Rmd Cheat Sheet - Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Use our rmd calculator to find out the required minimum distribution for your ira. What is a required minimum distribution (rmd)? Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Plus review your projected rmds over 10 years and over your.

Plus review your projected rmds over 10 years and over your. What is a required minimum distribution (rmd)? Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira.

Use our rmd calculator to find out the required minimum distribution for your ira. Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. What is a required minimum distribution (rmd)? Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Plus review your projected rmds over 10 years and over your.

All About Required Minimum Distributions (RMDs) — SoundView Advisors

Plus review your projected rmds over 10 years and over your. What is a required minimum distribution (rmd)? Use our rmd calculator to find out the required minimum distribution for your ira. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Review the required minimum distribution.

Required Minimum Distribution (RMD) for IRA 2024 TIME Stamped

Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. What is a required minimum distribution (rmd)? Use our rmd calculator to find out the required minimum distribution for your ira. Plus review your projected rmds over 10 years and over your. Review the required minimum distribution.

Required Minimum Distributions (RMDs) What Every Retiree Should Know

Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. What is.

Required Minimum Distribution (RMD) Age and the Required Beginning Date

Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. What is.

Required Minimum Distribution (RMD) Definition and Calculation

Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. Plus review.

Required minimum distribution hires stock photography and images Alamy

Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. Plus review.

Required Minimum Distributions (RMDs) Key Points to Know Kiplinger

Plus review your projected rmds over 10 years and over your. What is a required minimum distribution (rmd)? Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Use our rmd calculator to find out the required minimum distribution for your ira. Once a person reaches the age of.

Required Minimum Distributions (RMDs) Key Points to Know Kiplinger

Plus review your projected rmds over 10 years and over your. Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. Review the required minimum distribution rules for certain retirement plans, including traditional.

Required Minimum Distribution (RMD) Rules Have Changed for 2020

Use our rmd calculator to find out the required minimum distribution for your ira. Plus review your projected rmds over 10 years and over your. What is a required minimum distribution (rmd)? Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Review the required minimum distribution.

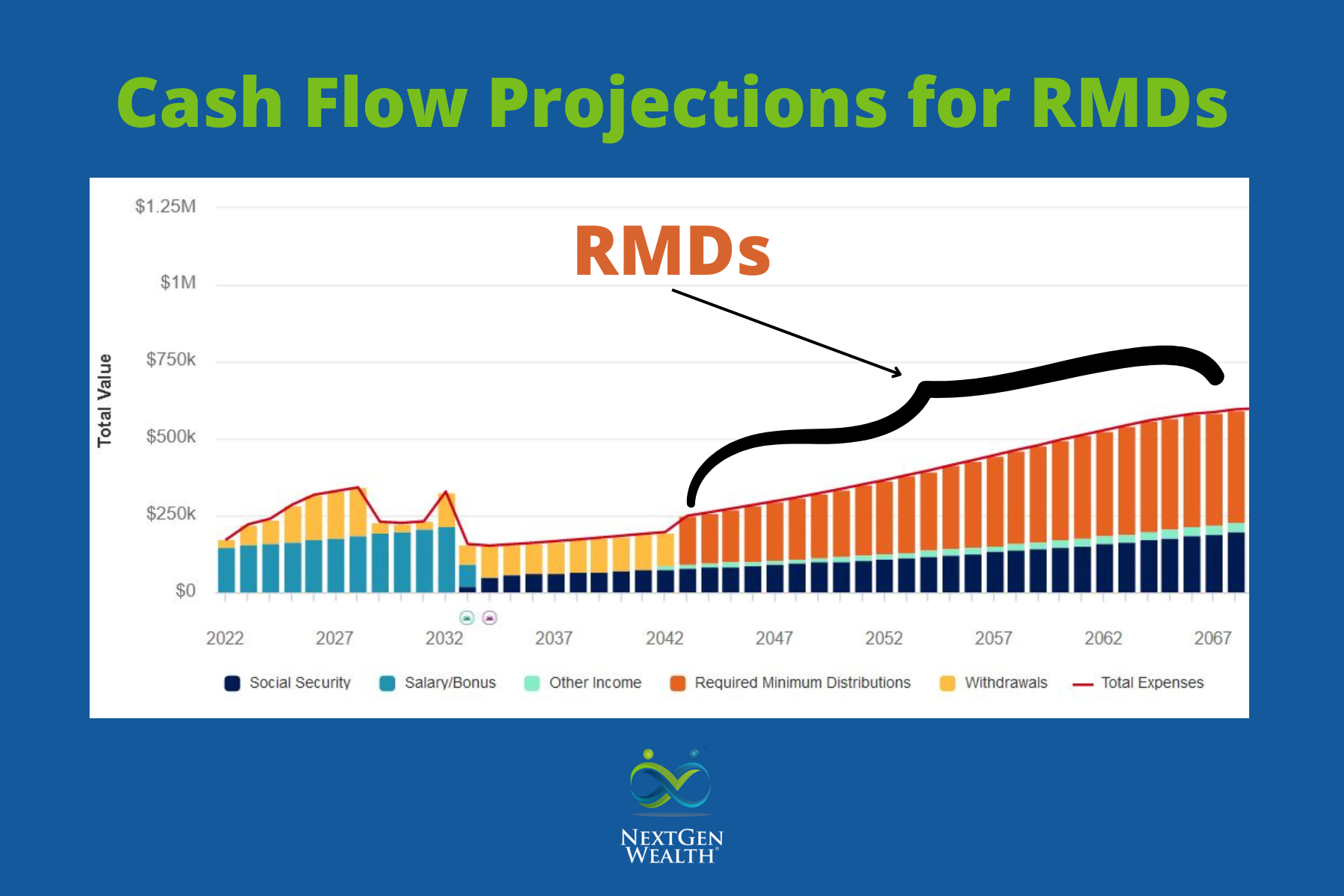

Will Required Minimum Distributions Affect My Retirement?

Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans. Plus review your projected rmds over 10 years and over your. Use our rmd calculator to.

Plus Review Your Projected Rmds Over 10 Years And Over Your.

Once a person reaches the age of 73, the irs requires retirement account holders to withdraw a minimum amount of money each year. Use our rmd calculator to find out the required minimum distribution for your ira. What is a required minimum distribution (rmd)? Review the required minimum distribution rules for certain retirement plans, including traditional iras, sep iras, simple iras and 401 (k) plans.

.jpg)

:max_bytes(150000):strip_icc()/requiredminimumdistribution.asp-finalv2-39869d80a21d416a936df24fea1eff2a.png)