Llp Forms - While both represent legal entities, the main difference between llps and llcs is the level of liability protection. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. This distinguishes an llp from a traditional. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. In an llp, each partner is not responsible or liable for another partner's misconduct or negligence.

In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. While both represent legal entities, the main difference between llps and llcs is the level of liability protection. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. This distinguishes an llp from a traditional. In an llp, each partner is not responsible or liable for another partner's misconduct or negligence.

Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. While both represent legal entities, the main difference between llps and llcs is the level of liability protection. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. This distinguishes an llp from a traditional. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. In an llp, each partner is not responsible or liable for another partner's misconduct or negligence.

Limited Liability Partnership (LLP) Full form, Benefits & More

This distinguishes an llp from a traditional. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. In an llp, each partner is not responsible or liable for another partner's misconduct or negligence. While both represent legal entities, the main difference between llps and llcs is the level.

Free Limited Liability Partnership (LLP) Agreement Template

In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. This distinguishes an llp from a traditional. While both represent legal entities, the main.

LLP Form 3 Procedure List of Documents Due Date Startup Setup

Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. In an llp, each partner is not responsible or liable for another partner's misconduct or negligence. While both represent legal entities, the main difference between llps and llcs is the level of liability protection. Limited liability.

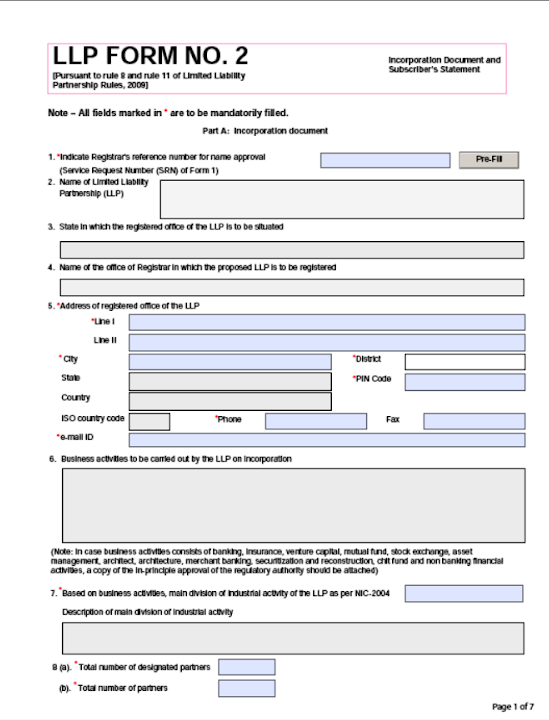

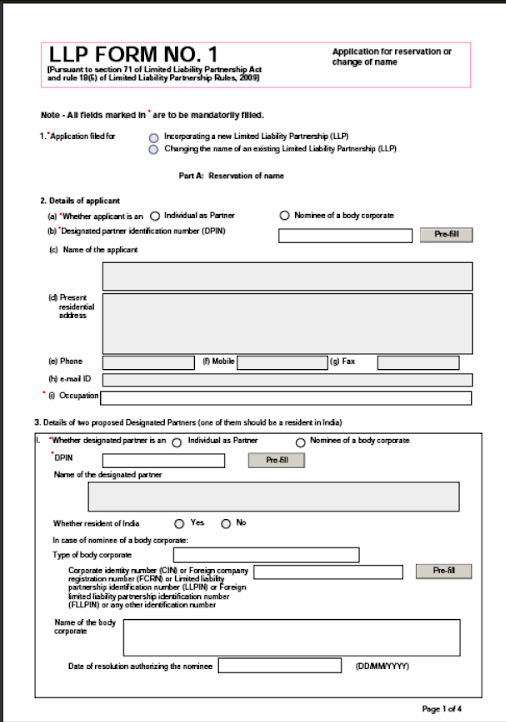

How to register a new Company or a new Business in India

Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. This distinguishes an llp from a traditional. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. While both represent legal entities, the main difference between llps.

