Tax Form 401K - Find irs forms and answers to tax questions. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Sign in or create an online account. We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free file. Prepare and file your federal income tax return online for free. Review the amount you owe, balance for each tax year, payment history, tax records and more. As your income goes up, the. Access irs forms, instructions and publications in electronic and print media.

We help you understand and meet your federal tax. Sign in or create an online account. File at an irs partner site with the irs free file program or use free file. Find irs forms and answers to tax questions. Review the amount you owe, balance for each tax year, payment history, tax records and more. As your income goes up, the. Access irs forms, instructions and publications in electronic and print media. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Prepare and file your federal income tax return online for free.

We help you understand and meet your federal tax. Sign in or create an online account. Find irs forms and answers to tax questions. Access irs forms, instructions and publications in electronic and print media. Prepare and file your federal income tax return online for free. File at an irs partner site with the irs free file program or use free file. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Review the amount you owe, balance for each tax year, payment history, tax records and more. As your income goes up, the.

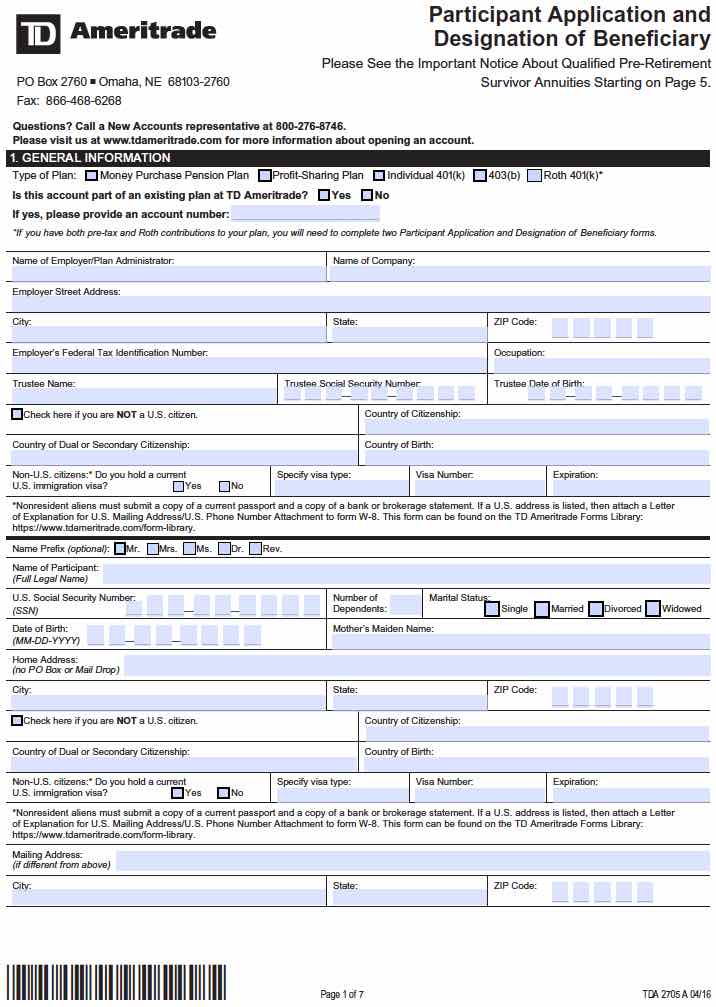

Solo 401k Reporting Requirements Solo 401k

Access irs forms, instructions and publications in electronic and print media. Find irs forms and answers to tax questions. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. File at an irs partner site with the irs free file program or use free file. Review the amount you owe,.

Live SelfDirected Roth Solo 401k Contribution Calculation (Both

File at an irs partner site with the irs free file program or use free file. Sign in or create an online account. Find irs forms and answers to tax questions. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets.

