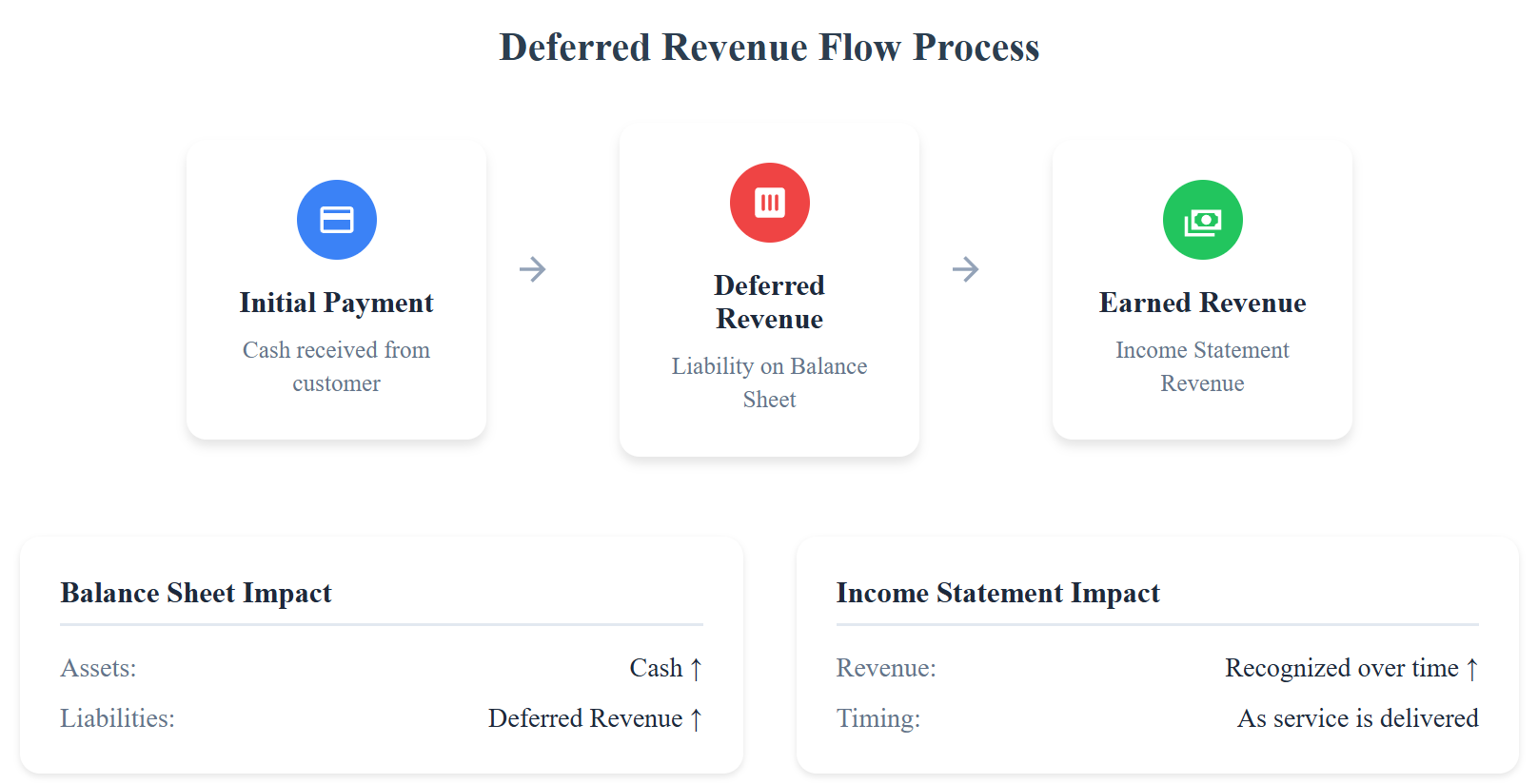

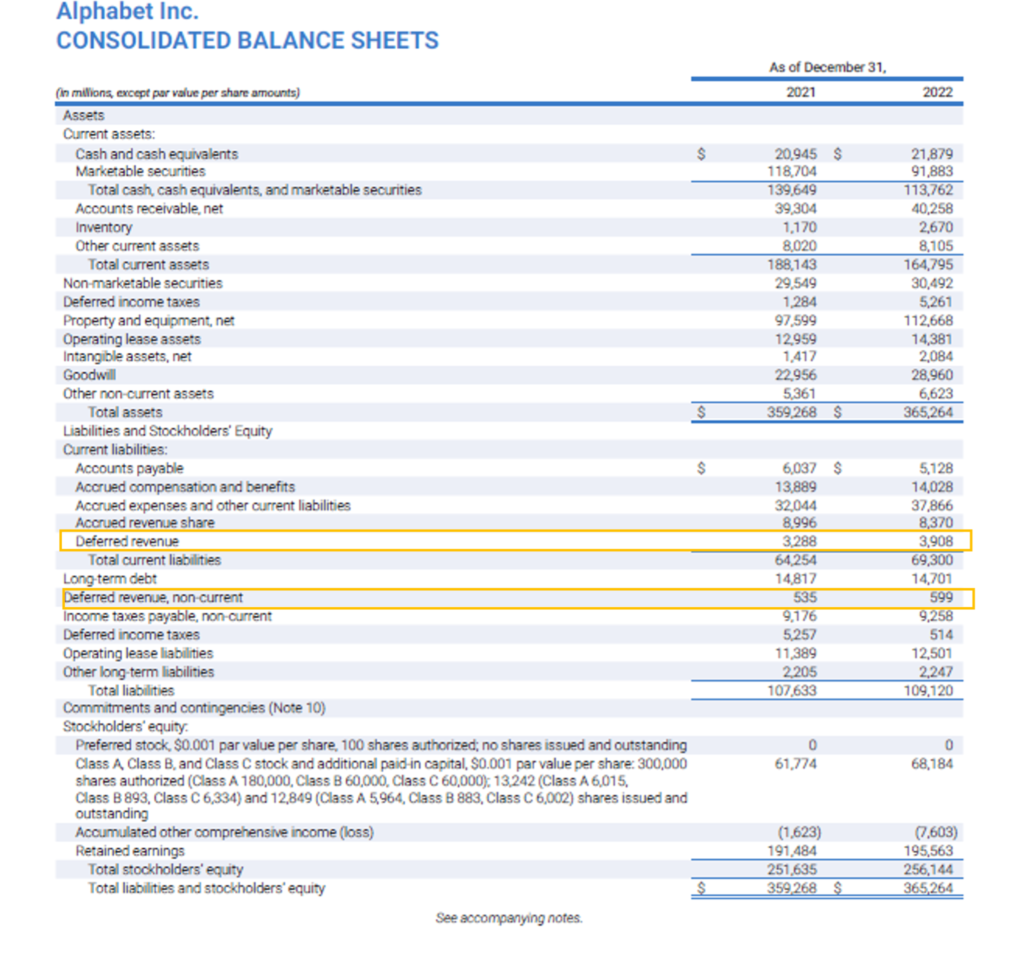

Where Is Deferred Revenue On Balance Sheet - When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. Its recognition is crucial for. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the.

If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. Its recognition is crucial for. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year.

Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Its recognition is crucial for. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet.

What is Deferred Revenue? The Ultimate Guide (2022)

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. If a customer pays for goods/services in advance, the company does not record any revenue.

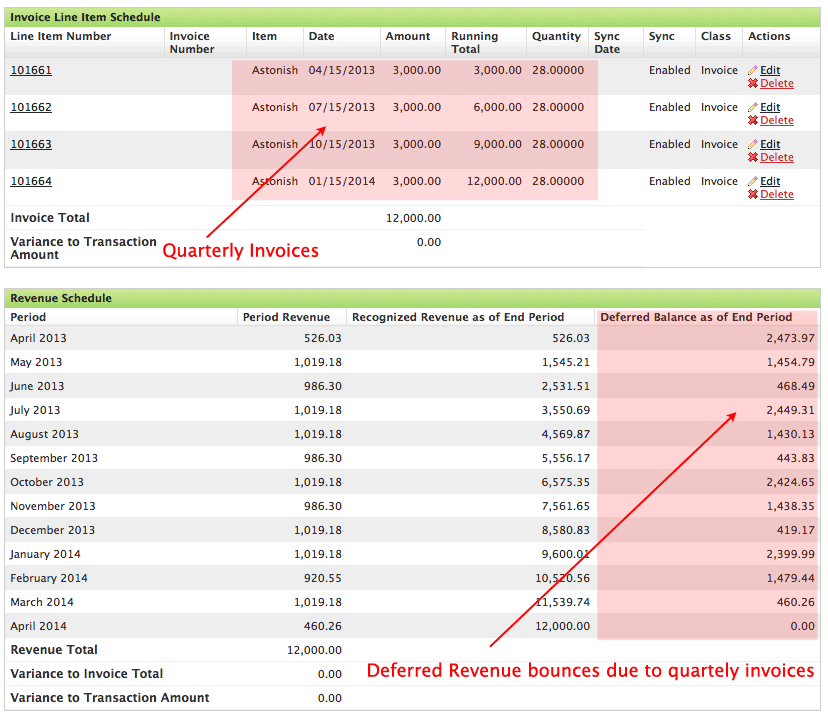

What is Deferred Revenue in a SaaS Business? SaaSOptics

If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. Deferred revenue is a current liability on the balance sheet, indicating obligations typically due.

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. If a customer pays for goods/services in advance, the company does not record any revenue on its income.

Unlocking the Mystery of Deferred Revenue A Friendly Guide for US

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. If a customer pays for goods/services in advance, the company does not record any revenue.

Deferred Revenue You can have it but not yet earned it skillfine

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Its recognition is crucial for. Deferred revenue appears as a liability on the.

Deferred Revenue Accounting, Definition, Example

If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Its recognition is crucial for. Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. When a customer prepays for goods or services, the business must record the receipt.

How To Record SaaS Deferred Revenue? FreeCashFlow.io

When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred.

What is Deferred Revenue? SOFTRAX

Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue is a current liability on the balance sheet, indicating obligations typically due within a year. Its recognition is crucial for. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue is a payment a company receives in advance for products or services it.

Deferred Revenue Balance Sheet Ppt Powerpoint Presentation Visual Aids

If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Its recognition is crucial for. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet. Deferred revenue is a payment a company receives.

When A Customer Prepays For Goods Or Services, The Business Must Record The Receipt Of Cash As Deferred Revenue On The Balance Sheet.

Its recognition is crucial for. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or services in the. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement and instead records a liability. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.