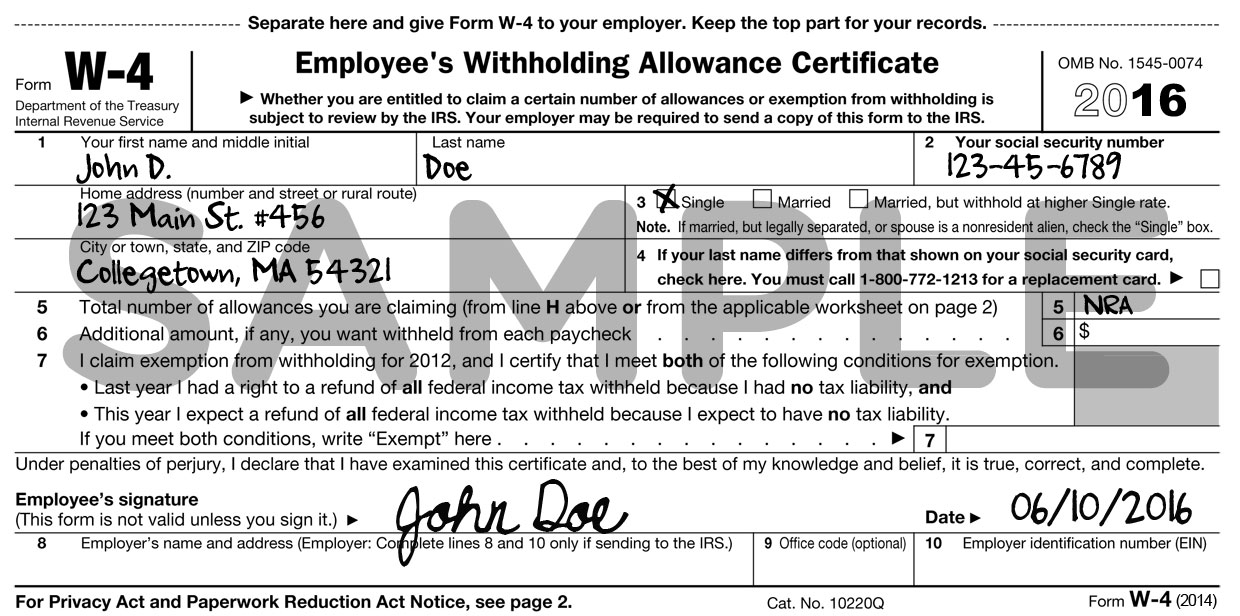

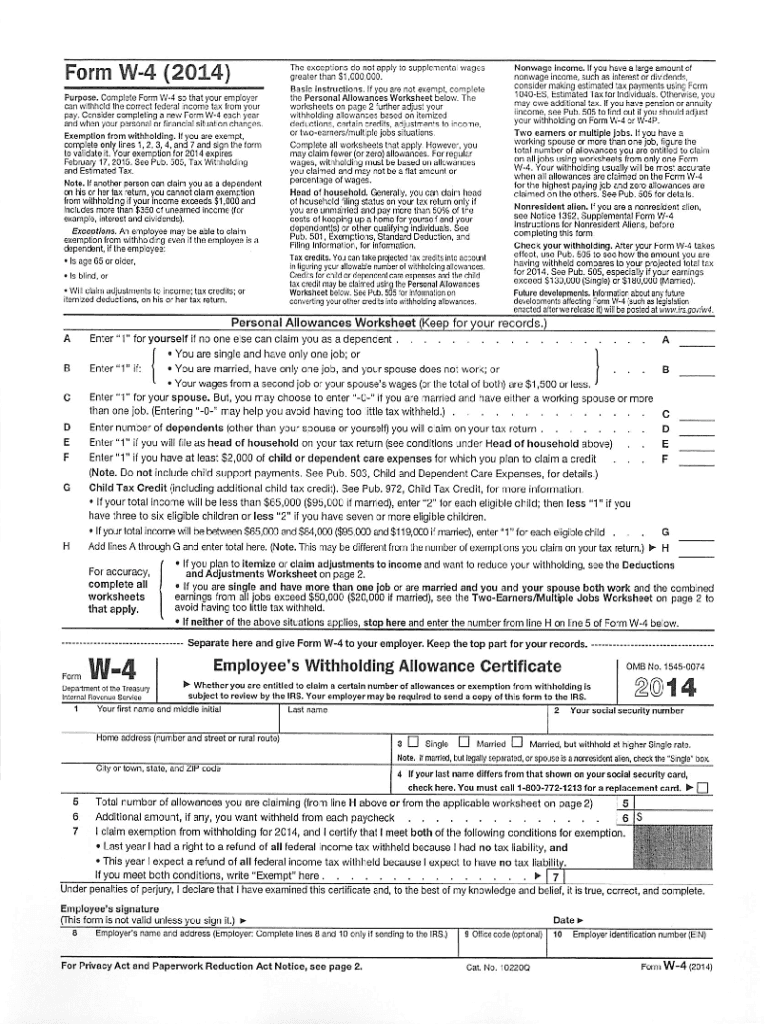

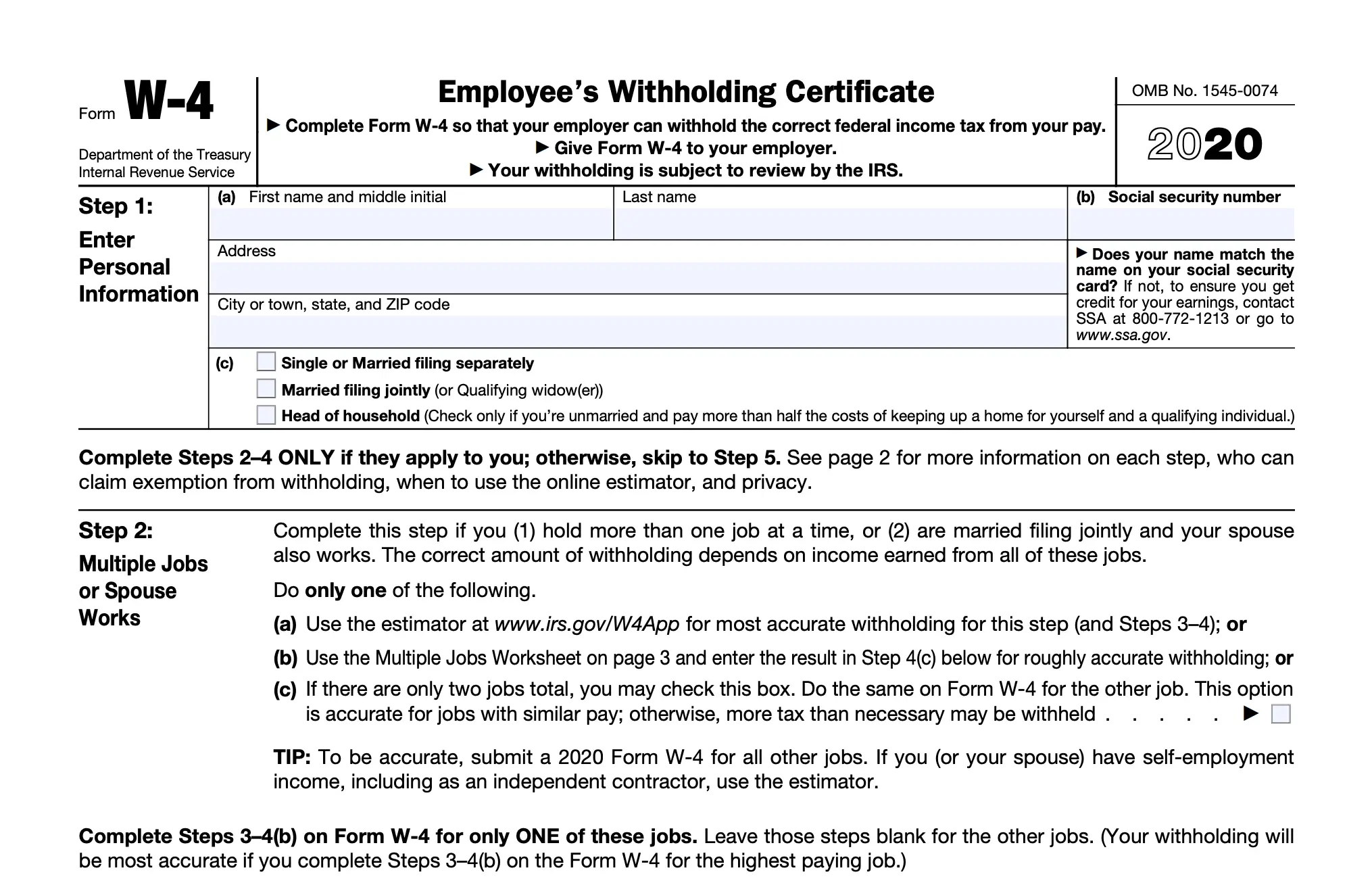

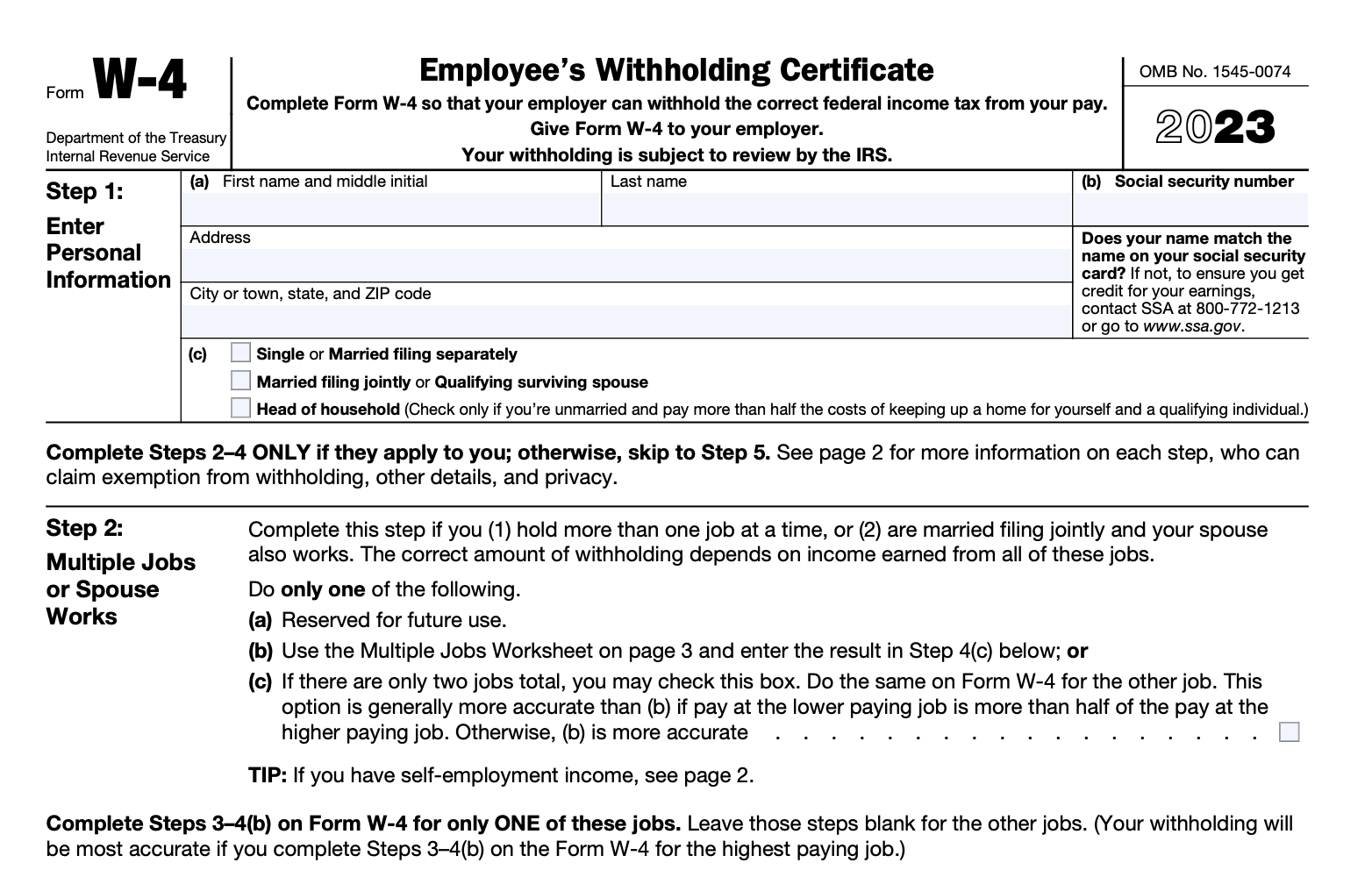

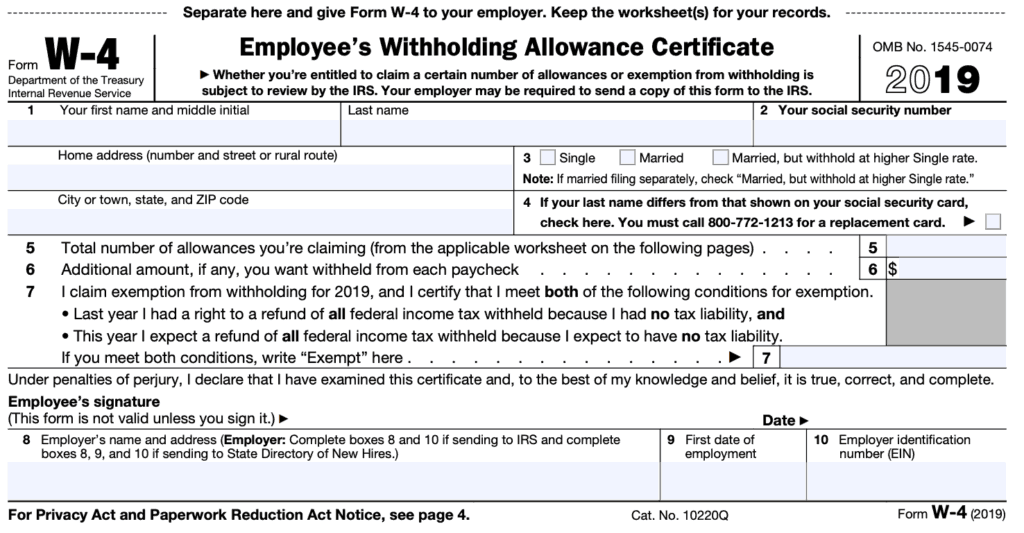

W4 Form Claim 0 Or 1 - In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will. Learn how to change your. After signing, the employer should fill out their name,. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. After signing, the employer should fill out their name,. If too little is withheld, you will. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee.

In order for the form to be valid, the w4 must be signed and dated by the employee. After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will.

Important Tax Information and Tax Forms · InterExchange

After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee.

Should I Claim 0 or 1 on W4? 2024 W4 Expert's Answer!

If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. After signing, the employer should fill out their name,.

Fillable Online Should I Claim 0 or 1 on W4? 2021 W4 Expert's Answer

In order for the form to be valid, the w4 must be signed and dated by the employee. If too little is withheld, you will. After signing, the employer should fill out their name,. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

Should I Claim 1 or 0 on my W4 Tax Allowances Expert's Answer!

After signing, the employer should fill out their name,. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee.

W 4 Form

After signing, the employer should fill out their name,. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. If too little is withheld, you will.

