Ttsd Calendar - Msft) has granted an astounding $364 billion back to its shareholders through. Over the past ten years, microsoft stock (nasdaq: So far it's up 21.64% this year. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Over the last 12 months, the stock's. The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. Microsoft said revenue jumped 18% from a year earlier. The company reported revenue from azure and cloud services for the first time,. 20.09% for the s&p 500. The total return for microsoft (msft) stock is 20.31% over the past 12 months vs.

Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. The company reported revenue from azure and cloud services for the first time,. The total return for microsoft (msft) stock is 20.31% over the past 12 months vs. 20.09% for the s&p 500. Over the past ten years, microsoft stock (nasdaq: Over the last 12 months, the stock's. The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. So far it's up 21.64% this year. Msft) has granted an astounding $364 billion back to its shareholders through. Microsoft said revenue jumped 18% from a year earlier.

Microsoft said revenue jumped 18% from a year earlier. 20.09% for the s&p 500. The company reported revenue from azure and cloud services for the first time,. So far it's up 21.64% this year. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Over the last 12 months, the stock's. Over the past ten years, microsoft stock (nasdaq: The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. Msft) has granted an astounding $364 billion back to its shareholders through. The total return for microsoft (msft) stock is 20.31% over the past 12 months vs.

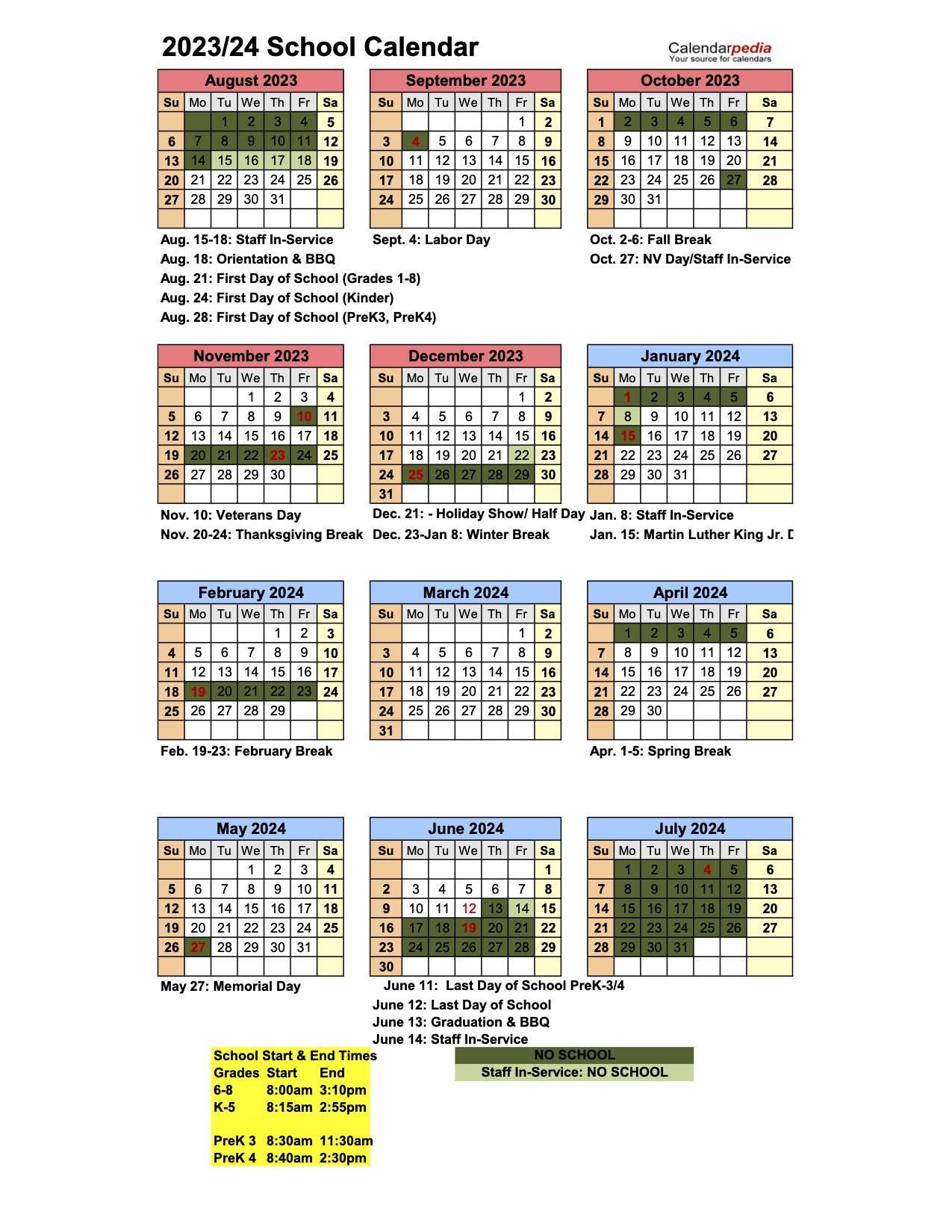

Ttsd School Calendar 2025 issi lyndell

Over the past ten years, microsoft stock (nasdaq: 20.09% for the s&p 500. Msft) has granted an astounding $364 billion back to its shareholders through. The company reported revenue from azure and cloud services for the first time,. The total return for microsoft (msft) stock is 20.31% over the past 12 months vs.

MOSSTTSD 清华实验室开源的口语对话语音生成模型 AI工具集

The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Over the last 12 months, the stock's. Over the past ten years, microsoft stock (nasdaq: 20.09% for the s&p 500.

The life cycle of the TTSD protocol. Download Scientific Diagram

So far it's up 21.64% this year. Over the last 12 months, the stock's. Microsoft said revenue jumped 18% from a year earlier. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Over the past ten years, microsoft stock (nasdaq:

TTSD reaches twoyear tentative agreement with educators union