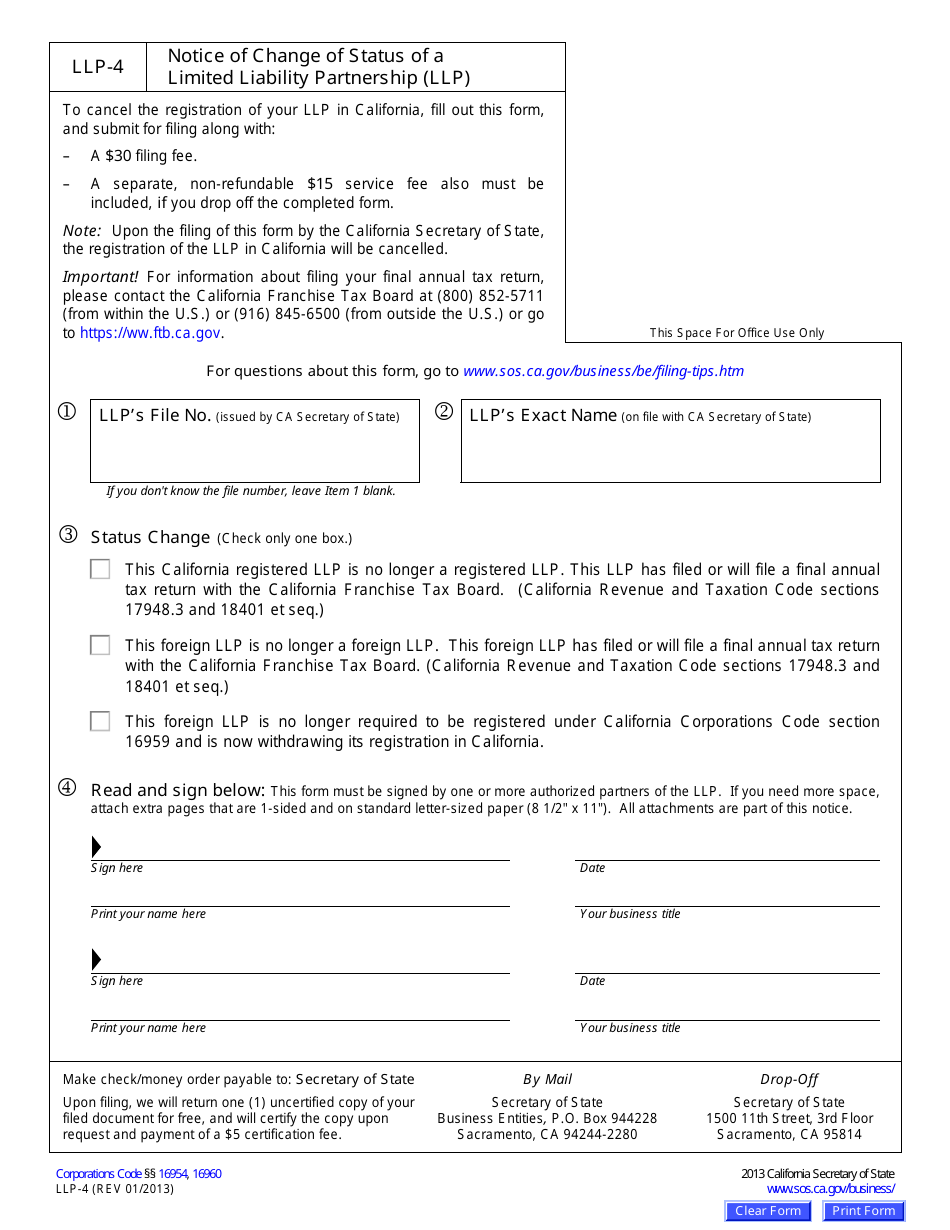

Form LLP4 Fill Out, Sign Online and Download Fillable PDF

In an llp, each partner is not responsible or liable for another partner's misconduct or negligence. This distinguishes an llp from a traditional. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities.

LLP Agreement An Overview A Complete Overview Learn by Quicko

Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. This distinguishes an llp from a traditional. While both represent legal entities, the main difference between llps and llcs.

LLP Formation Made Easy Your Path to Business Partnership!! by M.M

Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for.

LLP Formations Consultant LLP Registration in Delhi

This distinguishes an llp from a traditional. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. Limited liability partnership (llp) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. In an llp, each partner is not responsible or liable.

How to register a new Company or a new Business in India

This distinguishes an llp from a traditional. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. While both represent legal entities, the main difference between llps and llcs is the level of liability protection. In basic terms, the owners of an llp are considered partners in an organization, while the.

What Is Llp meredil

In an llp, each partner is not responsible or liable for another partner's misconduct or negligence. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members. This distinguishes an llp from a traditional. While both represent legal entities, the main difference between llps and llcs is the level.

Limited Liability Partnership (Llp) Is A Type Of General Partnership Where Every Partner Has A Limited Personal Liability For The Debts Of The Partnership.

This distinguishes an llp from a traditional. While both represent legal entities, the main difference between llps and llcs is the level of liability protection. Limited liability partnerships (llps) allow for a partnership structure where each partner’s liabilities are limited to the amount they. In basic terms, the owners of an llp are considered partners in an organization, while the owners of an llc are members.