What Is A K Tax Form at Audrey Tyler blog

Review the amount you owe, balance for each tax year, payment history, tax records and more. Find irs forms and answers to tax questions. As your income goes up, the. We help you understand and meet your federal tax. Sign in or create an online account.

Selfdirected Solo 401k Question Is a Form 1099R Required for

Prepare and file your federal income tax return online for free. File at an irs partner site with the irs free file program or use free file. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. We help you understand and meet your federal tax. As your income goes.

Taxes 1 PDF Irs Tax Forms 401(K)

Access irs forms, instructions and publications in electronic and print media. As your income goes up, the. Prepare and file your federal income tax return online for free. We help you understand and meet your federal tax. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets.

self employed 401k contribution

Review the amount you owe, balance for each tax year, payment history, tax records and more. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. File at an irs partner site with the irs free file program or use free file. We help you understand and meet your federal.

What to do if you have to take an early withdrawal from your Solo 401k

We help you understand and meet your federal tax. Prepare and file your federal income tax return online for free. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. Find irs forms and answers to tax questions. File at an irs partner site with the irs free file program.

What to do if you have to take an early withdrawal from your Solo 401k

Review the amount you owe, balance for each tax year, payment history, tax records and more. Access irs forms, instructions and publications in electronic and print media. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets. File at an irs partner site with the irs free file program or.

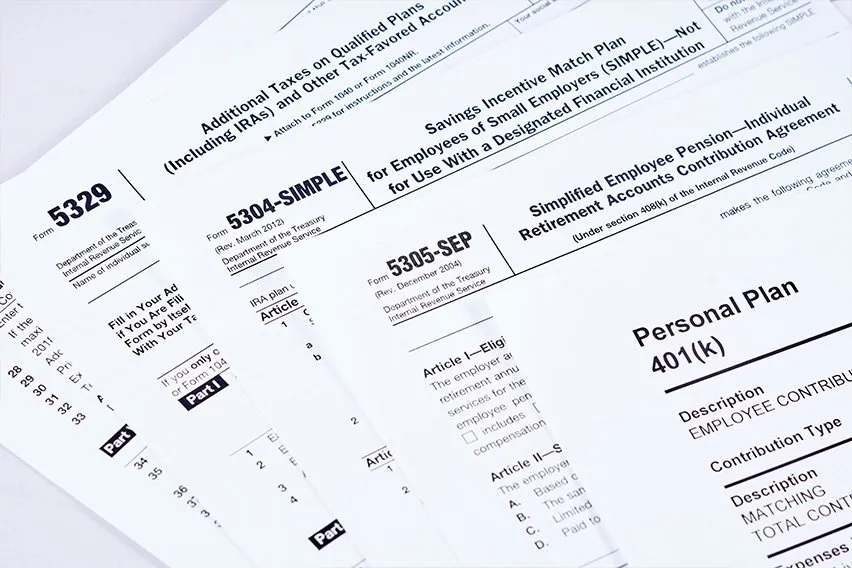

Do You Have to Report 401k on Tax Return? It Depends

Sign in or create an online account. As your income goes up, the. Access irs forms, instructions and publications in electronic and print media. Prepare and file your federal income tax return online for free. Review the amount you owe, balance for each tax year, payment history, tax records and more.

Where Do 401K Contributions Go On 1040 LiveWell

File at an irs partner site with the irs free file program or use free file. Access irs forms, instructions and publications in electronic and print media. Sign in or create an online account. Prepare and file your federal income tax return online for free. Find irs forms and answers to tax questions.

As Your Income Goes Up, The.

Sign in or create an online account. Find irs forms and answers to tax questions. Review the amount you owe, balance for each tax year, payment history, tax records and more. Prepare and file your federal income tax return online for free.

Access Irs Forms, Instructions And Publications In Electronic And Print Media.

We help you understand and meet your federal tax. File at an irs partner site with the irs free file program or use free file. Federal income tax rates and brackets you pay tax as a percentage of your income in layers called tax brackets.