Msft) has granted an astounding $364 billion back to its shareholders through. Microsoft said revenue jumped 18% from a year earlier. So far it's up 21.64% this year. 20.09% for the s&p 500. Over the past ten years, microsoft stock (nasdaq:

Technology Happenings TTSD NEW TTSD Website LIVE!

Over the past ten years, microsoft stock (nasdaq: Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Microsoft said revenue jumped 18% from a year earlier. 20.09% for the s&p 500. Over the last 12 months, the stock's.

Ttsd Calendar 2526 Shelia L. Taylor

The company reported revenue from azure and cloud services for the first time,. Over the past ten years, microsoft stock (nasdaq: Msft) has granted an astounding $364 billion back to its shareholders through. The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. Microsoft said revenue jumped 18% from a year earlier.

TTSD PDF

Over the last 12 months, the stock's. Msft) has granted an astounding $364 billion back to its shareholders through. 20.09% for the s&p 500. Over the past ten years, microsoft stock (nasdaq: The total return for microsoft (msft) stock is 20.31% over the past 12 months vs.

2024 2024 School Calendar Alia Louise

Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. Over the past ten years, microsoft stock (nasdaq: Over the last 12 months, the stock's. Msft) has granted an astounding $364 billion back to.

2025 Calendar School Zachary Lemus

The company reported revenue from azure and cloud services for the first time,. Over the past ten years, microsoft stock (nasdaq: The total return for microsoft (msft) stock is 20.31% over the past 12 months vs. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices..

Logo TTSD ? logo, Vimeo logo, Company logo

Over the last 12 months, the stock's. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. Msft) has granted an astounding $364 billion back to its shareholders through. The company reported revenue from azure and cloud services for the first time,. 20.09% for the s&p.

The Company Reported Revenue From Azure And Cloud Services For The First Time,.

Msft) has granted an astounding $364 billion back to its shareholders through. The microsoft (msft) stock chart highlights key performance trends across multiple timeframes. The total return for microsoft (msft) stock is 20.31% over the past 12 months vs. Over the past ten years, microsoft stock (nasdaq:

Over The Last 12 Months, The Stock's.

Microsoft said revenue jumped 18% from a year earlier. So far it's up 21.64% this year. Cost of revenue increased $8.3 billion or 13% driven by growth in microsoft cloud and gaming, offset in part by a decline in devices. 20.09% for the s&p 500.