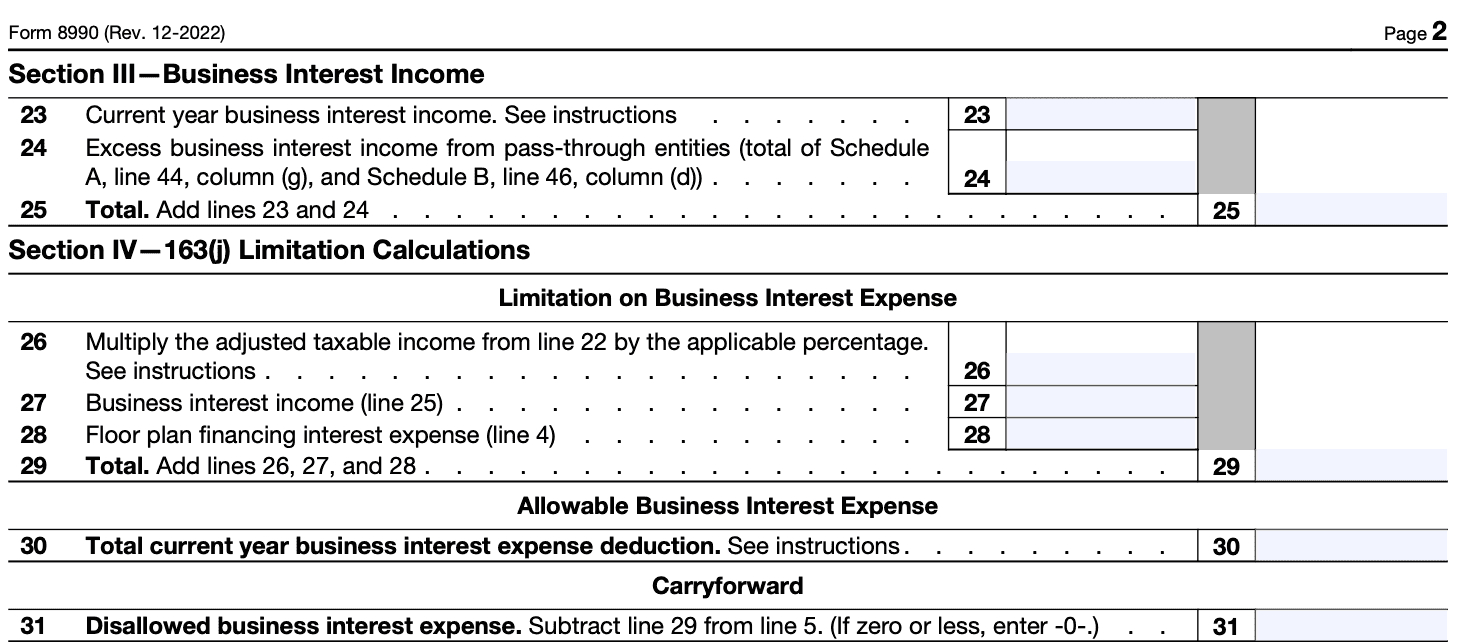

2022 Form IRS Instructions 8990 Fill Online, Printable, Fillable, Blank

Schedule a and schedule b need to be completed before part i when the taxpayer is a. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Part i is completed by all taxpayers subject to section 163(j). For tax years beginning after 2024, see the instructions for your.

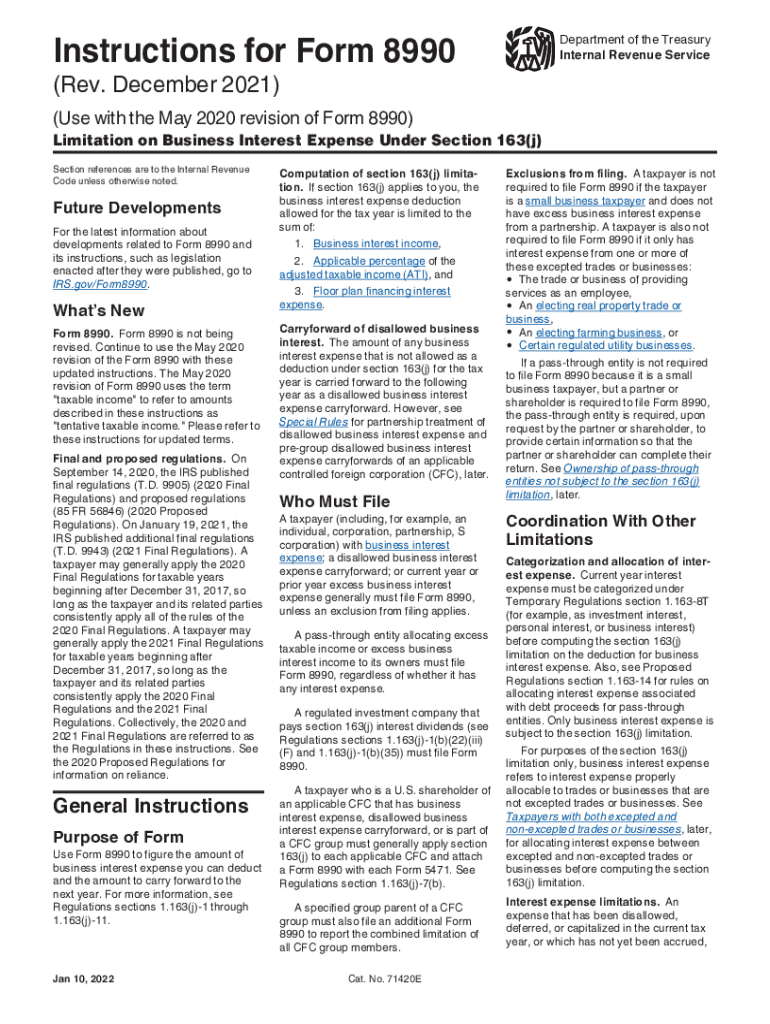

Download Instructions for IRS Form 8990 Limitation on Business Interest

Schedule a and schedule b need to be completed before part i when the taxpayer is a. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. For.

IRS Tax Form 8990 StepbyStep Filing Guide & Instructions

Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. Part i is completed by all taxpayers subject to section 163(j). For tax years beginning after 2024, see.

IRS Releases Final Form and Instructions for Form 8990 for 2018

Part i is completed by all taxpayers subject to section 163(j). Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Schedule a and schedule b need to be completed before part i when the taxpayer is a. Information about form 8990, limitation on business interest expense under section.

2021 Form IRS Instructions 8990 Fill Online, Printable, Fillable, Blank

Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on. For tax years beginning after 2024, see the instructions for your applicable income tax return for the average annual gross receipts test threshold. Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in.

For Tax Years Beginning After 2024, See The Instructions For Your Applicable Income Tax Return For The Average Annual Gross Receipts Test Threshold.

Schedule a and schedule b need to be completed before part i when the taxpayer is a. Part i is completed by all taxpayers subject to section 163(j). Complete lines a through d of form 8990 in accordance with the instructions discussed earlier in specific instructions and complete the. Information about form 8990, limitation on business interest expense under section 163 (j), including recent updates, related forms and instructions on.

.webp)