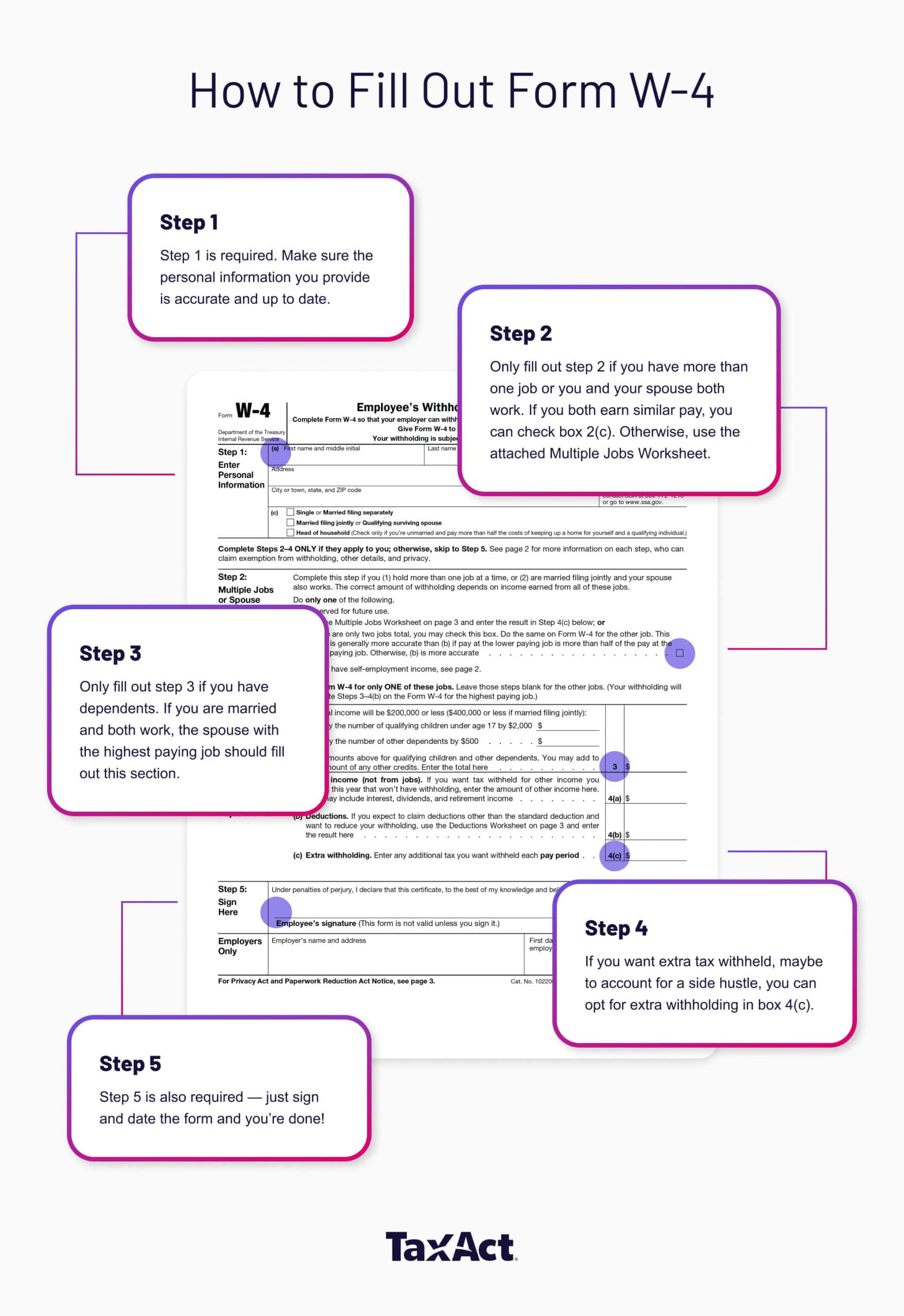

How To Fill Out Form W4 How to Claim Allowances TaxAct

If too little is withheld, you will. After signing, the employer should fill out their name,. In order for the form to be valid, the w4 must be signed and dated by the employee. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

43+ How To Claim 0 On W4 New Hutomo

In order for the form to be valid, the w4 must be signed and dated by the employee. After signing, the employer should fill out their name,. If too little is withheld, you will. Learn how to change your. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

Should I Claim 0 or 1 on W4? 2024 W4 Expert's Answer!

After signing, the employer should fill out their name,. If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your.

Should I Claim 1 or 0 Allowances On My W4 To Lower My Taxes?

If too little is withheld, you will. In order for the form to be valid, the w4 must be signed and dated by the employee. Learn how to change your. After signing, the employer should fill out their name,. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck.

Should I claim 0 or 1 on my W4 form for the year 2021? YouTube

After signing, the employer should fill out their name,. If too little is withheld, you will. Use the irs withholding estimator tool to decide the amount of income tax to be withheld from your paycheck. Learn how to change your. In order for the form to be valid, the w4 must be signed and dated by the employee.

Use The Irs Withholding Estimator Tool To Decide The Amount Of Income Tax To Be Withheld From Your Paycheck.

In order for the form to be valid, the w4 must be signed and dated by the employee. After signing, the employer should fill out their name,. If too little is withheld, you will. Learn how to change your.